Form For Independent Contractors

Description

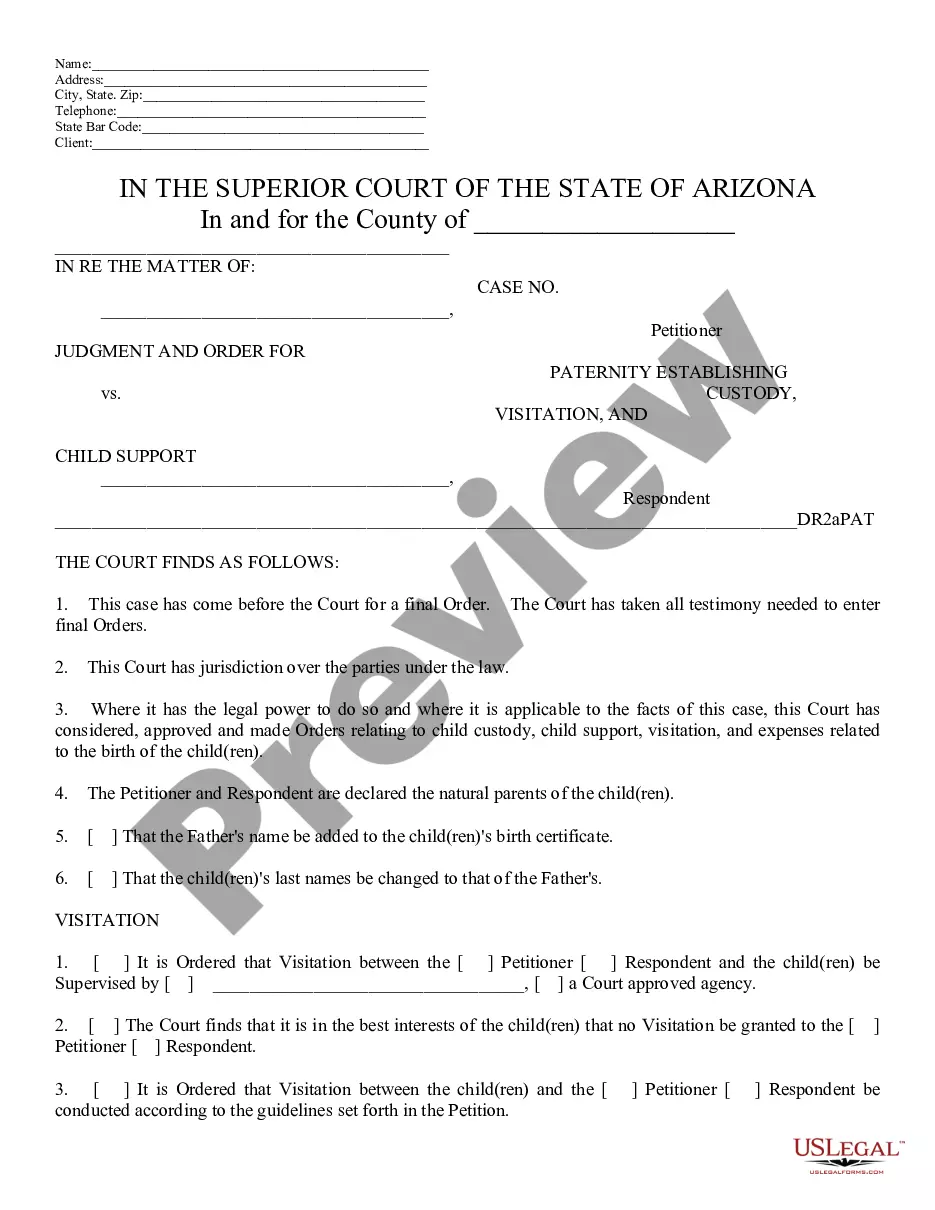

How to fill out Acknowledgment Form For Consultants Or Self-Employed Independent Contractors?

Locating a reliable source for the latest and pertinent legal templates is part of the challenge when dealing with bureaucracy.

Identifying the correct legal documentation requires precision and meticulousness, which is why it's crucial to obtain samples of Form For Independent Contractors solely from trusted providers, such as US Legal Forms. An incorrect template can squander your time and delay your circumstances. With US Legal Forms, most of your concerns are alleviated. You can access and verify all details regarding the document's applicability and significance for your scenario within your state or locality.

- Utilize the catalog navigation or search bar to find your template.

- Review the form’s description to determine if it meets the demands of your state and area.

- Access the form preview, if available, to verify that the template is what you need.

- Continue searching to find the proper template if the Form For Independent Contractors does not fulfill your requirements.

- If you are confident about the form’s applicability, download it.

- If you are a registered user, click Log in to verify your account and access your selected templates in My documents.

- If you haven't created an account yet, click Buy now to acquire the form.

- Select the pricing option that matches your needs.

- Proceed with the registration to complete your purchase.

- Finish your transaction by selecting a payment method (credit card or PayPal).

- Select the format of the document before downloading Form For Independent Contractors.

Form popularity

FAQ

The cost of living in NH is 15% less than MA. The cost of groceries in NH is 14% less than MA. The cost of housing in NH is 25% less than MA. The cost of utilities in NH is 10% less than MA.

County revenues rely on property taxes, Medicaid and limited Medicare payments, fees, and other locally-generated revenues to fund these services. State government provides the widest variety of services in New Hampshire.

It's commonly known as the Granite State for its extensive granite formations and quarries, but also has three other nicknames: Mother of River, the White Mountain State and Switzerland of America.

Ranked #2 on U.S. News and World Report's list of best states to live in the U.S., New Hampshire is known for its excellent quality of life, robust economy and pristine wilderness. Though the state boasts many attributes, finding the best towns and cities to live in can be tough.

Low unemployment ? New Hampshire is known for its low unemployment rate, which was 2.8% in January 2023. Median household income ? New Hampshire has the third-highest median household income in the nation in 2023, ing to the World Population Review, at $88,235.

Average Cost of Living in New Hampshire: $56,727 per year If New Hampshire exceeds your budget, don't bank on finding an affordable nearby state to move to. All of the states around New Hampshire ? Maine, Massachusetts, Connecticut, Rhode Island, and New York ? are some of the most expensive in the country to live in.

To request forms, please email forms@dra.nh.gov or call the Forms Line at (603) 230-5001. If you have a substantive question or need assistance completing a form, please contact Taxpayer Services at (603) 230-5920.

What sets new hampshire apart No broad-base personal income tax. No personal property or machinery tax. No sales or use taxes. No inventory tax. No capital gains tax. No professional service tax. No customs or software tax. No Internet tax.