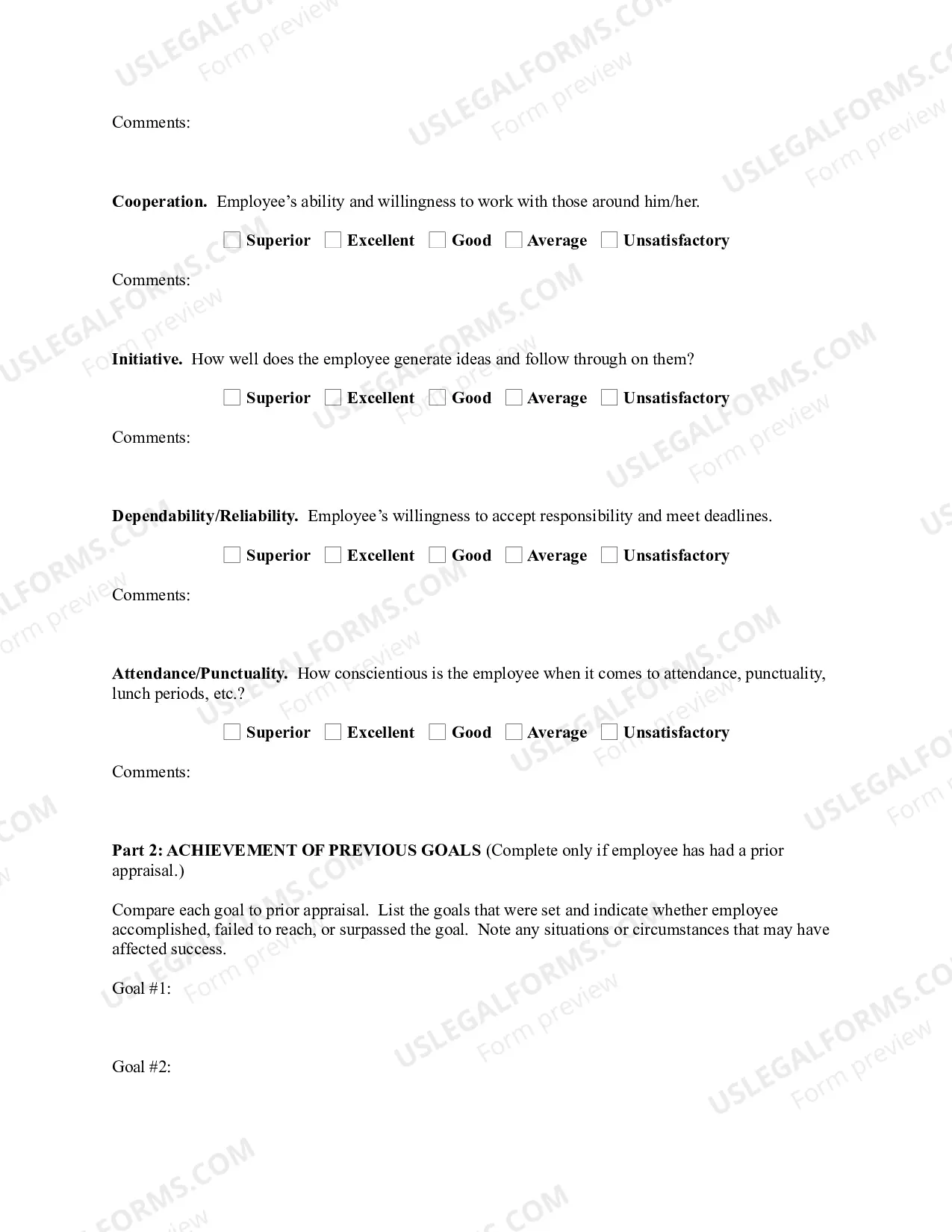

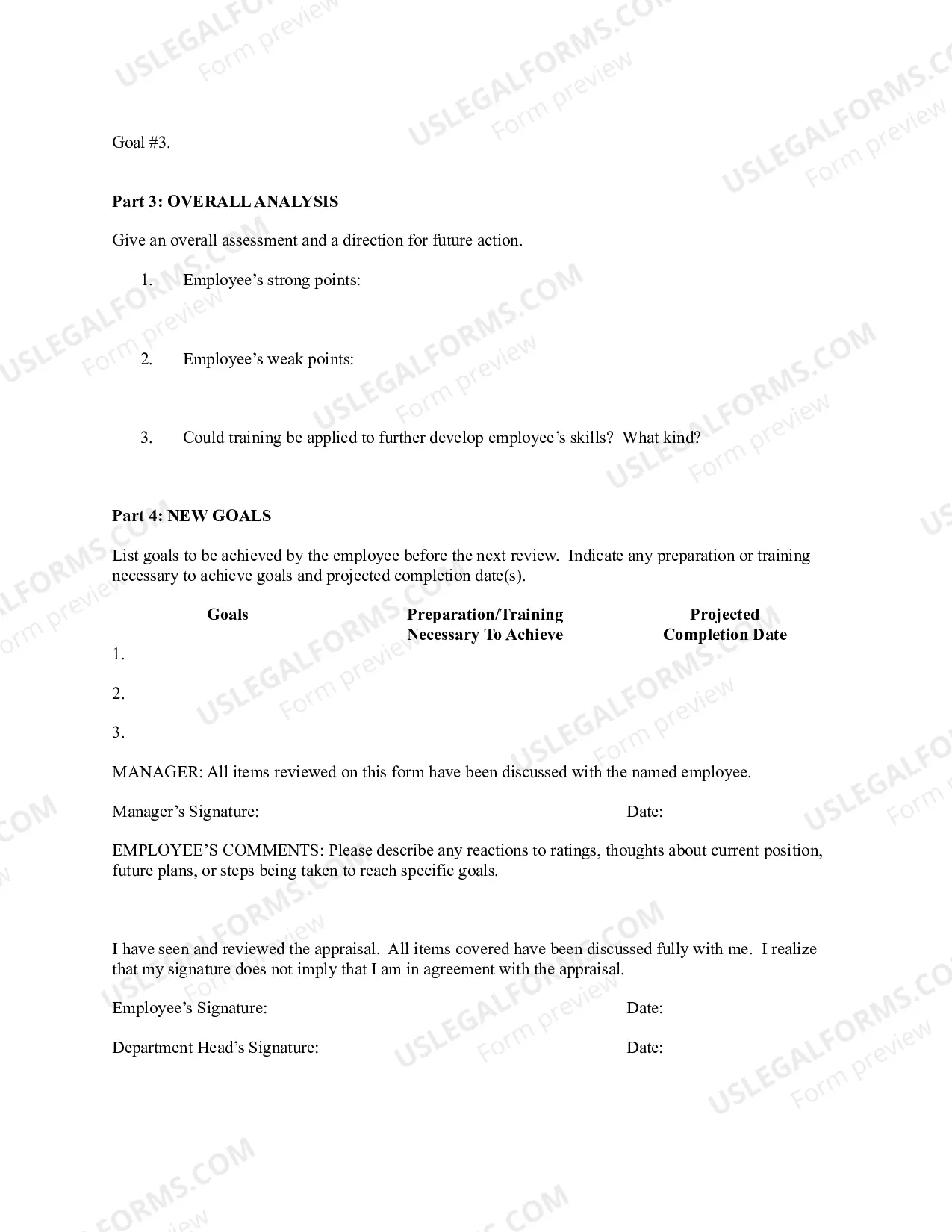

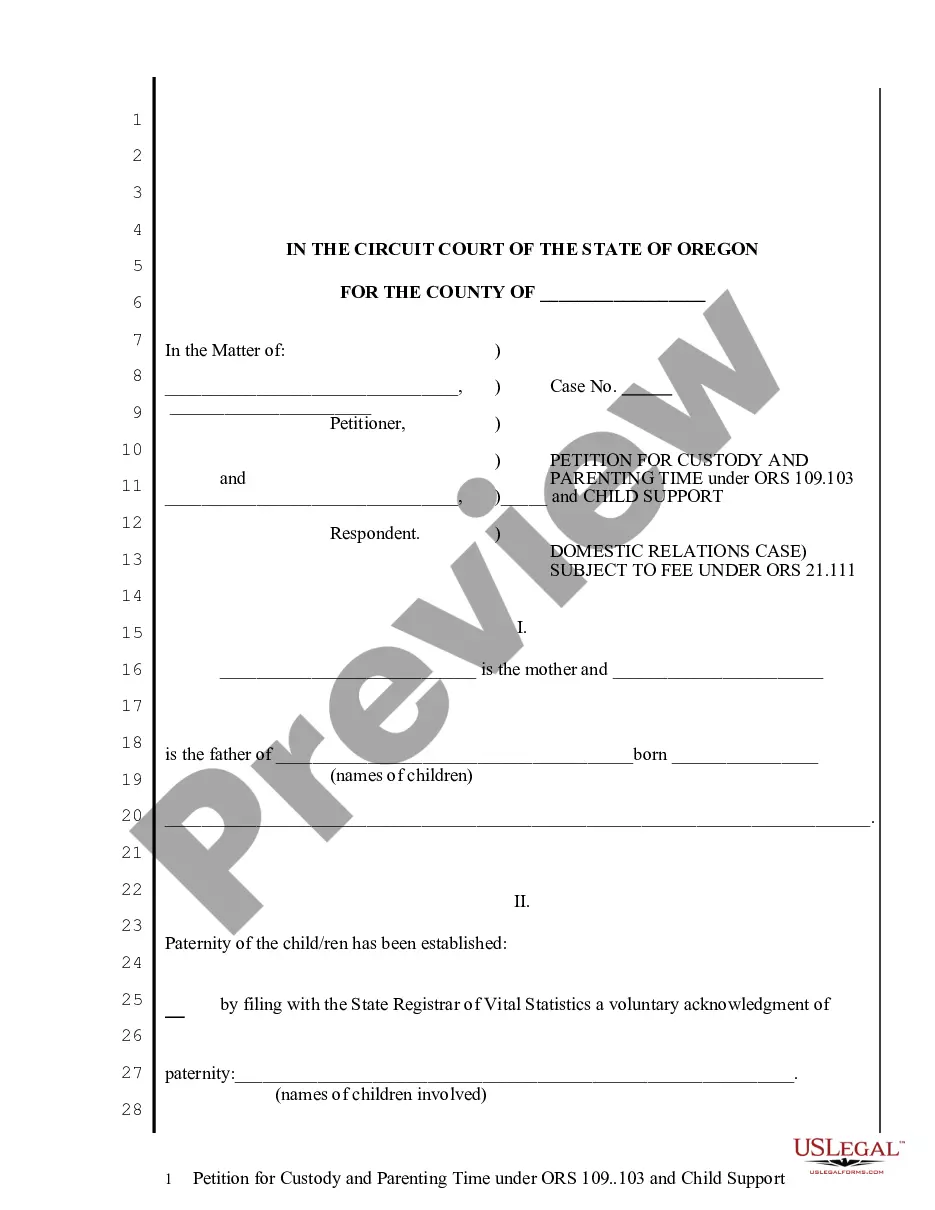

Pharmacist Performance Review Examples With Questions

Description

How to fill out Employee Evaluation Form For Pharmacist?

Acquiring legal documents that adhere to federal and state laws is essential, and the web provides numerous choices to choose from.

However, what’s the benefit of spending time searching for the suitable Pharmacist Performance Review Examples With Questions template online when the US Legal Forms digital library already has such documents assembled in one location.

US Legal Forms is the largest virtual legal repository with more than 85,000 fillable forms created by attorneys for various business and personal situations. They are easy to navigate, with all documents organized by state and intended use. Our specialists keep abreast of legal updates, ensuring you can always trust that your document is current and compliant when obtaining a Pharmacist Performance Review Examples With Questions from our site.

Click Buy Now when you’ve found the appropriate form and choose a subscription plan. Sign up for an account or Log In and process your payment via PayPal or a credit card. Select the format for your Pharmacist Performance Review Examples With Questions and download it. All templates you