Employee verification letter for bank is a document issued by an employer to confirm the employment status and income of an individual for various banking purposes. This letter serves as proof of the borrower's employment and salary, enabling them to avail financial services such as loans, mortgages, credit cards, or open a bank account. It is an essential piece of information required by banks to assess the creditworthiness and reliability of their customers. Keywords: Employee, verification letter, bank, employment status, income, proof, borrower, financial services, loans, mortgages, credit cards, bank account, essential, creditworthiness, reliability. There are different types of Employee verification letters for banks, including: 1. Employee Income Verification Letter: This letter confirms the employee's salary details, including their regular income, allowances, and any other benefits they receive from their employer. Banks request this letter to evaluate an individual's repayment capacity when applying for loans or credit cards. 2. Employment Confirmation Letter: This type of letter serves as evidence of an individual's current employment status. It verifies that they are an active employee, the duration of their employment, and their job position within the organization. Banks often require this letter to establish stability and to ensure that the individual has a steady source of income. 3. Employment History Verification Letter: This letter provides a detailed overview of an individual's employment history, including previous job positions, dates of employment, and relevant job responsibilities. Banks may request this letter to assess the applicant's stability, work experience, and industry expertise when considering their eligibility for business loans or other financial services. 4. Employment Reference Letter: This type of employee verification letter focuses on the individual's skills, qualifications, and work ethic. It is often requested by banks to evaluate a person's professional background, reputation, and reliability in terms of financial responsibility. These different types of employee verification letters are crucial for banks to authenticate an individual's employment status, income, and professional background. They allow banks to make informed decisions about lending money, offering financial services, or creating banking relationships based on the applicant's financial stability and credibility.

Employee Verification Letter For Bank

Description

How to fill out Employee Verification Letter For Bank?

The Employee Verification Letter For Bank you see on this page is a multi-usable formal template drafted by professional lawyers in accordance with federal and local regulations. For more than 25 years, US Legal Forms has provided people, organizations, and legal professionals with more than 85,000 verified, state-specific forms for any business and personal scenario. It’s the quickest, easiest and most trustworthy way to obtain the documents you need, as the service guarantees bank-level data security and anti-malware protection.

Acquiring this Employee Verification Letter For Bank will take you just a few simple steps:

- Browse for the document you need and review it. Look through the file you searched and preview it or check the form description to ensure it satisfies your needs. If it does not, utilize the search bar to find the correct one. Click Buy Now when you have located the template you need.

- Subscribe and log in. Opt for the pricing plan that suits you and create an account. Use PayPal or a credit card to make a quick payment. If you already have an account, log in and check your subscription to continue.

- Acquire the fillable template. Pick the format you want for your Employee Verification Letter For Bank (PDF, Word, RTF) and save the sample on your device.

- Fill out and sign the document. Print out the template to complete it by hand. Alternatively, utilize an online multi-functional PDF editor to rapidly and precisely fill out and sign your form with a eSignature.

- Download your papers one more time. Utilize the same document once again anytime needed. Open the My Forms tab in your profile to redownload any earlier saved forms.

Subscribe to US Legal Forms to have verified legal templates for all of life’s circumstances at your disposal.

Form popularity

FAQ

Dear [Formal name or company/department name], I am writing to confirm that [employee name] is currently employed by [company name, followed by any additional information requested]. If you have any questions, please reach out to me via [preferred method of contact information].

Every lender will perform income and employment verification before a loan goes through the underwriting process. Many lenders will repeat income and employment verifications before closing to confirm nothing has changed. This helps the lender reduce risk of a loan buyback.

Provide accurate information. Make sure the information is accurate by double-checking any employment dates, pay rates, and hours of work provided. Respond as promptly as possible and retain a copy of the employment verification in the employee's personnel file.

A letter of employment, also sometimes called a job letter or income verification letter, proves your employment status, shows what kind of work you do, and helps the lender confirm that you have reliable income to pay off your mortgage.

