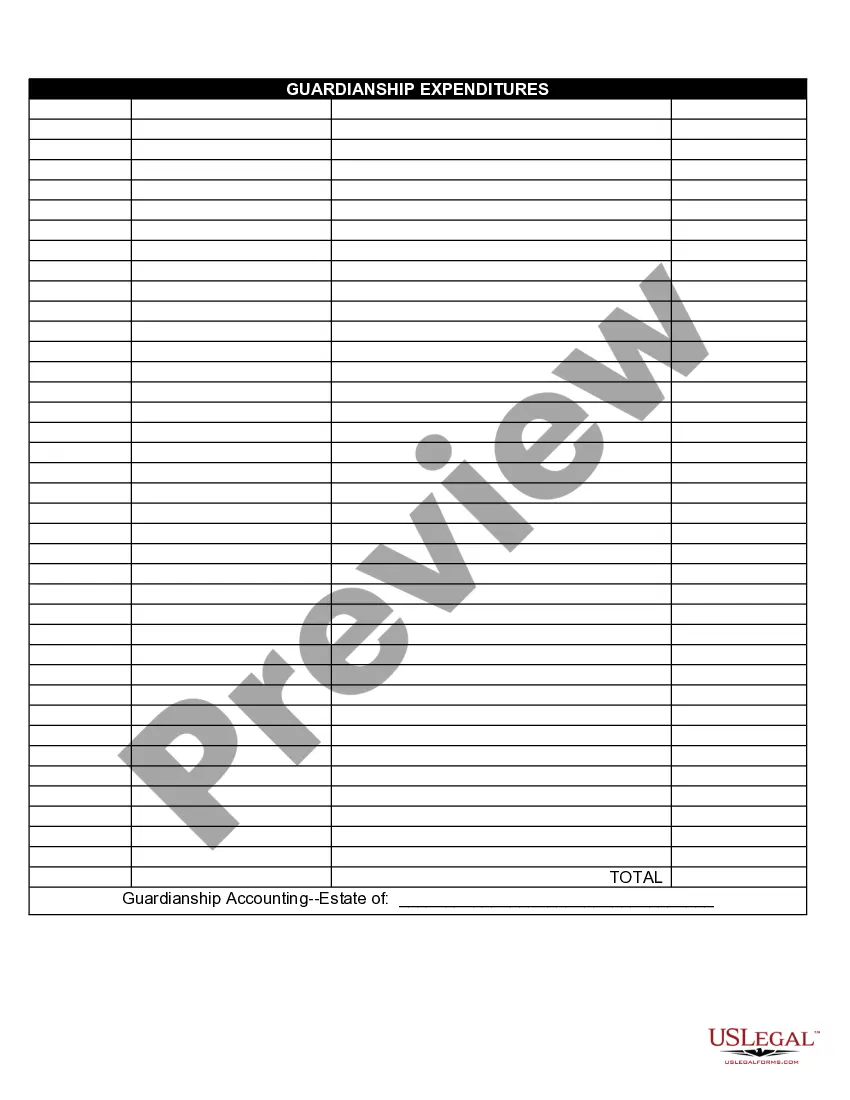

Name Amount Estate Withdrawal

Description

How to fill out Guardianship Expenditures?

Legal document management can be frustrating, even for the most skilled specialists. When you are looking for a Name Amount Estate Withdrawal and don’t get the time to devote in search of the correct and updated version, the operations might be nerve-racking. A strong online form catalogue can be a gamechanger for anyone who wants to handle these situations efficiently. US Legal Forms is a market leader in online legal forms, with more than 85,000 state-specific legal forms accessible to you at any time.

With US Legal Forms, you can:

- Access state- or county-specific legal and business forms. US Legal Forms handles any requirements you could have, from individual to organization paperwork, all-in-one location.

- Make use of advanced tools to accomplish and manage your Name Amount Estate Withdrawal

- Access a resource base of articles, guides and handbooks and resources highly relevant to your situation and needs

Help save effort and time in search of the paperwork you will need, and make use of US Legal Forms’ advanced search and Preview feature to discover Name Amount Estate Withdrawal and get it. If you have a monthly subscription, log in in your US Legal Forms profile, look for the form, and get it. Take a look at My Forms tab to view the paperwork you previously downloaded and to manage your folders as you can see fit.

If it is your first time with US Legal Forms, create an account and have unlimited access to all advantages of the library. Listed below are the steps to consider after downloading the form you need:

- Validate this is the right form by previewing it and reading through its description.

- Be sure that the sample is approved in your state or county.

- Select Buy Now when you are all set.

- Choose a monthly subscription plan.

- Pick the format you need, and Download, complete, sign, print out and deliver your document.

Take advantage of the US Legal Forms online catalogue, backed with 25 years of experience and stability. Change your everyday document administration into a smooth and easy-to-use process right now.

Form popularity

FAQ

2. You Can Avoid Probate With A Small Estate Affidavit Cars, boats, or mobile homes. Real property outside of California. Property held in trust, including a revocable living trust. Real or personal property that the person who died owned jointly with someone else (such as joint tenancy)

You will need to file a petition with the courts to withdraw money from the account. The court will review your petition and make a judgment based on the information.

In California, probate settles a deceased person's estate and is required in California if the estate is worth more than $184,500. It typically occurs when the deceased person died without a will, but it can occur even if the deceased person did have a will if they owned real property that is subject to probate.

Make sure you qualify to use this process For example, if the decedent died on April 1, 2022, or later, the estate is small if it is valued at $184,500 or less. If the decedent died before April 1, 2022, the estate is small if it is valued at $166,250 or less.

California law says the personal representative must complete probate within one year from the date of appointment, unless s/he files a federal estate tax. In this case, the personal representative can have 18 months to complete probate.