Form Independent Contractors With 1099

Description

How to fill out Acknowledgment Form For Consultants Or Self-Employed Independent Contractors?

Creating legal documents from the ground up can occasionally be intimidating.

Certain cases may require extensive research and substantial expenses.

If you’re looking for a simpler and more cost-effective method for preparing Form Independent Contractors With 1099 or any other paperwork without unnecessary complications, US Legal Forms is always accessible to you.

Our online archive of over 85,000 current legal forms covers nearly every aspect of your financial, legal, and personal affairs. With just a few clicks, you can rapidly access state- and county-compliant forms meticulously assembled for you by our legal professionals.

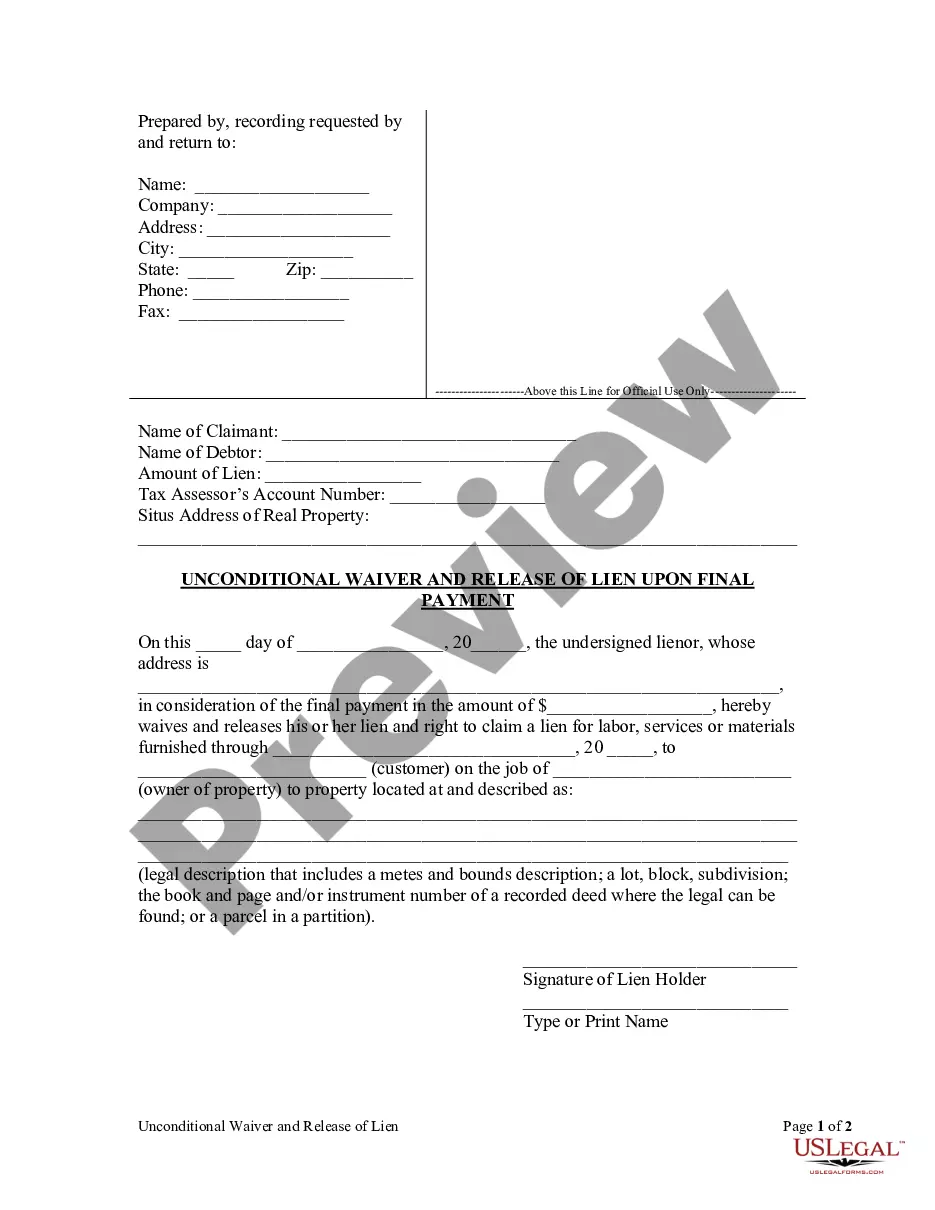

