Cobra Coverage For Dependents Turning 26

Description

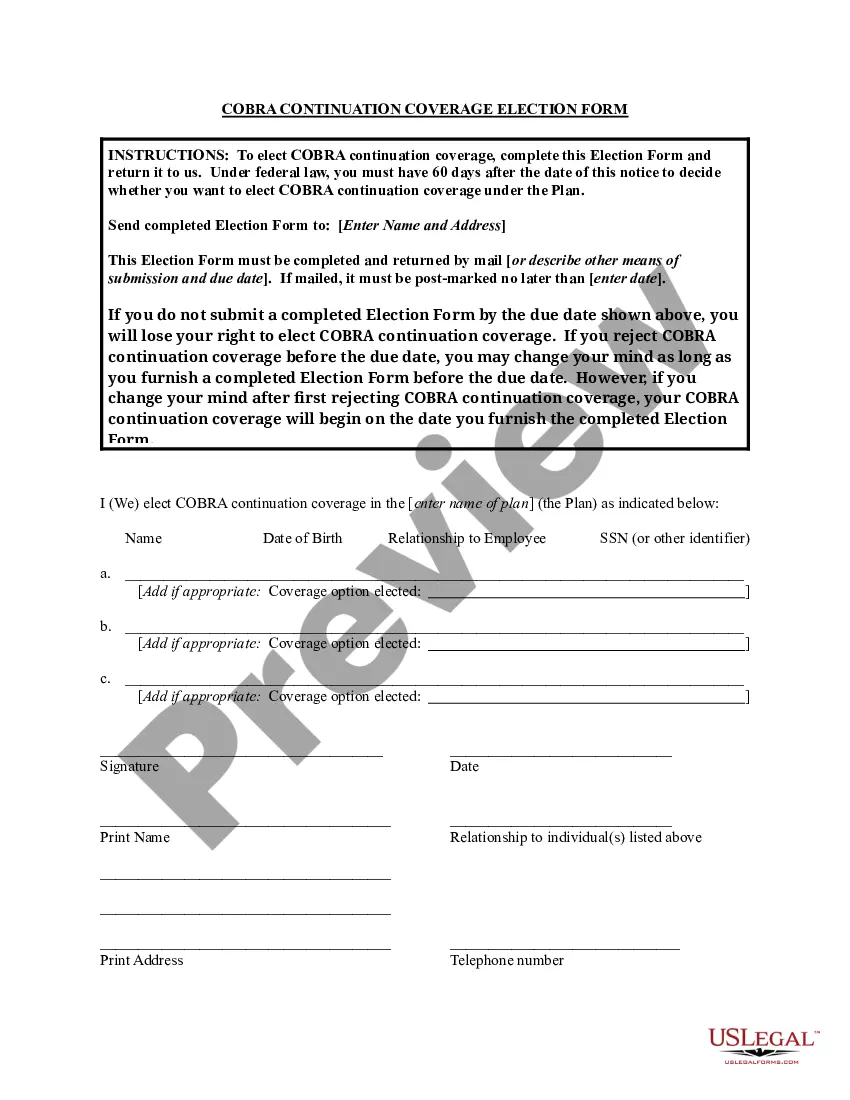

How to fill out Cobra Coverage For Dependents Turning 26?

Administration necessitates exactness and correctness.

If you do not manage filling out forms like Cobra Coverage For Dependents Turning 26 regularly, it can lead to some confusions.

Choosing the right example from the beginning will ensure that your document submission will proceed smoothly and avert any hassles of re-submitting a document or repeating the entire task completely from the start.

Acquiring the correct and current templates for your documentation is a matter of minutes with an account at US Legal Forms. Eliminate the bureaucratic issues and streamline your work with forms.

- Find the example using the search tool.

- Verify the Cobra Coverage For Dependents Turning 26 you’ve discovered is applicable for your state or locality.

- Access the preview or review the details that contain information on the application of the template.

- When the outcome matches your inquiry, click the Buy Now button.

- Select the appropriate choice among the presented pricing options.

- Log Into your account or create a new one.

- Complete the purchase using a credit card or PayPal account.

- Download the document in your preferred file format.

Form popularity

FAQ

Yes, turning 26 is a significant life moment in the context of health insurance. This milestone triggers options for your dependent, including eligibility for COBRA coverage. It is an opportunity to secure continued health benefits during a crucial transition period. Consulting resources like uslegalforms can provide clarity on navigating these insurance changes efficiently.

When your child turns 26, they will no longer be eligible for coverage under your health plan. If you wish to maintain their health insurance, exploring COBRA coverage for dependents turning 26 becomes necessary. The COBRA option allows your child to continue receiving health benefits without interruption. It is important to communicate clearly with your insurer about the next steps.

Yes, turning 26 is considered a qualifying life event for COBRA. This means that when your dependent child reaches this age, they can continue their health coverage through COBRA. It’s essential to act quickly to secure COBRA coverage for dependents turning 26, as there are time limits for enrollment. Understanding these details helps ensure your child maintains necessary health coverage.

COBRA participants cannot add dependents during the regular open enrollment period as you would with standard health insurance plans. However, you can apply for COBRA coverage for dependents turning 26 or due to qualifying events. It is vital to stay informed about your options to ensure continued coverage for your dependent family members.

You can add dependents to your COBRA coverage under certain conditions. If your dependents are eligible, such as a spouse or a child turning 26, you have the option to include them in your plan. This flexibility is helpful for those who want to maintain comprehensive health coverage for their loved ones.

Yes, you can add a baby to your COBRA coverage. If your family expands while you are enrolled in COBRA, you qualify to add your newborn to your existing plan. Keep in mind that you must do this within a specific timeframe, so it's crucial to act promptly when your baby arrives.

Yes, dependents can be added to COBRA coverage, but it depends on the specific plan and circumstances. If your dependent is turning 26 and losing their coverage, they may qualify for COBRA coverage for dependents turning 26. Make sure to check the enrollment deadlines to ensure they do not miss this important opportunity.

Indeed, turning 26 is considered a qualifying event for health insurance. This change triggers your eligibility to seek your own coverage or enroll in COBRA. Being aware of this event helps you take the right steps towards securing health insurance that fits your needs. In this case, investigating COBRA coverage for dependents turning 26 provides a viable option for continued health benefits.

You may not necessarily get kicked off your parents' insurance the day you turn 26. Coverage often remains until the end of the month when your birthday occurs. It is wise to verify this detail with your parent's insurance provider to avoid any lapses in coverage. Exploring COBRA coverage for dependents turning 26 could be beneficial during this transition period.

Yes, a child who turns 26 is generally eligible for COBRA continuation coverage. This option helps you maintain your health insurance for a limited period after losing parental coverage. However, you must act swiftly and enroll within the designated timeframe. Utilize COBRA coverage for dependents turning 26 to ensure that you remain protected during this transition.