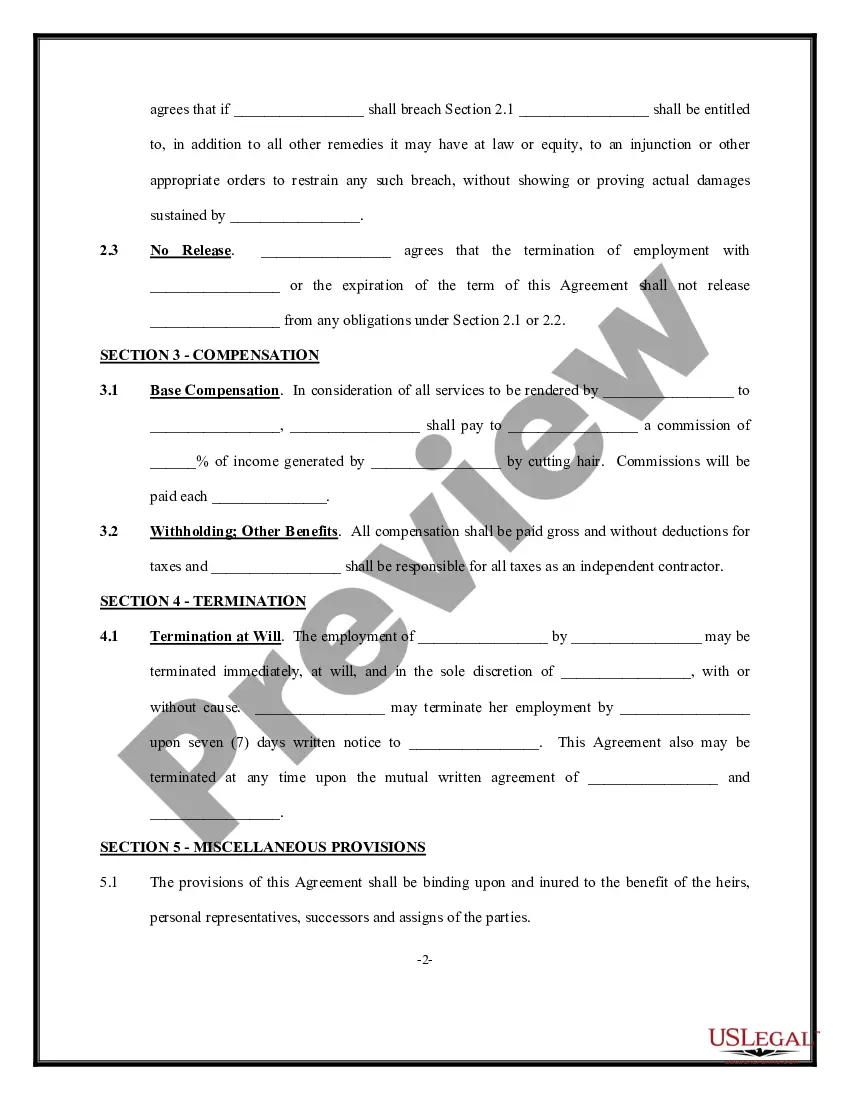

A Salon independent contractor agreement with 1099 is a legally binding document that outlines the terms and conditions between a salon owner or operator and a stylist or beauty professional who is considered an independent contractor. This agreement is commonly used in the salon industry to clearly define the rights, responsibilities, and expectations of both parties involved. Keywords: salon independent contractor agreement, 1099, stylist, beauty professional, salon owner, operator, terms and conditions, rights, responsibilities, expectations. There are different variations and types of Salon independent contractor agreements with 1099, including: 1. Hair Stylist Independent Contractor Agreement with 1099: This agreement specifically caters to hair stylists who provide various hair services such as cutting, coloring, styling, and treatments. It establishes the working relationship and expectations between the stylist and the salon owner or operator. 2. Nail Technician Independent Contractor Agreement with 1099: This type of agreement is designed for nail technicians who specialize in providing nail care services such as manicures, pedicures, acrylics, gels, and nail art. It covers the specific terms applicable to nail technicians within a salon setting. 3. Esthetician Independent Contractor Agreement with 1099: This agreement focuses on estheticians who offer a range of skincare services such as facials, waxing, chemical peels, and microdermabrasion. It defines the agreement between the esthetician and the salon owner or operator. 4. Massage Therapist Independent Contractor Agreement with 1099: This specific agreement is tailored for massage therapists who provide various types of massages and bodywork therapies. It includes important clauses related to client confidentiality, liability, and the use of salon facilities. 5. Makeup Artist Independent Contractor Agreement with 1099: This type of agreement is specifically designed for makeup artists who offer makeup application services for events, weddings, photo shoots, and other occasions. It outlines the expectations and responsibilities of the makeup artist within the salon environment. These various types of Salon independent contractor agreements with 1099 are meant to cater to the different specialties and services offered within the salon industry. They ensure that both the salon owner or operator and the independent contractor are on the same page regarding their working relationship, compensation, schedules, client acquisition, and other important aspects. It is crucial for all parties involved to carefully review and understand the terms and conditions outlined in the agreement before signing.