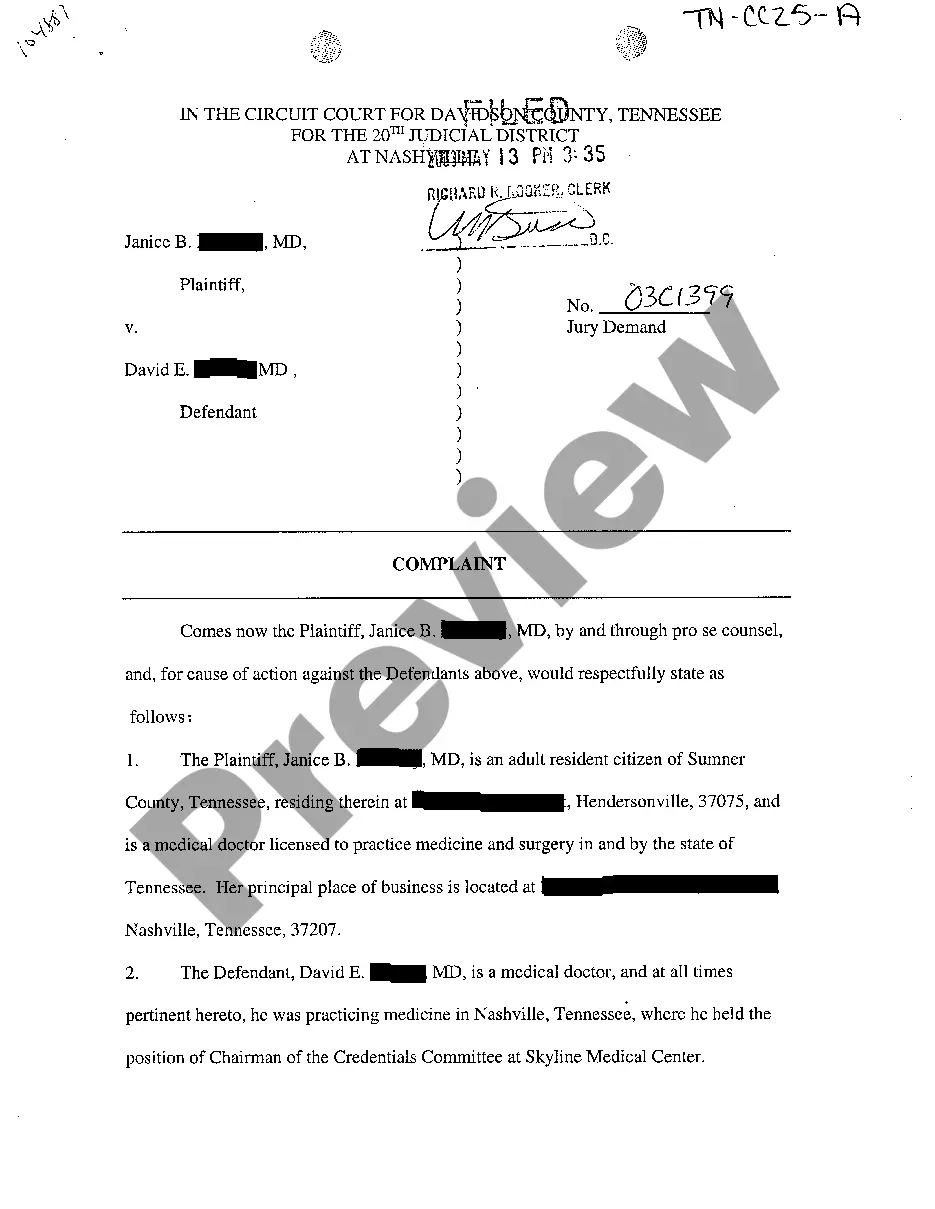

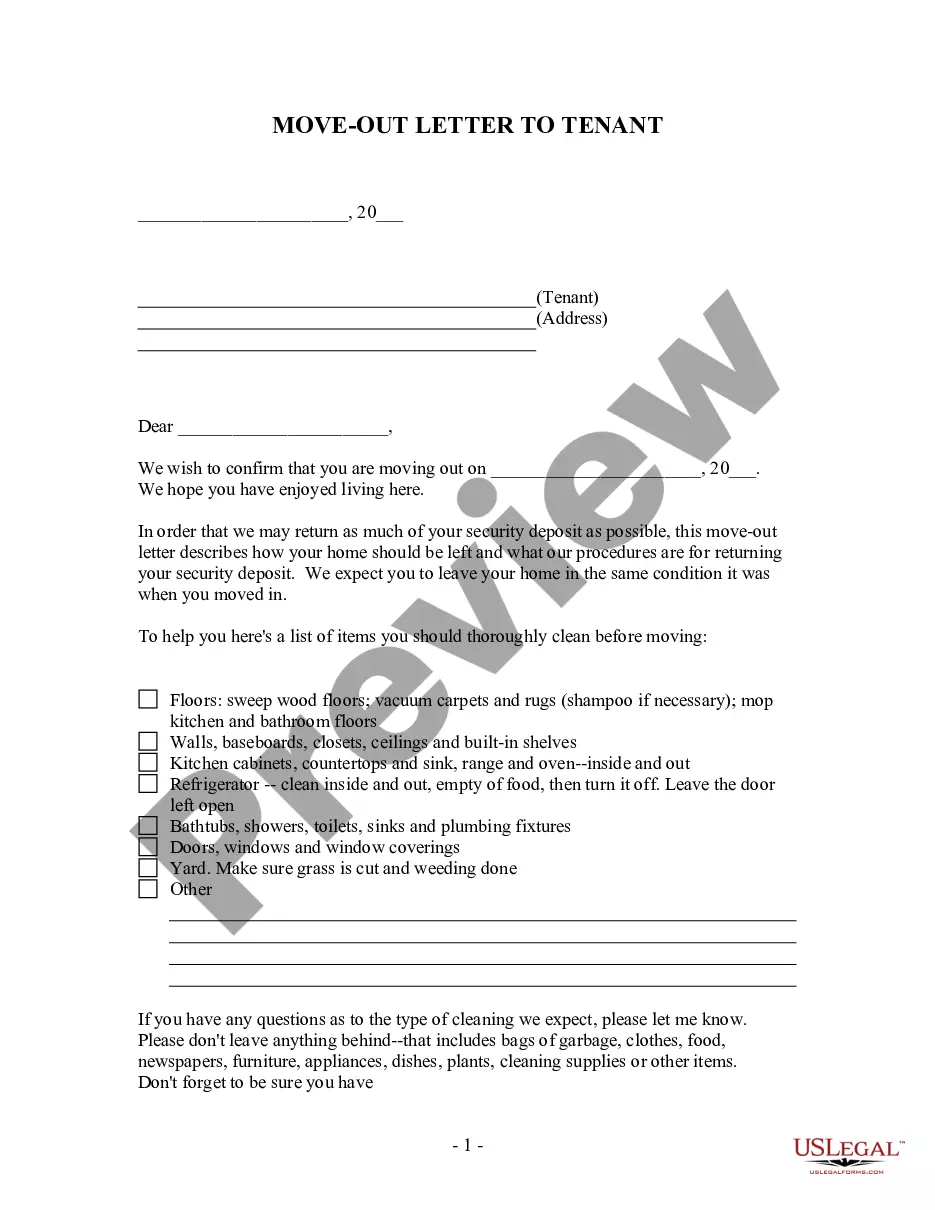

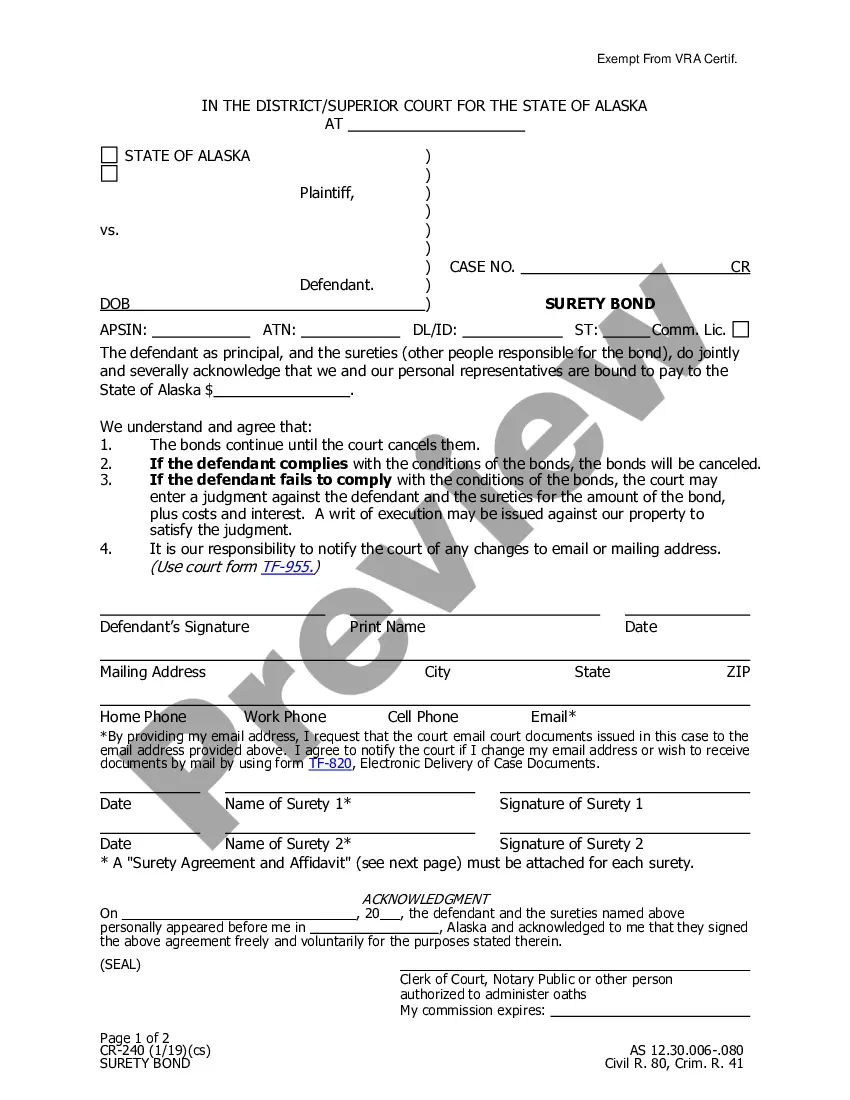

Examine the document preview and descriptions to ensure you have located the document you need.

- Utilize our platform whenever you require a trusted and dependable service that allows you to easily find and download the Form Independent Contractors With 1099.

- If you’re familiar with our website and have previously registered with us, simply Log In to your account, select the form, and download it or re-download it at any time through the My documents tab.

- Don’t have an account? No worries. It only takes a few minutes to register and browse the library.

- Before you proceed with downloading Form Independent Contractors With 1099, make sure to follow these suggestions.

Form popularity

FAQ

