Cobra Coverage For Retirees

Description

How to fill out Cobra Coverage For Retirees?

How to obtain expert legal documents that adhere to your state's laws and prepare the Cobra Coverage For Retirees without consulting a lawyer.

Numerous online services provide templates to address diverse legal scenarios and requirements. However, it might require some time to identify which of the accessible samples meet both the usage requirements and legal standards for you.

US Legal Forms is a trustworthy service that assists you in locating official documents crafted according to the latest state legislation updates and saves you money on legal help.

If you do not possess an account with US Legal Forms, then adhere to the instructions below.

- US Legal Forms is not just a typical online library.

- It consists of over 85k authenticated templates for different business and personal situations.

- All documents are organized by area and state to expedite your search process and make it more convenient.

- Moreover, it integrates with powerful tools for PDF editing and electronic signatures, allowing users with a Premium subscription to seamlessly fill out their documents online.

- It requires minimal time and effort to secure the required paperwork.

- If you already have an account, Log In and confirm your subscription is active.

- Download the Cobra Coverage For Retirees using the relevant button beside the file name.

Form popularity

FAQ

The 60 days COBRA loophole refers to a provision that allows individuals to delay their acceptance of COBRA coverage for up to 60 days. During this time, you can evaluate your other health insurance options, such as enrolling in a spouse's plan or finding a private plan. If you choose not to take COBRA within this period, you may lose the right to enroll later. Being aware of this loophole can help retirees make informed decisions about their healthcare coverage.

There are seven qualifying events that can trigger COBRA coverage for retirees, including termination of employment, reduction in work hours, divorce or legal separation, death of the covered employee, loss of dependent status, eligibility for Medicare, and the employer filing for bankruptcy. Understanding these events helps retirees know when they can enroll in COBRA. By being informed, retirees can better plan for their healthcare needs during retirement. It's essential to take timely action to secure COBRA coverage after any of these events.

COBRA coverage for retirees must be offered by employers with 20 or more employees. Under COBRA, retirees can continue their health insurance coverage for a limited time after leaving employment. This coverage typically lasts for up to 18 months, but it can be extended under certain circumstances. It is important for retirees to understand their rights and responsibilities under COBRA to ensure they maintain their health coverage.

You can enroll in COBRA coverage for retirees immediately after receiving your eligibility notice. Generally, you have a 60-day window to sign up for COBRA, which offers you time to consider your options. Prompt enrollment ensures you don’t experience a gap in health coverage. Remember, timely payment of premiums is critical to maintain continuous coverage.

Yes, COBRA does apply to retiree coverage. It allows retirees to maintain their health benefits after leaving a job, provided the company has 20 or more employees. This option ensures you receive the same health coverage as when you were employed. It’s a valuable tool for securing your health care during retirement.

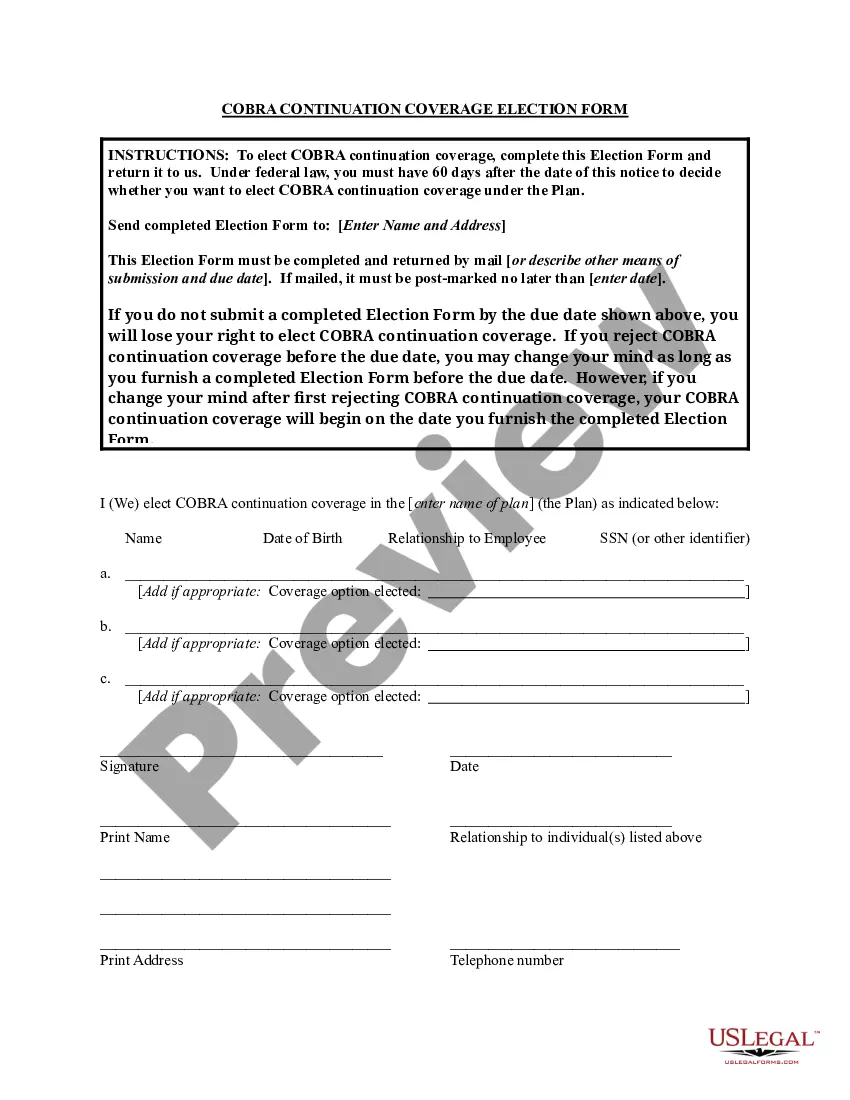

To set up COBRA coverage for retirees, start by reviewing your health plan documents. Your former employer must notify you of your eligibility after a qualifying event. Then, you need to complete the COBRA enrollment form, which the employer provides. Finally, submit the form along with your first premium payment to activate your COBRA coverage.

Yes, you can obtain COBRA coverage if you retire. Retirement is considered a qualifying event, allowing you to enroll in COBRA coverage for retirees. This option helps you continue your health insurance coverage temporarily, providing peace of mind during your transition into retirement.

Determining whether COBRA coverage for retirees is worth it depends on your individual circumstances. On one hand, it allows you to maintain your existing health plan, which could be beneficial if you have ongoing medical needs. However, since the premiums can be high, it is essential to weigh the costs against potential healthcare expenses to make an informed choice.

Typically, COBRA coverage does not start immediately after your retirement. Instead, it usually begins the day after your employer-sponsored coverage ends. It is critical to act quickly, as you must choose to enroll in COBRA coverage for retirees within a specified time frame to avoid any gap in your health coverage.

COBRA coverage has specific rules, such as eligibility requirements and duration limitations. Generally, you must have been part of a group health plan and experience a qualifying event like retirement to qualify. Understanding these rules helps you make informed decisions about your COBRA coverage for retirees and ensures compliance with federal regulations.