Trustee Power To Lend

Description

How to fill out Power Of Attorney By Trustee Of Trust?

Managing legal documents can be daunting, even for experienced professionals.

If you are seeking a Trustee Power To Lend and do not have the opportunity to spend time searching for the correct and recent version, the process can be anxiety-inducing.

Tap into a valuable resource library of articles, guides, and materials related to your circumstances and requirements.

Save time and energy searching for the documents you need, and employ US Legal Forms' enhanced search and Review feature to locate Trustee Power To Lend and obtain it.

Select a monthly subscription plan, choose the file format you need, and Download, complete, eSign, print, and dispatch your documents. Benefit from the US Legal Forms online catalog, backed by 25 years of experience and reliability. Streamline your everyday document management into a seamless and user-friendly procedure today.

- If you have a subscription, Log In to your US Legal Forms account, locate the form, and retrieve it.

- Check out the My documents tab to see the documents you have previously downloaded and manage your folders as desired.

- If this is your first time using US Legal Forms, create a free account and gain unlimited access to all platform benefits.

- Below are the actions to take after obtaining the form you need.

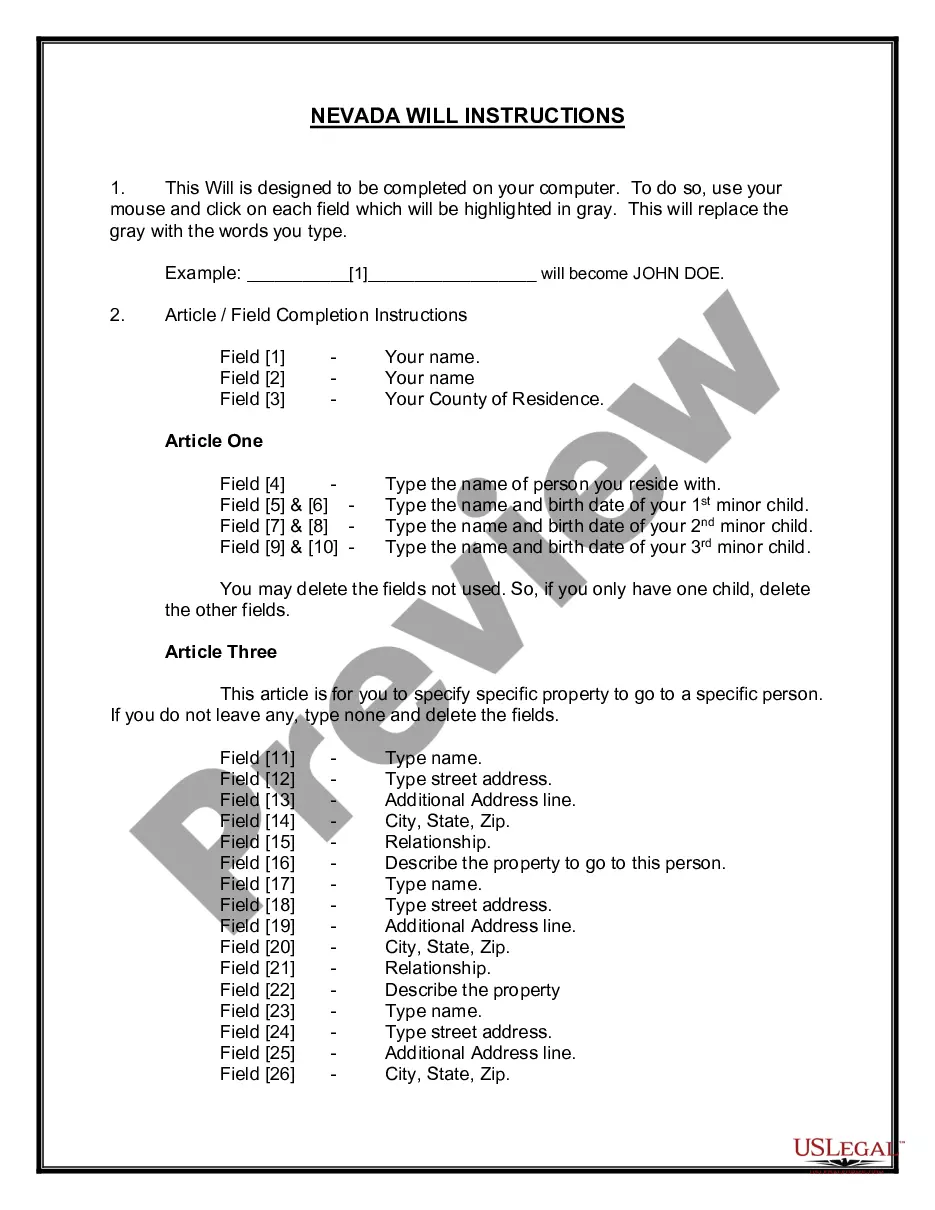

- Verify that it is the correct document by previewing it and reviewing its description.

- Ensure the sample is authorized in your state or county.

- Click Buy Now when you are prepared.

- Access state- or county-specific legal and business documents.

- US Legal Forms addresses any requirements you might have, from personal to corporate documentation, all in one place.

- Utilize sophisticated tools to complete and oversee your Trustee Power To Lend.

Form popularity

FAQ

So long as the terms of the trust do not forbid the borrowing of trust funds by a trustee, a trustee may have the ability to borrow money from the trust.

Lending to an irrevocable trust is available but typically only from specialized irrevocable trust loan lenders. Irrevocable trust loans to beneficiaries and trustees allow for borrowing against trust-owned real estate. This is essentially a home equity loan against the real estate within an irrevocable trust.

And although a beneficiary generally has very little control over the trust's management, they are entitled to receive what the trust allocates to them. In general, a trustee has extensive powers when it comes to overseeing the trust.

Trustees lend money or assets to beneficiaries and their associates. If you borrow money from the trust, you will need to keep a record of it. If the loan is on commercial terms, you will need to repay the principal and interest as per the loan agreement.

Conventional lenders, such as banks and credit unions, are reluctant (or in most cases unable) to offer loans to irrevocable trusts in California. This reluctance is partly due to the complexity, lack of personal guarantee, as well as the hassle to set up this loan.