locate through US Legal Forms are reusable. To re-download and fill out previously bought forms, access the My documents section in your profile. Benefit from the most comprehensive and user-friendly legal document service!

- Acquiring a Pharmacist Performance Review Examples With Questions is quick and straightforward for both existing and new users.

- If you already possess an account with an active subscription, Log In and download the document template you need in the desired format.

- If you are new to our site, follow the steps below.

- Review the template using the Preview function or through the text outline to confirm it meets your requirements.

- If needed, find another sample using the search bar at the top of the page.

Form popularity

FAQ

Lump-sum settlement For example, you might owe $4,000 between charges, interest and fees on your credit card, but you ask the bank to accept $2,500 (your original credit limit) to settle the account in full. If the card issuer accepts, it will forgive the remaining balance.

You enroll through a credit counseling agency. The agency will work with your creditors to reduce or eliminate interest and work out a payment schedule. Qualifying Texans can get out of debt in 36-60 payments, on average. Another option for Texas residents is debt settlement.

Credit cards are another example of a type of debt that generally doesn't have forgiveness options. Credit card debt forgiveness is unlikely as credit card issuers tend to expect you to repay the money you borrow, and if you don't repay that money, your debt can end up in collections.

Although the average settlement amounts to 48% of what you originally owed, that number is a bit skewed. If your debts are still with the original creditor, settlement amounts tend to be much higher. You can end up paying up to 80% of what you owe if the debt is still with the original creditor.

Bankruptcy is your best option for getting rid of debt without paying.

The 1099-C form reports a cancellation of debt; creditors are required to issue Form 1099-C if they cancel a debt of $600 or more. Form 1099-C must be issued when an identifiable event in connection with a cancellation of debt occurs.

Credit cards are another example of a type of debt that generally doesn't have forgiveness options. Credit card debt forgiveness is unlikely as credit card issuers tend to expect you to repay the money you borrow, and if you don't repay that money, your debt can end up in collections.

Debt settlement, when you pay a creditor less than you owe to close out a debt, will hurt your credit scores, but it's better than ignoring unpaid debt. It's worth exploring alternatives before seeking debt settlement.