Workers' Compensation: Coverage A vs. It covers salary replacement payments as well as medical care, rehabilitation, and death benefits as necessary. All states except Texas have such benefits, although they vary widely from state to state and many states exclude some employees from eligibility.

New Hampshire Workers' Compensation & First Report of Injury Fax it to: 603-271-6149. Mail it to: Workers' Compensation Division, NH Department of Labor, 95 Pleasant St., Concord, NH 03301. Email it to: WorkersComp@dol.nh.gov.

Statutes of Limitation for Injured Employees The injured worker has two (2) years from the date of injury to notify the employer of his injury in order to make a claim for benefits.

How much does workers' compensation insurance cost in New Hampshire? The average cost of workers' compensation in New Hampshire is $35 per month. Your workers' comp premium is calculated based on a few factors, including: Payroll.

Under the New Hampshire Workers' Compensation Law RSA 281-A:5, every employer who has any employees, full or part-time, is required to cover these employees with workers' compensation insurance written by a carrier. It does not matter if they are related, such as daughter, son, husband, etc.

What report is filed? A detailed narrative progress/supplemental report to document any significant change in the worker's medical or disability status.

Workers' Compensation for New Hampshire Workers. If you are hurt at work, workers' compensation (or "workers' comp") pays your medical bills. It also pays 60% of your lost wages after you miss more than three days of work. Workers' compensation is a type of insurance that all employers MUST provide.