Most Common Interview Questions For Entry Level Jobs

Description

How to fill out Checklist Of Standard Hiring Interview Questions With Listening Tips And Suggested Follow-up Questions?

It’s widely known that you cannot instantly transform into a legal authority, nor can you quickly learn how to efficiently assemble the Most Common Interview Questions For Entry Level Jobs without possessing a specific skill set.

Drafting legal papers is a lengthy endeavor that necessitates specialized education and abilities. So why not entrust the compilation of the Most Common Interview Questions For Entry Level Jobs to the professionals.

With US Legal Forms, one of the most extensive legal template collections, you can find anything from court documents to templates for inter-office communication.

You can regain access to your documents from the My documents section whenever needed. If you are a returning client, you can simply Log In and locate and download the template from the same section.

No matter the intent of your documentation—whether it’s financial, legal, or personal—our website has everything you need. Experience US Legal Forms today!

- Identify the document you require by utilizing the search box at the top of the webpage.

- View it (if this feature is available) and review the accompanying description to ascertain if the Most Common Interview Questions For Entry Level Jobs aligns with your needs.

- Begin your search anew if you require a different document.

- Create a complimentary account and select a subscription plan to purchase the template.

- Click Buy now. Once the payment is completed, you can download the Most Common Interview Questions For Entry Level Jobs, complete it, print it, and deliver it to the necessary individuals or organizations.

Form popularity

FAQ

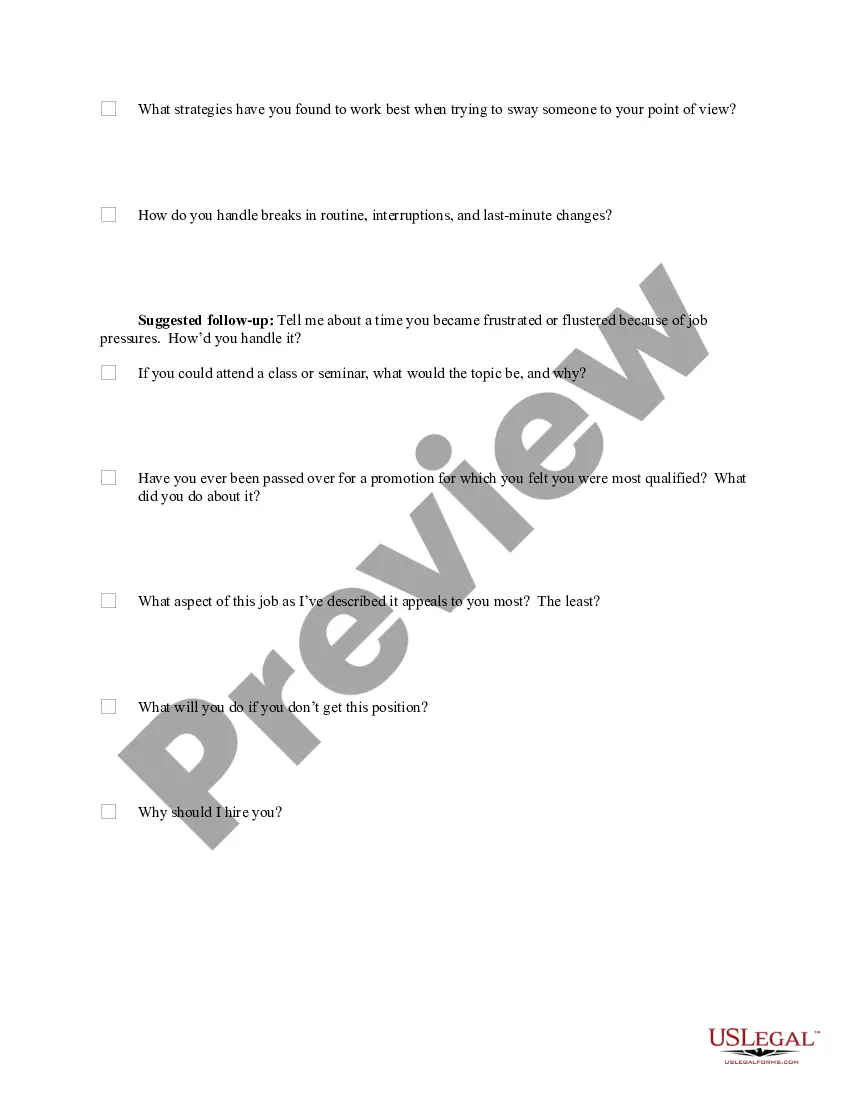

The three main parts of an interview are the introduction, the body, and the conclusion. During the introduction, you establish rapport and set the tone. The body is where you answer the most common interview questions for entry level jobs, highlighting your qualifications and experiences. Finally, the conclusion allows you to summarize your fit for the role and clarify next steps. Understanding this structure can help you navigate interviews more confidently.

If the satisfaction isn't recorded within a minimum of 60 days, they may incur penalties and be held liable for damages and attorney's fees.

Mortgage Perfection means the recording of the Mortgages necessary under applicable law for the perfection of Liens granted by the Company or any Guarantor hereunder or under the Security Documents in any Real Property.

A satisfaction of mortgage is a signed document confirming that the borrower has paid off the mortgage in full and that the mortgage is no longer a lien on the property.

Key takeways. When shopping for a mortgage, ask each lender to detail their requirements, annual percentage rate (APR) and fees. Be prepared to answer questions regarding your income, debt, down payment amount and more. You'll need to back up your answers with documentation.

Satisfactions Generally: Once a mortgage or deed of trust is paid, the holder of the mortgage is required to satisfy the mortgage or deed of trust of record to show that the mortgage or deed of trust is no longer a lien on the property.

Mortgage lien release process? You must send a letter to the bank asking for the restoration of the original documents if you have made your last EMI or all remaining payments on your home loan. The banks typically react to such communications in a minimum of seven business days.

In addition the following information should be included: The Payee Name. The Owner(s) of the mortgage holder. Total amount of mortgage. Mortgage date of execution. Full and legal description of the property to include tax parcel number. Acknowledgement that all payments have been made in full.