Employee Contract Rules

Description

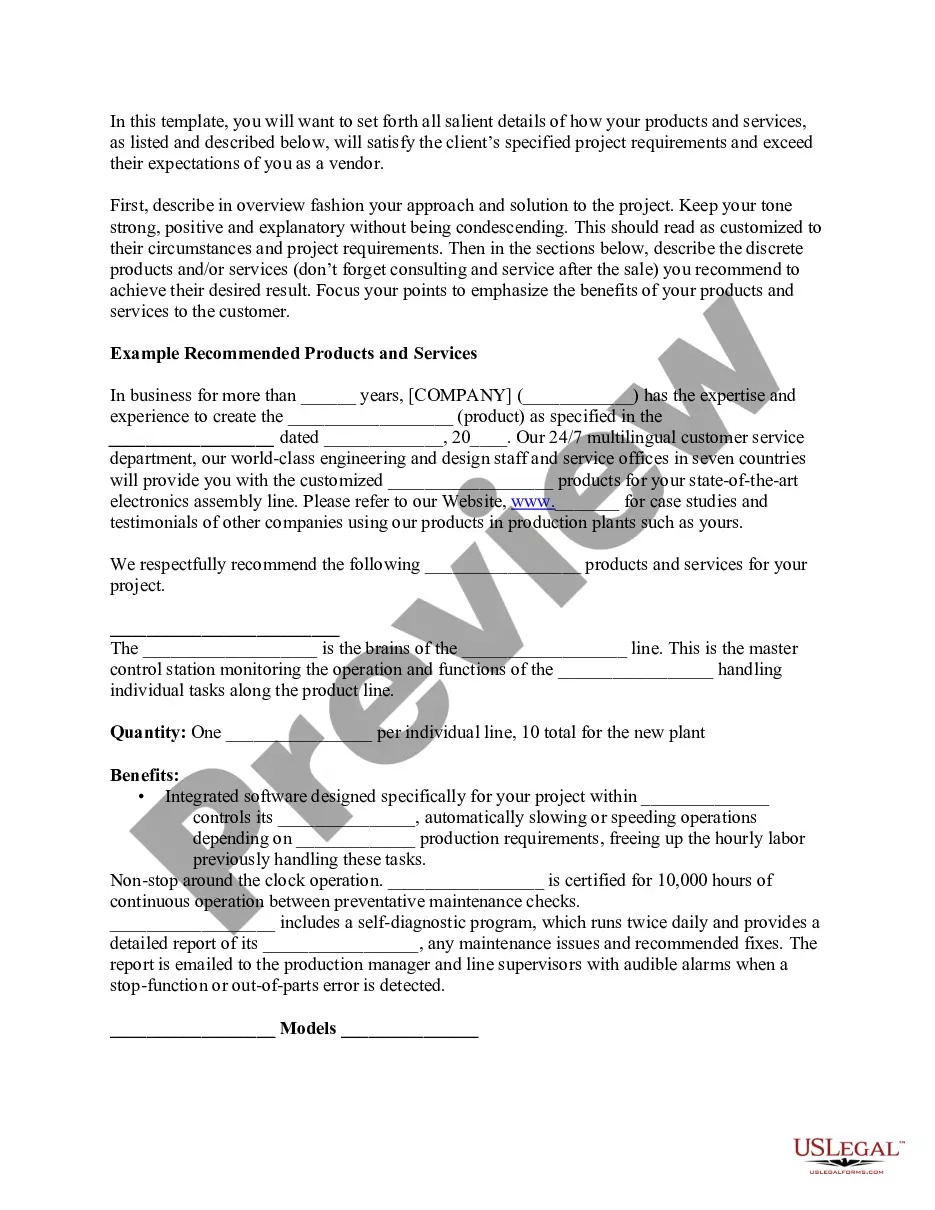

How to fill out Personal Guaranty Of Employment Agreement Between Corporation And Employee?

The Employee Contract Guidelines you see on this page is a reusable formal blueprint crafted by expert attorneys in accordance with federal and local regulations.

For over 25 years, US Legal Forms has supplied individuals, businesses, and lawyers with more than 85,000 verified, state-specific documents for any corporate and personal occasion. It’s the quickest, most direct, and most reliable method to procure the paperwork you need, as the service assures bank-level data security and anti-malware safeguards.

Enroll in US Legal Forms to have verified legal templates for all of life’s situations at your fingertips.

- Search for the document you require and review it.

- Look through the file you sought and preview it or examine the form description to confirm it meets your requirements. If not, utilize the search option to locate the appropriate one. Click Buy Now when you have found the template you need.

- Select and Log In.

- Pick the pricing option that best fits you and sign up for an account. Use PayPal or a credit card to make a swift payment. If you already possess an account, Log In and check your subscription to proceed.

- Obtain the editable template.

- Choose the format you prefer for your Employee Contract Guidelines (PDF, Word, RTF) and save the document on your device.

- Complete and sign the document.

- Print the template to finish it manually. Alternatively, use an online multi-functional PDF editor to quickly and accurately fill out and sign your form with a legally-binding electronic signature.

- Re-download your documents later.

- Utilize the same document again whenever needed. Open the My documents tab in your profile to re-download any previously saved forms.

Form popularity

FAQ

Several people are required to attend real estate closings. They include the seller and the buyer and their respective lawyers. Also, the buyer's bank attorney will attend a real estate closing along with any real estate brokers.

A3: Form RP-5217-PDF is required whenever a deed is recorded with the county clerk's office. Form-RP-5217-PDF is required even if a property is not being sold and only the names are changing on the deed.

To change a deed in New York City, you will need a deed signed and notarized by the grantor. The deed must also be filed and recorded with the Office of the City Register. Transfer documents identifying if any taxes are due must also be filed and recorded with the City Register.

Settlement/closing the transaction Seller signs the deed and closing affidavit. Buyer signs the new note and mortgage. The old loan is paid off. Seller, real estate professionals, attorneys and other parties present at the closing of the transaction are paid.

States that mandate the physical presence of an attorney, or restrict other types of closing duties to attorneys, include: Alabama, Connecticut, Delaware, District of Columbia, Florida, Georgia, Kansas, Kentucky, Maine, Maryland, Massachusetts, Mississippi, New Hampshire, New Jersey, New York, North Dakota, ...

Form TP-584 must be filed for each conveyance of real property from a grantor/transferor to a grantee/transferee. It may not be necessary to complete all the schedules on Form TP-584. The nature and condition of the conveyance will determine which of the schedules you must complete.

The signed original RP-5217-PDF must accompany all deeds and correction deeds upon filing with the Recording Officer. A filing fee is also required. Limited data items (date of Sale, full sale price, spelling error, etc) may require a change AFTER the form is filled and signed.

In New York State, a quitclaim deed is often the easiest and quickest way to convey the property, but it's not necessarily the best. This type of deed is often used to convey property between family members as a gift, as a result of divorce, or to place the real property into a trust.