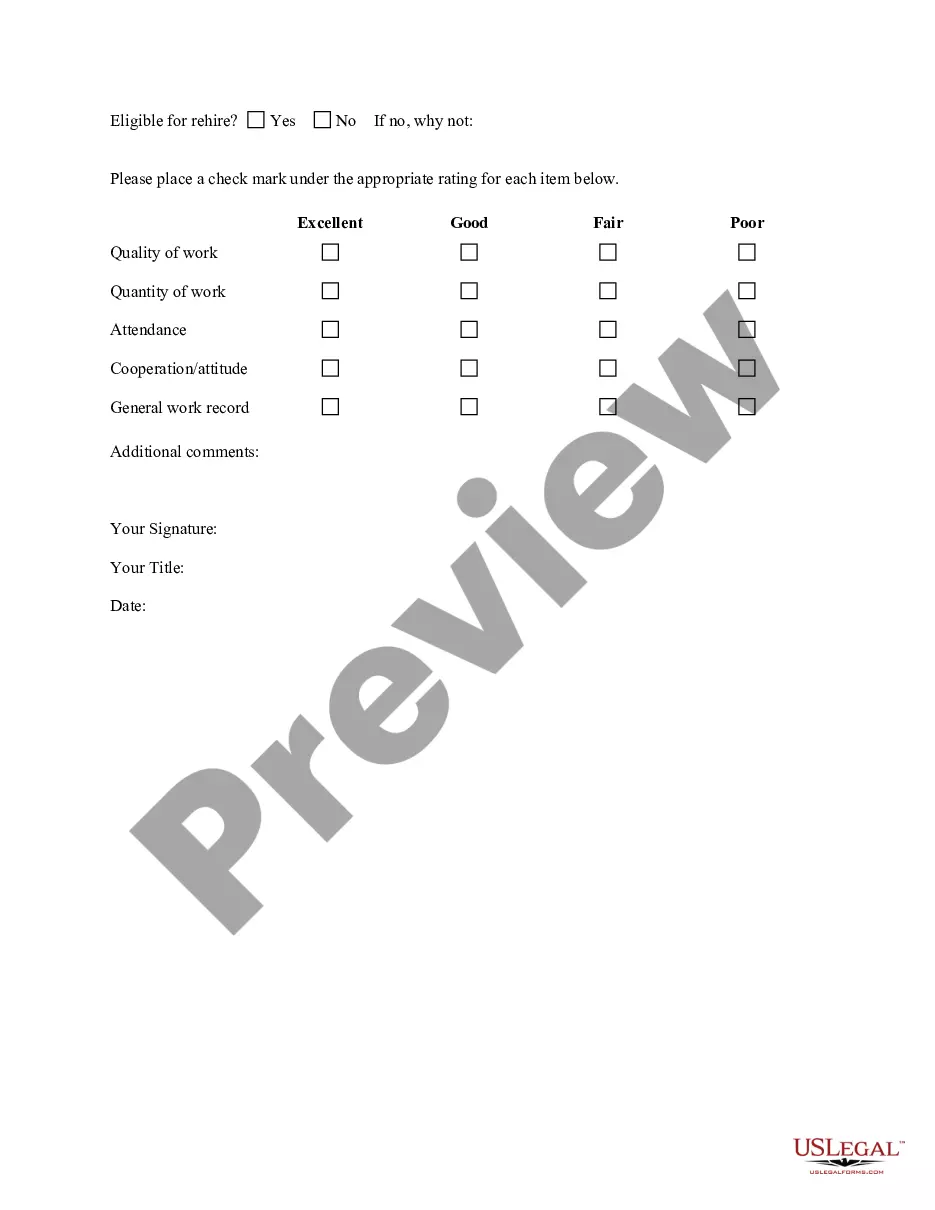

Responding to Requests for Employment Verification: How Much Should You Share? The start and end dates of employment. The last job title held by the employee. The ending pay rate. Indicator of whether the separation was voluntary or involuntary. Indicator of whether the employee is eligible for re-hire.