Independent Contractor Based Form Pinnacol

Description

How to fill out Determining Self-Employed Independent Contractor Status?

Locating a reliable source for obtaining the latest and pertinent legal templates is a significant part of managing bureaucracy.

Selecting the appropriate legal documents necessitates precision and careful consideration, which is why it is crucial to obtain samples of the Independent Contractor Based Form Pinnacol exclusively from trustworthy providers, such as US Legal Forms. An incorrect template can squander your time and delay your current situation. With US Legal Forms, you have minimal concerns. You can retrieve and review all the details regarding the document’s application and significance for your circumstances and in your jurisdiction.

Once you have the form on your device, you can edit it using the editor or print it and complete it by hand. Eliminate the inconvenience that comes with your legal documentation. Explore the extensive US Legal Forms collection where you can discover legal templates, assess their applicability to your situation, and download them immediately.

- Use the catalog navigation or search bar to find your template.

- Read the form’s description to verify if it aligns with the requirements of your jurisdiction.

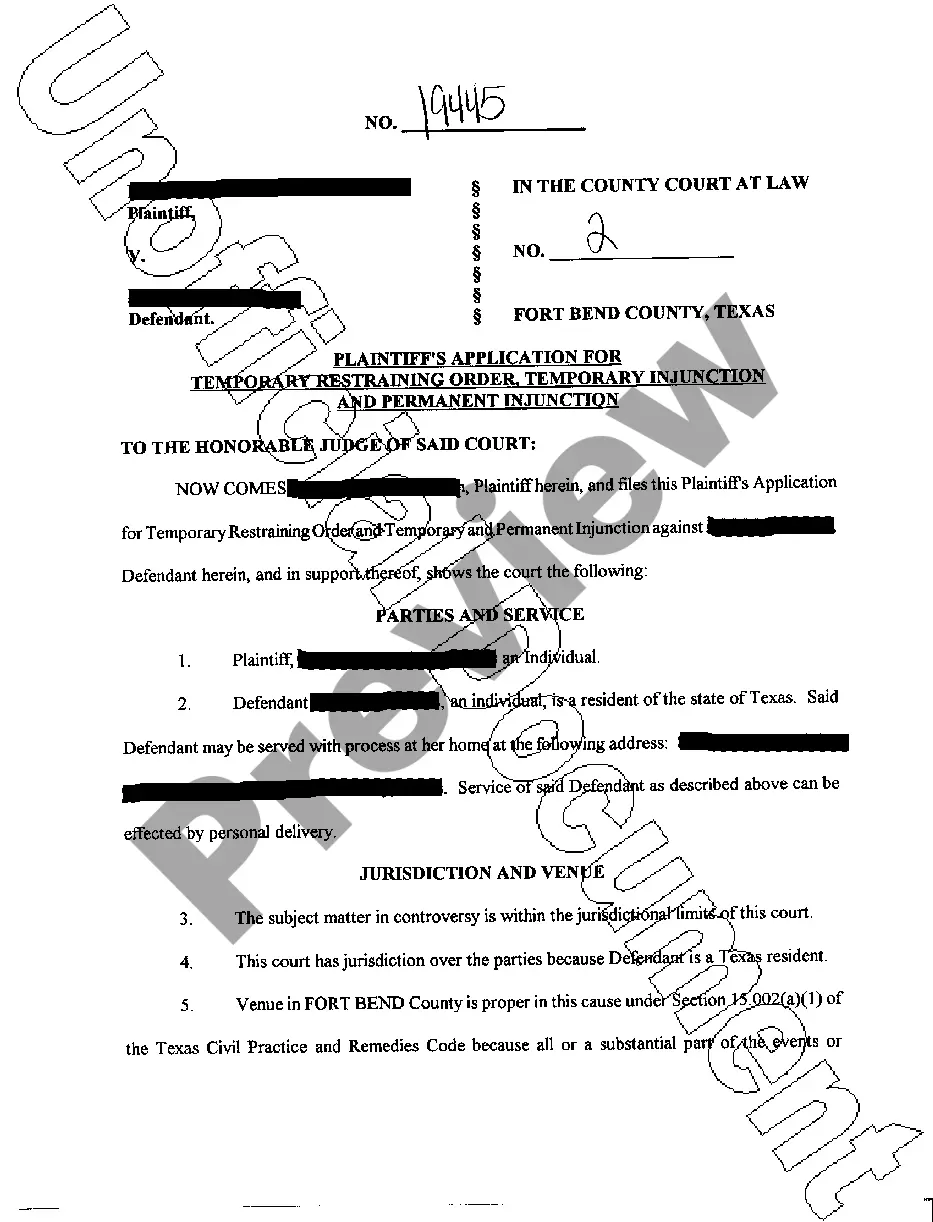

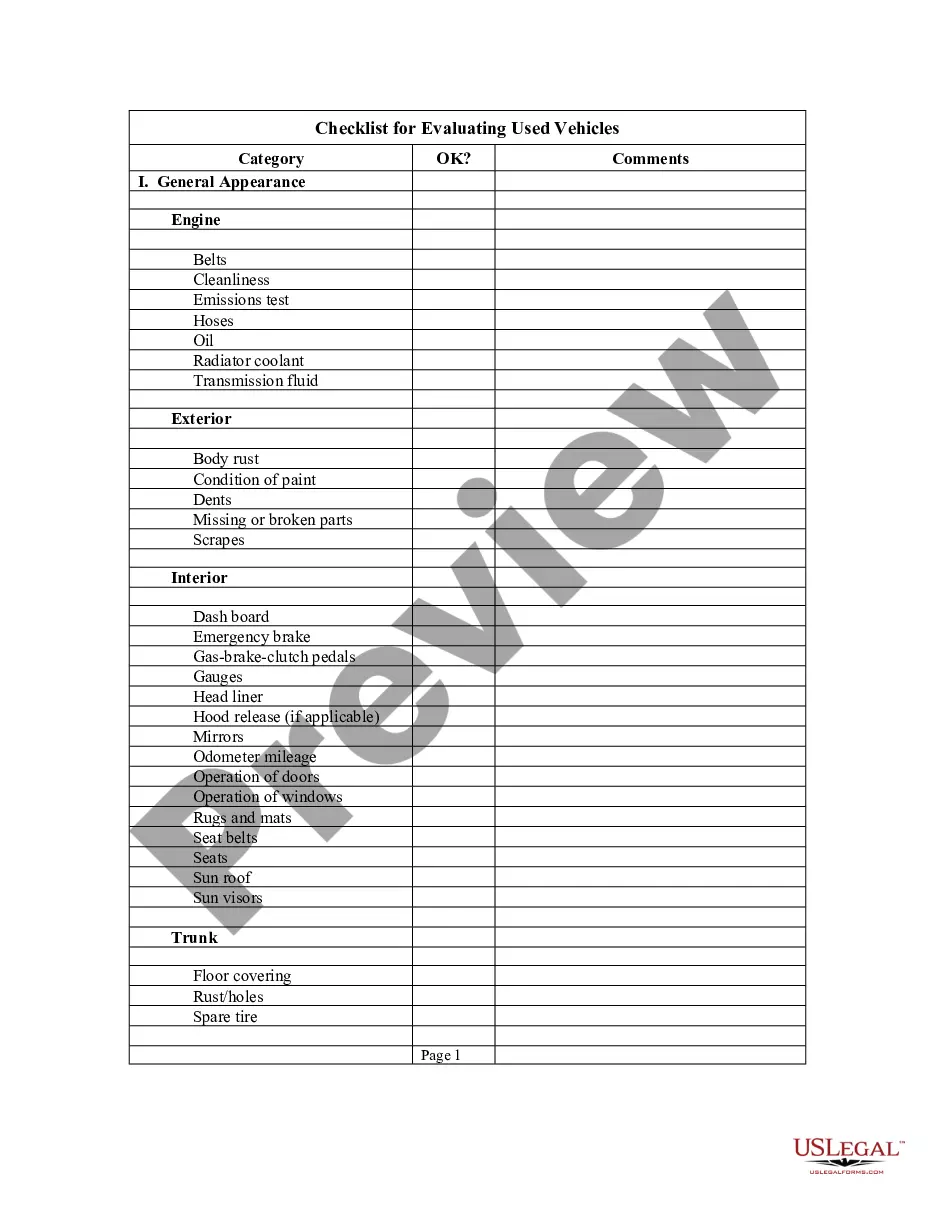

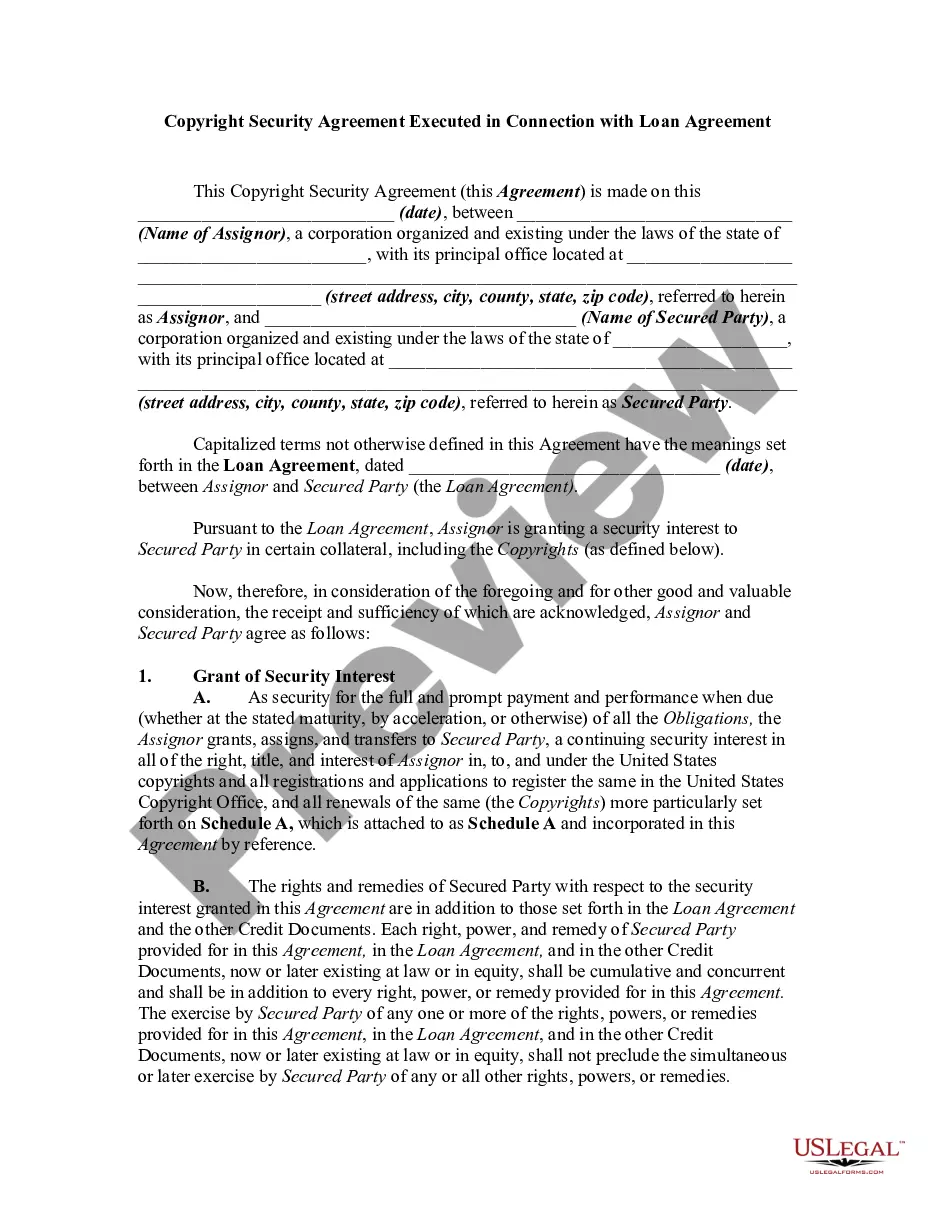

- View the form preview, if offered, to ensure the template is the one you need.

- Return to the search and find the appropriate document if the Independent Contractor Based Form Pinnacol does not meet your requirements.

- If you are confident about the form’s applicability, download it.

- As a registered user, click Log in to verify your identity and access your selected templates in My documents.

- If you haven't created a profile yet, click Buy now to obtain the template.

- Choose the pricing plan that suits your needs.

- Proceed to the registration to finalize your purchase.

- Complete your transaction by selecting a payment option (credit card or PayPal).

- Choose the file format for downloading the Independent Contractor Based Form Pinnacol.

Form popularity

FAQ

Ing to the law in Colorado, independent contractor taxes must be paid by the contractor as they are also classified as self-employed. This means that if you are an independent contractor, you must withhold your own local, state, and federal taxes and submit your tax report to the IRS on your own.

Colorado state law mandates that businesses include contract labor workers in their workers' compensation policies. This requirement extends to all individuals who've received payment throughout the year, whether through 1099 forms, cash transactions, or even uninsured subcontractors.

Ing to the law in Colorado, independent contractor taxes must be paid by the contractor as they are also classified as self-employed. This means that if you are an independent contractor, you must withhold your own local, state, and federal taxes and submit your tax report to the IRS on your own.

Workers required to work or be available full time are likely to be employees. In contrast, independent contractors generally can work whenever and for whomever they choose. Work done on premises. Workers who work at a business' premises or at a place designated by the business are more likely employees.

1099 employees are not covered by most labor laws, which means 1099 employees are not entitled to certain protections like federal or state minimum wage or overtime pay. 1099 employees must pay their own taxes. 1099 employees are responsible for paying their own self-employment taxes, as well as income taxes.