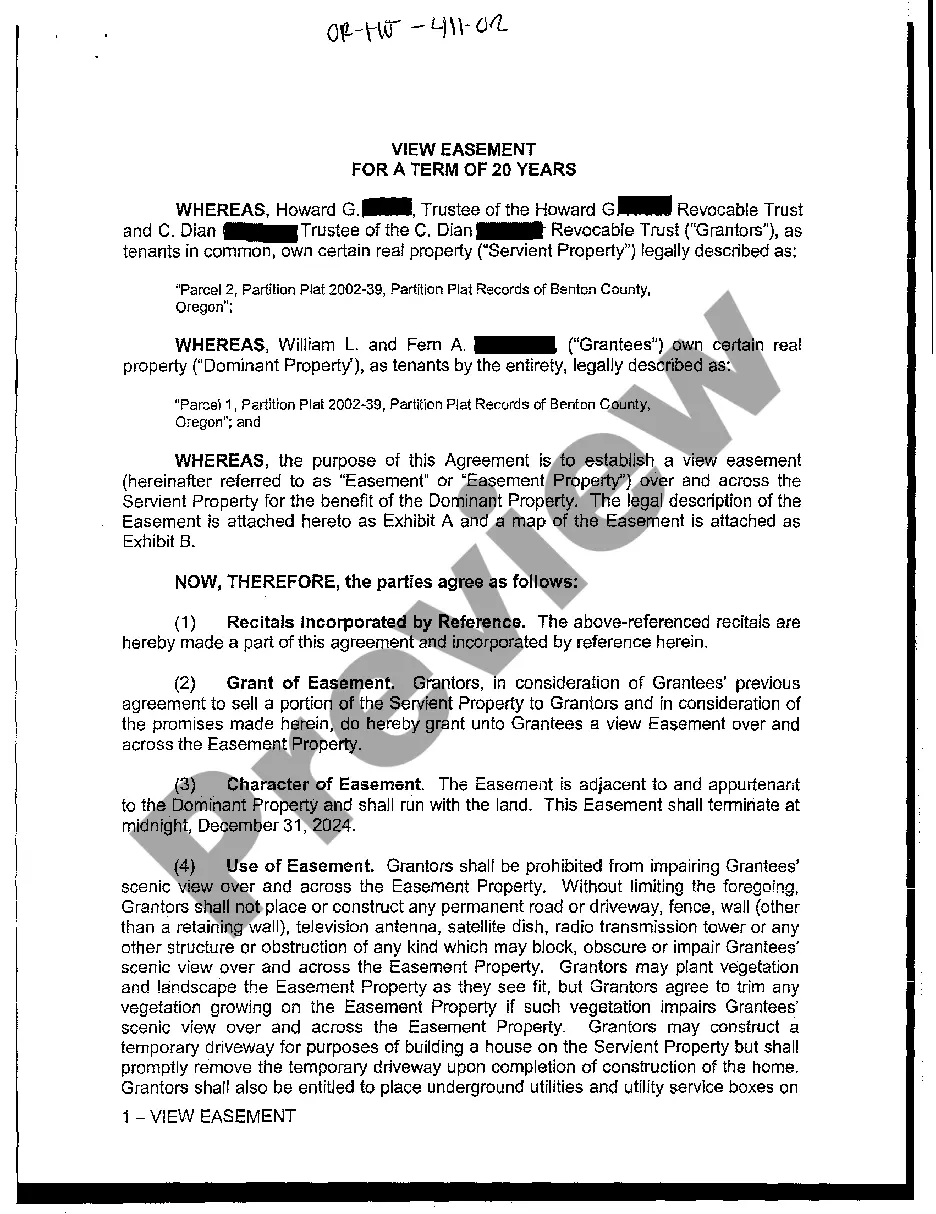

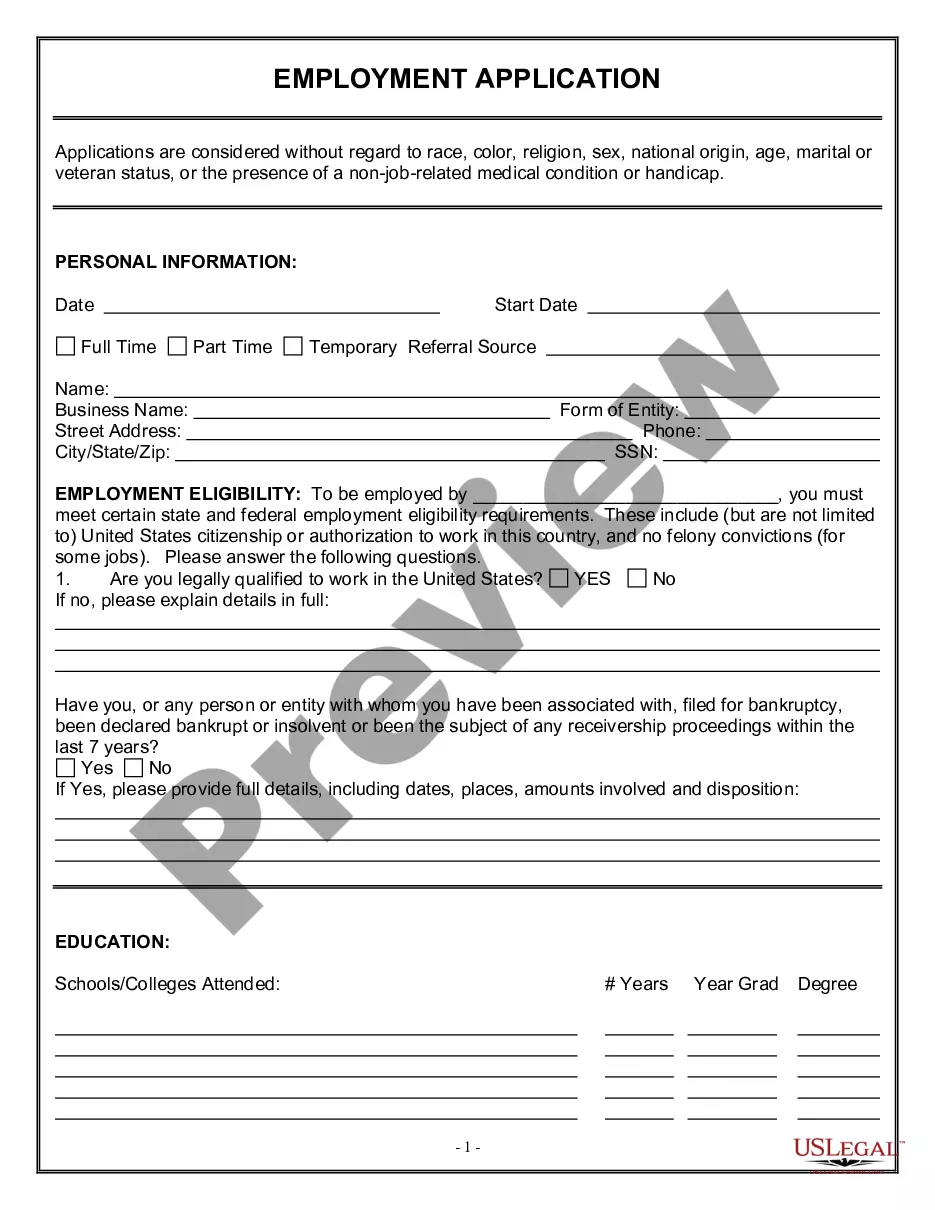

Annual Report Form Sample Withholding Reconciliation

Description

How to fill out Notice Of Annual Report Of Employee Benefits Plans?

It's clear that you can't turn into a legal expert instantly, nor can you understand how to swiftly create an Annual Report Form Sample Withholding Reconciliation without a specific set of expertise.

Producing legal documents is a lengthy process that necessitates specialized training and abilities. So why not entrust the crafting of the Annual Report Form Sample Withholding Reconciliation to the experts.

With US Legal Forms, one of the most extensive legal document collections, you can discover everything from court documents to templates for internal business correspondence. We recognize the importance of compliance and adherence to federal and state regulations.

You can regain access to your forms from the My documents section whenever you need. If you're already a client, you can simply Log In, and find and download the template from the same section.

Regardless of the nature of your documents—whether they are financial and legal or personal—our website has you covered. Give US Legal Forms a try today!

- Locate the document you require using the search feature at the top of the page.

- View it (if this option is available) and read the accompanying description to decide if the Annual Report Form Sample Withholding Reconciliation is what you need.