Salon Independent Contractor Agreement With 1099

Description

How to fill out Salon Independent Contractor Agreement With 1099?

Drafting legal paperwork from scratch can sometimes be intimidating. Some cases might involve hours of research and hundreds of dollars invested. If you’re searching for an easier and more cost-effective way of creating Salon Independent Contractor Agreement With 1099 or any other paperwork without the need of jumping through hoops, US Legal Forms is always at your fingertips.

Our online library of over 85,000 up-to-date legal documents covers virtually every aspect of your financial, legal, and personal affairs. With just a few clicks, you can instantly access state- and county-specific forms carefully put together for you by our legal professionals.

Use our website whenever you need a trustworthy and reliable services through which you can easily find and download the Salon Independent Contractor Agreement With 1099. If you’re not new to our services and have previously set up an account with us, simply log in to your account, select the form and download it away or re-download it at any time in the My Forms tab.

Don’t have an account? No worries. It takes minutes to register it and explore the library. But before jumping straight to downloading Salon Independent Contractor Agreement With 1099, follow these recommendations:

- Check the form preview and descriptions to ensure that you are on the the form you are looking for.

- Check if form you choose complies with the regulations and laws of your state and county.

- Pick the best-suited subscription option to buy the Salon Independent Contractor Agreement With 1099.

- Download the form. Then fill out, certify, and print it out.

US Legal Forms boasts a spotless reputation and over 25 years of experience. Join us today and transform form execution into something easy and streamlined!

Form popularity

FAQ

Salon Tax Avoidance = HIDING If you are caught lying or hiding anything from the IRS, then you are likely to be charged with tax evasion. The IRS will look at various aspects of your business to scrutinize the expenses you are deducting and ensuring that you are capturing all revenue incoming to the business.

How is Form 1099-NEC completed? Obtain a copy of Form 1099-NEC from the IRS or a payroll service provider. Provide the name and address of both the payer and the recipient. Calculate the total compensation paid. Note the amount of taxes withheld if backup withholding applied. 1099 Payroll - How to Pay Independent Contractors - ADP adp.com ? articles-and-insights ? articles ? 1... adp.com ? articles-and-insights ? articles ? 1...

An independent contractor agreement is a contract that lays out the terms of the independent contractor's work. It covers the contractual obligations, scope, and deadlines of the work to be performed. It affirms that the client and contractor are not in an employer-employee relationship. What Is an Independent Contractor Agreement? - Ironclad ironcladapp.com ? journal ? contracts ? independ... ironcladapp.com ? journal ? contracts ? independ...

They have a dress code to follow, behavioral or procedural policies are in place, they need to arrive on time and their prices are determined by the salon owner. In this structure stylists are paid their agreed upon commission split throughout the year and then are handed a 1099 to file on their own. When is it right to receive a 1099 as a hairstylist? thethrivingstylist.com ? blog ? when-is-it-right-... thethrivingstylist.com ? blog ? when-is-it-right-...

If you work for a person or a company and earn $600 or more paid to you in cash (again that means paid to you by cash, check, trade, credit card payment?just no taxes taken out) within a year they are required by law to send you a 1099-MISC. Whether you receive a 1099-MISC or not, if you made the money from ... chucksloan.com ? selfemployed chucksloan.com ? selfemployed