Performance Interview Form With Answers

Description

How to fill out Checklist - Before The Performance Appraisal Interview?

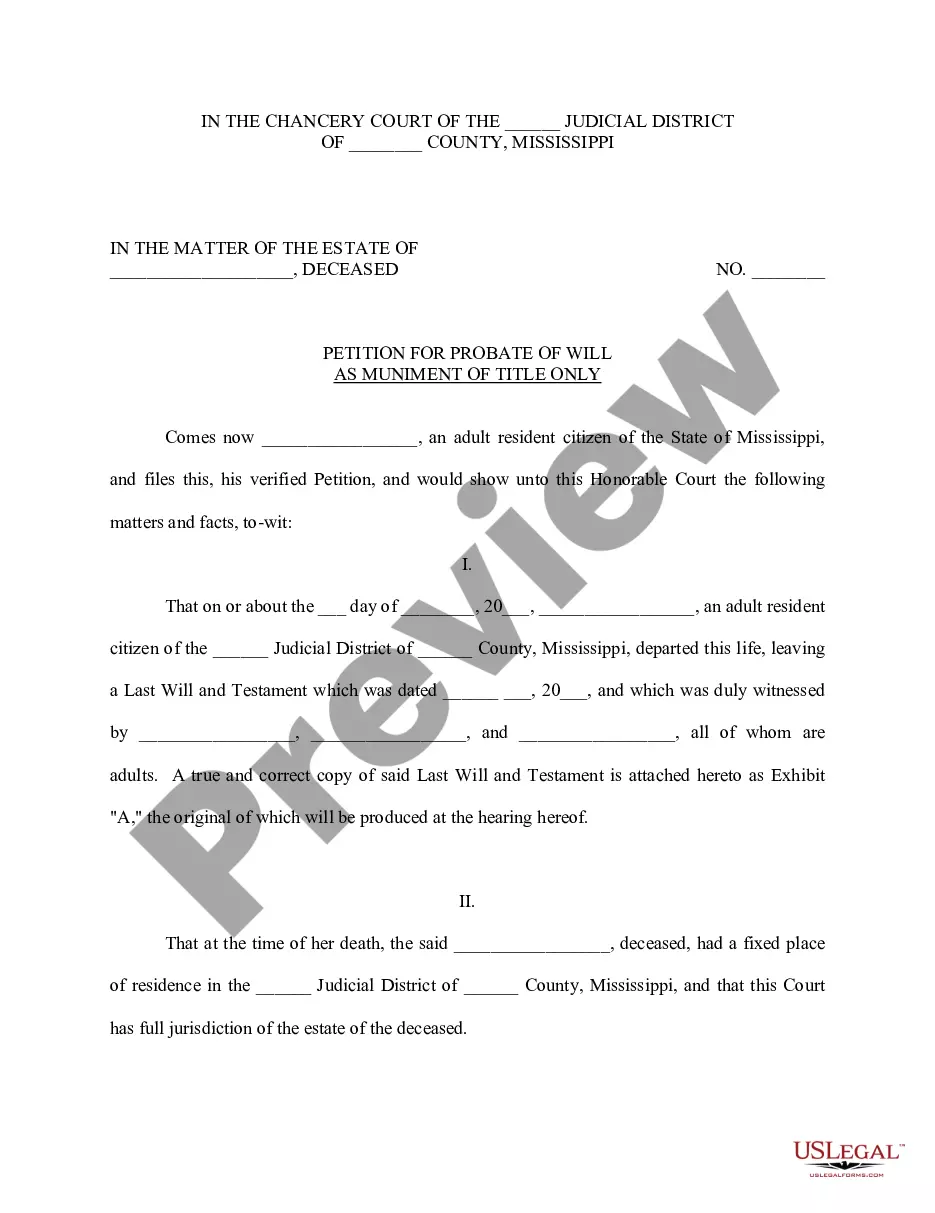

The Performance Interview Form With Responses displayed on this page is a reusable official template created by experienced attorneys in accordance with federal and state laws.

For over 25 years, US Legal Forms has assisted individuals, businesses, and legal experts with more than 85,000 authenticated, state-specific documents for various business and personal scenarios. It’s the fastest, simplest, and most reliable way to source the forms you require, as the service ensures the utmost level of data confidentiality and malware defense.

Subscribe to US Legal Forms to access validated legal templates for every aspect of life available at your fingertips.

- Search for the document you require and examine it.

- Browse the file you searched and preview it or review the form description to confirm it meets your needs. If it doesn’t, use the search feature to locate the appropriate one. Click Buy Now once you have found the template you need.

- Choose and Log In.

- Select the payment option that fits you and create an account. Utilize PayPal or a debit/credit card to make a swift payment. If you already possess an account, Log In and check your subscription to continue.

- Obtain the editable template.

- Pick the format you desire for your Performance Interview Form With Responses (PDF, Word, RTF) and save the document on your device.

- Fill out and endorse the document.

- Print the template to fill it out manually. Alternatively, use an online versatile PDF editor to quickly and accurately fill in and sign your form with a legitimate signature.

- Retrieve your documents once more.

- Reaccess the same document whenever necessary. Visit the My documents section in your profile to redownload any previously downloaded documents.

Form popularity

FAQ

To answer this question, articulate the specific criteria you use to gauge success in both personal and professional contexts. Utilize the Performance interview form with answers to demonstrate how you track milestones, gather feedback, and adjust your goals. This comprehensive approach will showcase your focus on continuous growth.

When answering this question, emphasize qualitative and quantitative measures. Discuss how you use the Performance interview form with answers to reflect on achievements and challenges. Additionally, mention setting personal benchmarks and seeking feedback from peers to enhance your evaluation process.

Individuals: Most users of MyTax Illinois are individuals filing returns and making payments for Illinois Individual Income Tax. The option to file an Illinois individual income tax return without a MyTax account is improved and now available for taxpayers who file a simple return.

No. You do not have to activate a MyTax Illinois account to file your 2022 Form IL-1040, Individual Income Tax Return. For more information, see File Form IL-1040, Individual Income Tax Return, on MyTax Illinois.

If you have created a MyTax Illinois account, login to your account to view and print your return. If you filed your IL-1040 without creating a MyTax Illinois account, go to the MyTax Illinois home screen. Click the "Retrieve a return, application, or payment" button.

MyTax Illinois, available at mytax . illinois . gov, is a free online account management program offered by the state of Illinois to provide a centralized location for users to file returns, renew licenses, register for accounts, make payments, review correspondence, and generally manage their accounts .

File Form IL-1040-X, Amended Individual Income Tax Return, for tax years ending on December 31, 2021, and December 31, 2020, on MyTax Illinois. Use MyTax Illinois to electronically file your Amended Individual Income Tax Return. It's fast, easy, and free.

How to get Forms Download Forms. Submit a request to have forms or publications mailed to you. You can also request certain forms and publications by calling our 24-hour forms order hotline at 1 800 356-6302.

Use MyTax Illinois to electronically file your original Individual Income Tax Return. It's easy, free, and you will get your refund faster.

Don't have a MyTax Illinois account? Visit MyTax.Illinois.gov and click the ?Sign up Now!? button to create your MyTax Illinois account. For full activation information, see the Guide to Creating MyTax Illinois Account available on our website for additional help.