- Initiate your search again if you're looking for a different template.

- Sign up for a complimentary account and choose a subscription plan to acquire the template.

- Select Buy now. Once the payment is processed, you can download the Annual Report Form Sample Withholding Reconciliation, fill it out, print it, and send or mail it to the appropriate individuals or organizations.

Form popularity

FAQ

General Instructions Form NC-3 reconciles the total North Carolina income tax withheld as listed on the W-2 and 1099 statements with the amount of tax reported as withheld for the year. If you are required to withhold or you voluntarily withheld North Carolina income taxes, you must file Form NC-3.

The Form W-4 in Depth Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number. ... Step 2: Indicate Multiple Jobs or a Working Spouse. ... Step 3: Add Dependents. ... Step 4: Add Other Adjustments. ... Step 5: Sign and Date Form W-4.

Claiming 1 reduces the amount of taxes that are withheld from weekly paychecks, so you get more money now with a smaller refund. Claiming 0 allowances may be a better option if you'd rather receive a larger lump sum of money in the form of your tax refund.

Annual Reconciliation is the process in which employers reconcile total annual earnings reported periodically throughout the year to the total earnings reported in the Monthly Remittance Reports.

By placing a ?0? on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. 2. You can choose to have no taxes taken out of your tax and claim Exemption (see Example 2).