Bill Paying Checklist Printable With Answers

Description

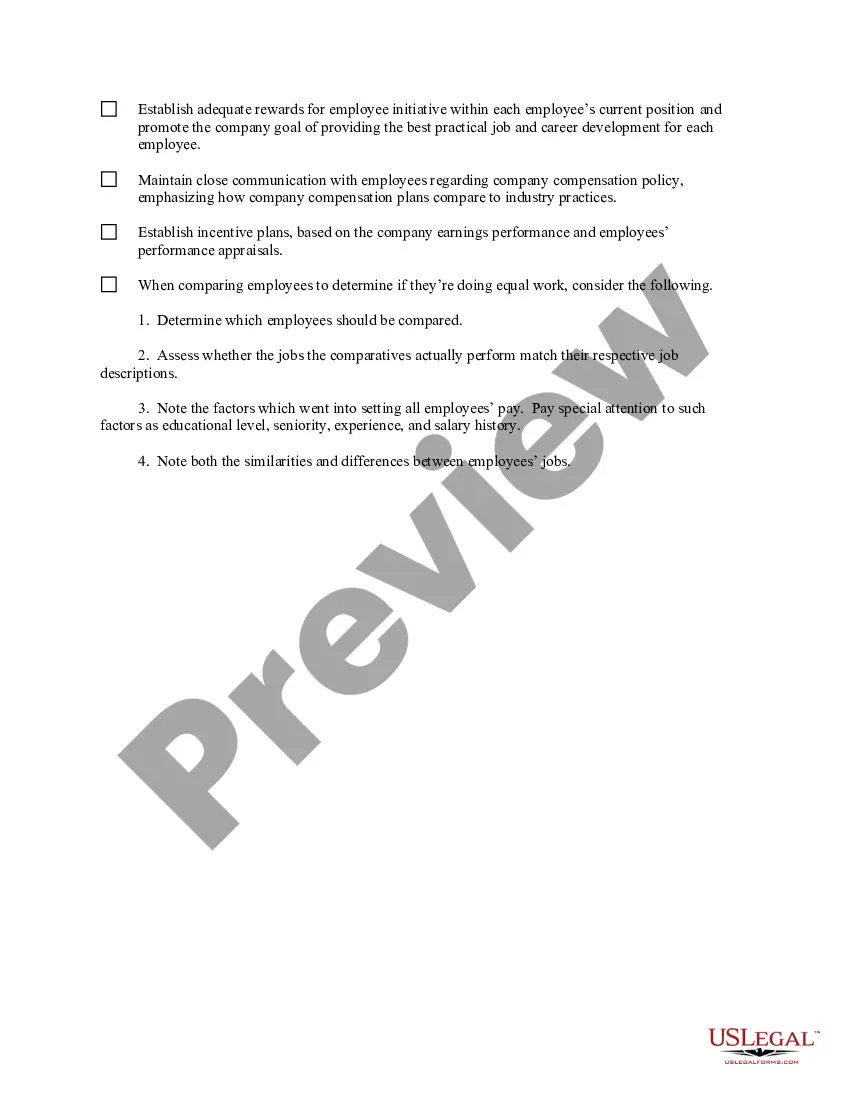

How to fill out Equal Pay Checklist?

No matter if you handle documents regularly or only need to send a legal document occasionally, it's essential to have a valuable resource where all the samples are relevant and current.

One task you must accomplish using a Bill Paying Checklist Printable With Answers is to confirm that it is indeed its most recent version, as this determines its submitability.

If you're looking to streamline your search for the most current document samples, seek them out on US Legal Forms.

Having a US Legal Forms account will enable you to access all the samples you need with added ease and less inconvenience. Simply click Log In in the site header and navigate to the My documents section to have all the forms you need readily available, saving you time in finding the appropriate template or determining its relevance. To obtain a form without an account, follow these instructions: Use the search menu to locate the form you require. Inspect the Bill Paying Checklist Printable With Answers preview and outline to confirm it's exactly the one you seek. After verifying the form, simply select Buy Now. Choose a subscription plan that suits you. Create an account or Log In to your existing one. Provide your credit card information or PayPal account to finalize the purchase. Choose the document format for download and confirm your selection. Eliminate confusion when dealing with legal documents. All your templates will be organized and validated with a US Legal Forms account.

- US Legal Forms is a repository of legal forms that includes nearly every document example you might seek.

- Look for the templates you need, verify their relevance immediately, and learn more about their functionality.

- With US Legal Forms, you gain access to over 85,000 document templates across various professional fields.

- Acquire the Bill Paying Checklist Printable With Answers samples in just a few clicks and store them at any time in your account.

Form popularity

FAQ

The best way to track bills and payments is to find a method that fits your lifestyle and preferences. Many people benefit from using digital budgeting apps or creating spreadsheets, but a simple bill paying checklist printable with answers can also be highly effective. By consistently updating your tracking tool, you can ensure all payments are accounted for and deadlines are met with ease.

A billing tracker provides a comprehensive view of your billing cycles, due dates, and payment history. This tool helps you manage expenses and ensures timely payment with minimal hassle. Using a bill paying checklist printable with answers can streamline this process, giving you an organized way to track your bills and making it easier to maintain your budgets.

A bill payment tracker is a specific tool designed to monitor the status of your bills and payments. It allows you to easily record due dates and amounts, helping you plan your monthly budget effectively. By incorporating a bill paying checklist printable with answers, you can enhance your bill payment tracking experience, leading to better financial management and peace of mind.

Bill tracking involves monitoring your payments and due dates to manage your finances effectively. This practice allows you to stay on top of your monthly obligations and avoid late fees. You can use various tools, including a bill paying checklist printable with answers, to assist in tracking bills efficiently. It's an essential habit for maintaining financial health.

Making a bill list starts with compiling all your recurring expenses. Begin by writing down each bill, its due date, and the amount owed. You can enhance this process by using a bill paying checklist printable with answers to organize your list efficiently. This visual aid will help you ensure that you don’t overlook any bills each month.

To keep up with bills each month, you can create a routine of reviewing your expenses and payments. Utilizing a bill paying checklist printable with answers can simplify this task; it helps you track due dates and amounts. Additionally, consider setting reminders on your phone or calendar to ensure you never miss a payment. By doing this consistently, you can maintain control over your finances.

Here are 7 ways to simplify bill paying within your home.Make a Date with Your Bills.Automate It.Pay Everything Once.Change Your Due Date.Pay Yourself First.Mark Your Bills as Paid.Tailor Your Bill-Paying System.

How to Make a Monthly Bill Organizer:Step 1: Grab a Cheapo Spiraled Notebook.Step 2: Write Down Each Payday for the WHOLE YEAR.Step 3: Add your Money In categories.Step 4: Record your Bills by Pay Period.Step 5: Payday is Here!Step 6: Money Out!!

It allows you to make person to person payments electronically to anyone you choose, such as a landlord, babysitter or relative. Sending money electronically is faster, more convenient and more secure than sending a check. And even when a paper check is necessary, online bill pay can save you time.

Learn how to get on top of your payments and avoid costly charges, higher interest costs and dings on your credit report.Make a list.Create bill-paying spaces.Check your statements.Review your due dates.Ask about your grace periods.Make a bill-paying date with yourself.Streamline the payment process.More items...