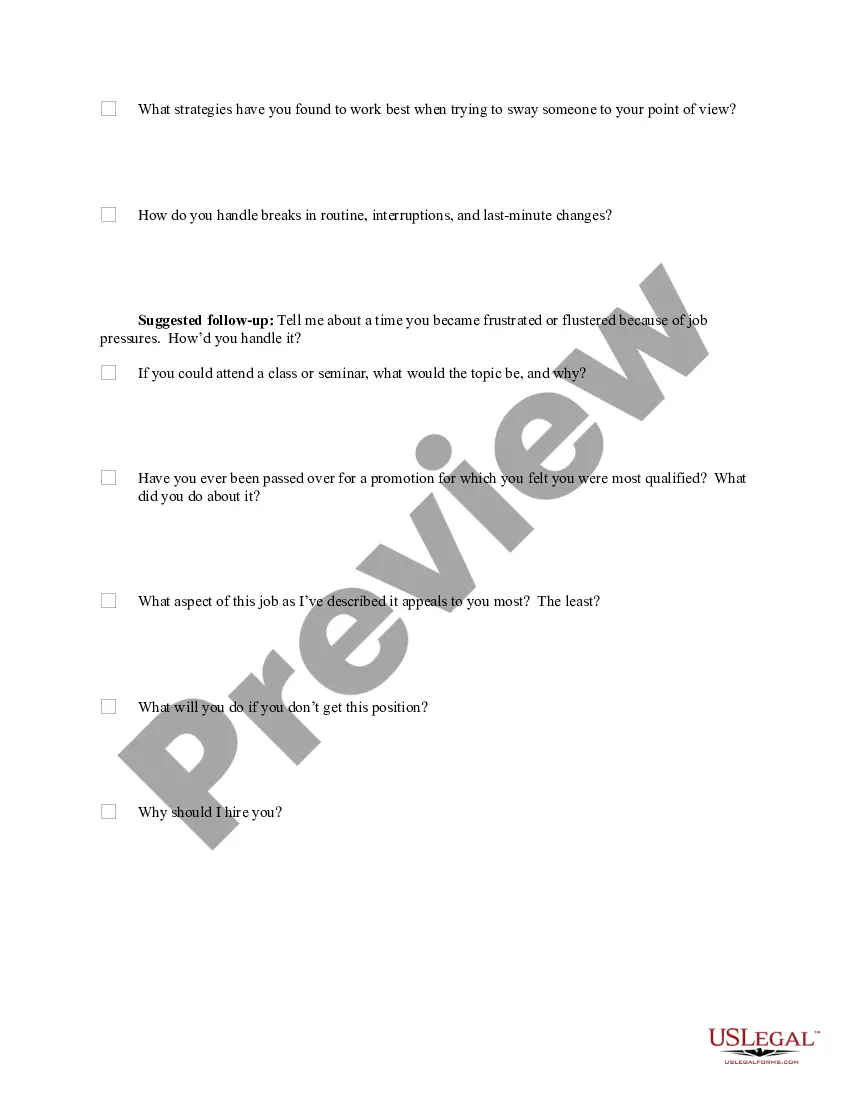

Most Common Interview Questions For A Restaurant

Description

How to fill out Checklist Of Standard Hiring Interview Questions With Listening Tips And Suggested Follow-up Questions?

Creating legal documents from the ground up can sometimes feel overwhelming.

Some situations could require extensive research and a significant investment of money.

If you're looking for a simpler and more cost-effective solution for generating Most Common Interview Questions For A Restaurant or any other documents without unnecessary complications, US Legal Forms is readily available to assist you.

Our online library of over 85,000 current legal documents covers nearly every aspect of your financial, legal, and personal affairs. With just a few clicks, you can promptly obtain state- and county-specific forms carefully crafted by our legal professionals.

Ensure that the selected template aligns with the requirements of your state and county. Choose the most appropriate subscription plan to acquire the Most Common Interview Questions For A Restaurant. Download the document, then fill it out, sign it, and print it. US Legal Forms boasts a solid reputation and over 25 years of expertise. Join us today and transform form completion into a straightforward and efficient process!

- Utilize our service whenever you require a dependable and trustworthy platform to swiftly locate and download the Most Common Interview Questions For A Restaurant.

- If you're familiar with our site and have previously registered, simply Log In to your account, find the template, and download it or re-obtain it anytime later in the My documents section.

- Not yet signed up? No worries. It takes just a few minutes to register and search through the catalog.

- Before proceeding to download the Most Common Interview Questions For A Restaurant, keep these tips in mind.

- Review the document preview and descriptions to confirm you've located the correct form.

Form popularity

FAQ

Frequently asked questions in a restaurant often revolve around menu items, dietary restrictions, and reservation policies. Guests commonly inquire about ingredient sourcing or special menu options. Addressing these questions effectively can enhance the dining experience and foster customer loyalty.

California LLC Fee The CA LLC fee is $85, payable to the secretary of state. In addition, a California LLC fee is also due for the statement of information, a document that must be submitted within 90 days of LLC formation and carries a filing cost of $20.

Go to the CA Secretary of State: Business Entities Search page. Select ?LP/LLC Name? and run a few searches. Enter the first 2 to 3 words of your desired LLC name. This will help make sure that you see everything that is potentially similar.

The Budget Act temporarily waives such fees for the State's 2022-2023 fiscal year. The fee waiver included in the Budget Act was intended to eliminate a barrier to entry for new businesses in California, thus fostering business growth in the State.

California passed a new Budget Act (Senate Bill 154) that waives the registration fees for California LLCs formed between July 1st, 2022 and June 30, 2023. That means instead of $70 to form a California LLC, you can start an LLC for free in California!

The Cost of Forming an LLC in California The California Secretary of State charges $70 for the initial filing of an LLC. However, California's annual franchise tax, which is at least $800, is the highest ongoing expense. Even startup companies with no sales are subject to this minimum tax.

Starting an LLC in California ? fees to file You'll pay two filing fees with your LLC application in California: $70 fee to file articles of organization with the California Secretary of State's office. $20 fee to file a Statement of Information, Form LLC-12, with the California Secretary of State.

A key advantage of an LLC is its flexible taxation options. By default, a California LLC is subject to pass-through taxation, so it's taxed like a partnership or sole proprietorship. As a pass-through entity, the LLC itself doesn't pay taxes.

Prepare and file articles of organization In California, Articles of Organization can be filed with Form LLC-1. Prepare Articles of Organization and file them with the California Secretary of State to properly register your California LLC.