Cobra Coverage For Widows

Description

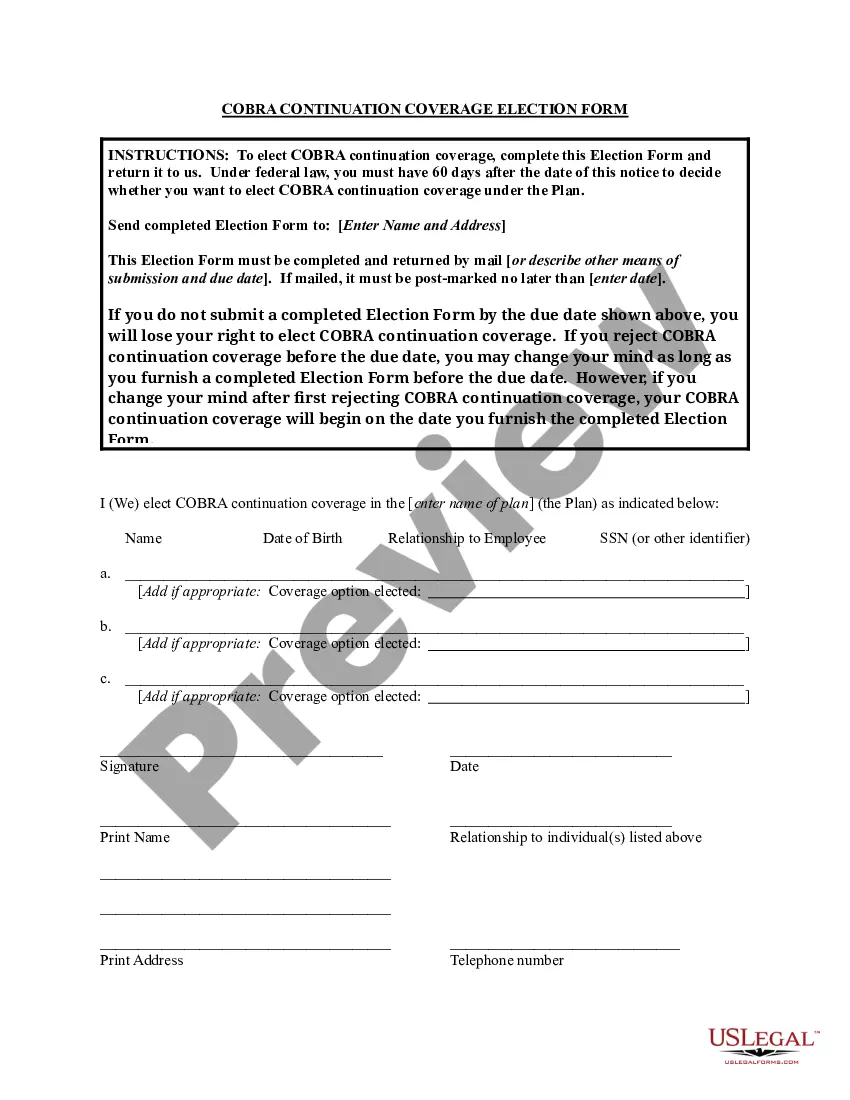

How to fill out Cobra Coverage For Widows?

Traversing the red tape of official documents and templates can be challenging, particularly for someone who does not engage in this professionally.

Even locating the correct template for Cobra Coverage For Widows will consume substantial time, as it needs to be accurate and valid to the last detail.

However, you will need to invest significantly less time selecting an appropriate template from a trusted resource.

Acquire the correct form in a few simple steps: Enter the document name in the search bar. Identify the appropriate Cobra Coverage For Widows from the search results. Review the description of the sample or view its preview. If the template meets your needs, click Buy Now. Proceed to select your subscription plan. Use your email to set a password to create an account at US Legal Forms. Choose a credit card or PayPal payment method. Download the template document onto your device in your preferred format. US Legal Forms will save you considerable time in validating whether the form you found online is appropriate for you. Establish an account and gain unlimited access to all required templates.

- US Legal Forms is a platform that streamlines the search for suitable forms online.

- US Legal Forms serves as a one-stop-shop to find the most current samples of documents, understand their usage, and download these templates to complete them.

- It boasts a repository with over 85K forms applicable in various sectors.

- When seeking a Cobra Coverage For Widows, you need not question its authenticity as all documents are confirmed.

- Creating an account at US Legal Forms will guarantee you have all essential samples at your fingertips.

- You can store them in your history or add them to the My documents section.

- Access your saved documents from any device by clicking Log In on the library site.

- If you have yet to create an account, you can always search for the needed template again.

Form popularity

FAQ

COBRA coverage is only available from the moment you elect to continue it, although some retroactive options may exist if you experience a qualified event but did not enroll right away. In most scenarios, you need to act within the required timeframes for your COBRA coverage for widows to take effect. Knowing the rules around retroactive coverage can be beneficial in ensuring seamless health coverage.

COBRA allows a spouse who loses coverage due to a qualifying event, such as death or divorce, to enroll in their partner's health plan. This coverage is crucial, especially for widows, as it provides access to needed medical services without interruption. Understanding how COBRA works with a spouse enables you to effectively use COBRA coverage for widows during a difficult time.

The 7 COBRA qualifying events include job loss, reduction in hours, divorce, death, Medicare entitlement, a dependent child losing coverage, and bankruptcy of the employer. Each event triggers your right to elect COBRA coverage. Being aware of these events helps you understand when you can apply for COBRA coverage for widows and secure healthcare support.

The 60 day rule for COBRA indicates that a qualified individual must elect to continue their health insurance coverage after losing it within 60 days. This applies to widows who want to retain their deceased husband's health benefits. Knowing this rule is essential to ensure that you don’t lose your rights to COBRA coverage for widows due to a missed deadline.

A widow can generally remain on COBRA for up to 36 months after the qualifying event, such as their husband's death. This extended period allows you to continue receiving coverage, ensuring that you have time to transition to other health insurance options. Utilizing COBRA coverage for widows provides critical support during a significant life change.

If your husband dies, your health insurance options may change. You will typically qualify for COBRA coverage, allowing you to maintain your husband's health insurance plan for a limited time. It’s crucial to act promptly to secure COBRA coverage for widows, as this ensures continuity of care and access to necessary medical treatments during a challenging period.

The COBRA 60 day loophole refers to the ability for qualified individuals, such as widows, to elect COBRA coverage within 60 days after losing their health insurance. This means that, even if they miss the initial notification period, they can still secure COBRA coverage if they act within this timeframe. Understanding this loophole is vital for ensuring continued access to essential health services through COBRA coverage for widows.

When your husband dies, your health insurance may change significantly, with options available to manage these transitions. With COBRA coverage for widows, you can continue your existing health plan for a limited period, ensuring continuity of care. It’s essential to take advantage of this provision to safeguard your health during a tough time.

Upon the death of a spouse, various benefits may become available to you, including potential access to COBRA coverage for widows. This option allows you to keep your health insurance and maintain access to necessary medical services. It’s important to understand the benefits you are entitled to and to initiate any necessary actions promptly.

After the loss of your partner, you may feel overwhelmed; however, it’s crucial not to rush decisions regarding health insurance. Avoid making hasty changes to your coverage without considering your options, such as COBRA coverage for widows, which can provide stability during your transition. Take a moment to review all your benefits before making any commitments.