Annual Report Form Sample Withholding

Description

How to fill out Notice Of Annual Report Of Employee Benefits Plans?

Utilizing legal templates that comply with federal and state regulations is essential, and the internet provides numerous options to select from.

However, what is the advantage of spending time searching for the accurately drafted Annual Report Form Sample Withholding template online when the US Legal Forms online library already consolidates such templates in one location.

US Legal Forms is the largest online legal repository, boasting over 85,000 editable templates created by attorneys for any professional and personal situation. They are easy to navigate, with all documents categorized by state and intended purpose.

All templates you discover through US Legal Forms are reusable. To re-download and complete previously obtained forms, navigate to the My documents tab in your account. Experience the most comprehensive and user-friendly legal documentation service!

- Our specialists stay abreast of legislative updates, ensuring that your documents are always current and compliant when acquiring an Annual Report Form Sample Withholding from our platform.

- Accessing an Annual Report Form Sample Withholding is quick and straightforward for both existing and new users.

- If you possess an account with a valid subscription, Log In and download the document sample you require in your desired format.

- If you are visiting our website for the first time, follow the instructions below.

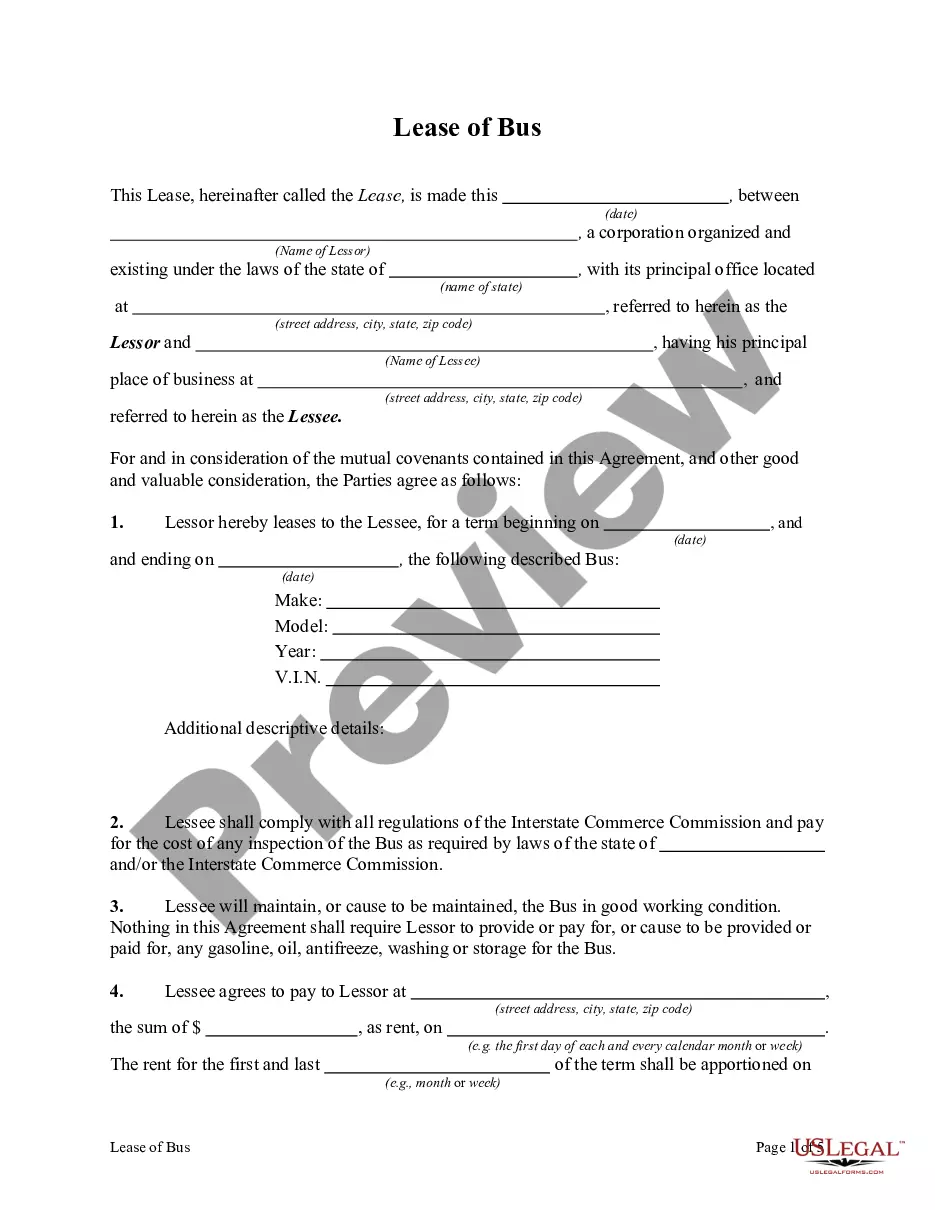

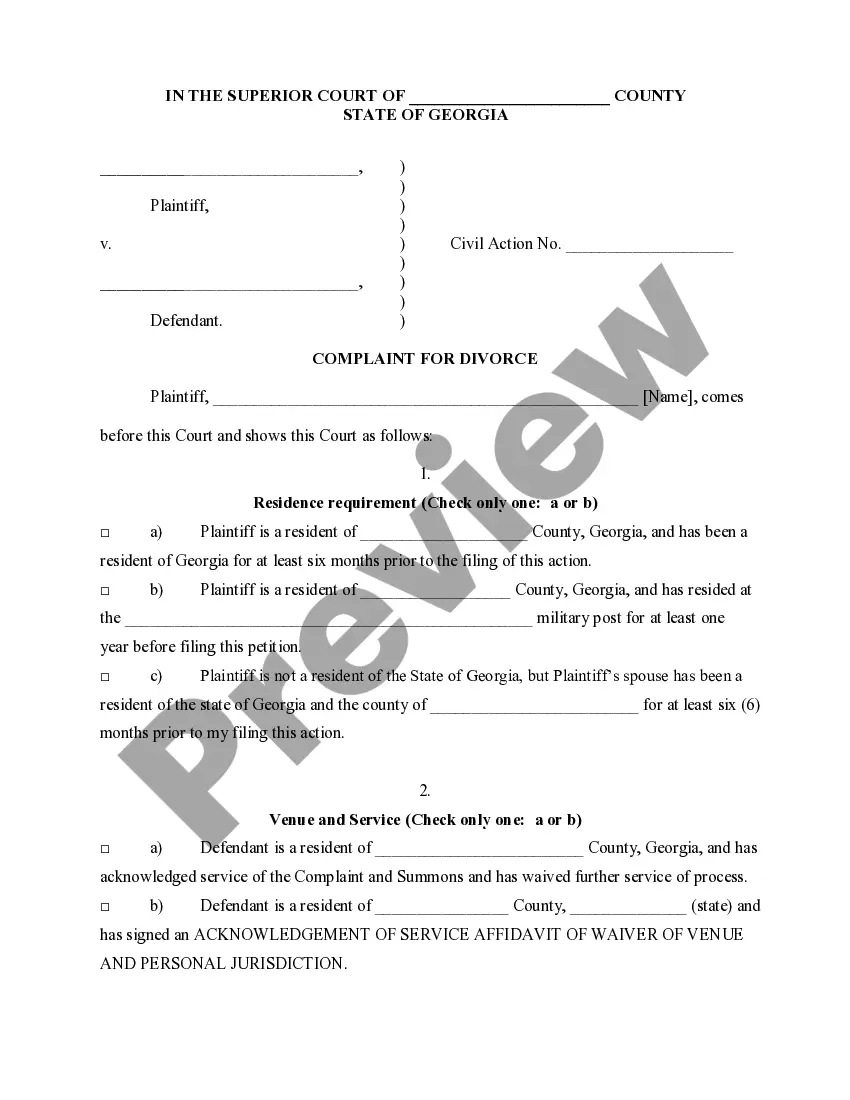

- Review the template using the Preview feature or through the text outline to ensure it meets your needs.

Form popularity

FAQ

Whether you claim 0 or 1 on your W-4 depends on your individual tax situation. Claiming 0 will result in more tax being withheld from each paycheck, which may be suitable if you want a larger refund when filing your taxes. Conversely, claiming 1 will decrease your withholding, which can lead to a smaller refund or potential taxes due at the end of the year. To make the best decision, consult an annual report form sample withholding for insight into common practices.

To fill the forms out, employees must follow the instructions on each line of both the federal and provincial forms. Then, each of the amounts on the lines is added together and totaled. This sum is entered into the last line of page 1 on the TD1 form that says ?Total Claim Amount.?

The TD1 form gives your employer the best estimate of your personal tax situation, so that they can deduct the right amount of income tax from your pay. If you don't give accurate information on the form, your employer may take the wrong amount of tax off your pay.

Services rendered in Canada (withholding tax) Any payment received for services provided in Canada is subject to a 15% tax withholding, which must be remitted to the CRA by the person making the payment. This withholding is a payment on account of the corporation's potential tax liability to Canada.

HOW TO: Fill-in a Canadian TD1 Form *2023* - YouTube YouTube Start of suggested clip End of suggested clip Form.MoreForm.