Business Deductibility Checklist For Taxes

Description

How to fill out Business Deductibility Checklist?

It’s well-known that you cannot become a legal expert in a day, nor can you easily learn how to swiftly create a Business Deductibility Checklist For Taxes without possessing a specific skill set.

Compiling legal documents is a lengthy process that demands unique training and expertise.

So why not entrust the development of the Business Deductibility Checklist For Taxes to the specialists.

You can revisit your documents from the My documents section at any time. If you are a current client, you can just Log In, and locate and download the template from the same section.

Regardless of the purpose of your forms—whether financial, legal, or personal—our site has you covered. Give US Legal Forms a try today!

- Find the document you need by utilizing the search feature at the top of the webpage.

- View it (if this option is available) and review the accompanying description to determine if the Business Deductibility Checklist For Taxes is what you're seeking.

- Commence your search again if you require another template.

- Sign up for a free account and choose a subscription plan to acquire the template.

- Select Buy now. After completing the purchase, you can obtain the Business Deductibility Checklist For Taxes, complete it, print it out, and send or deliver it to the required individuals or entities.

Form popularity

FAQ

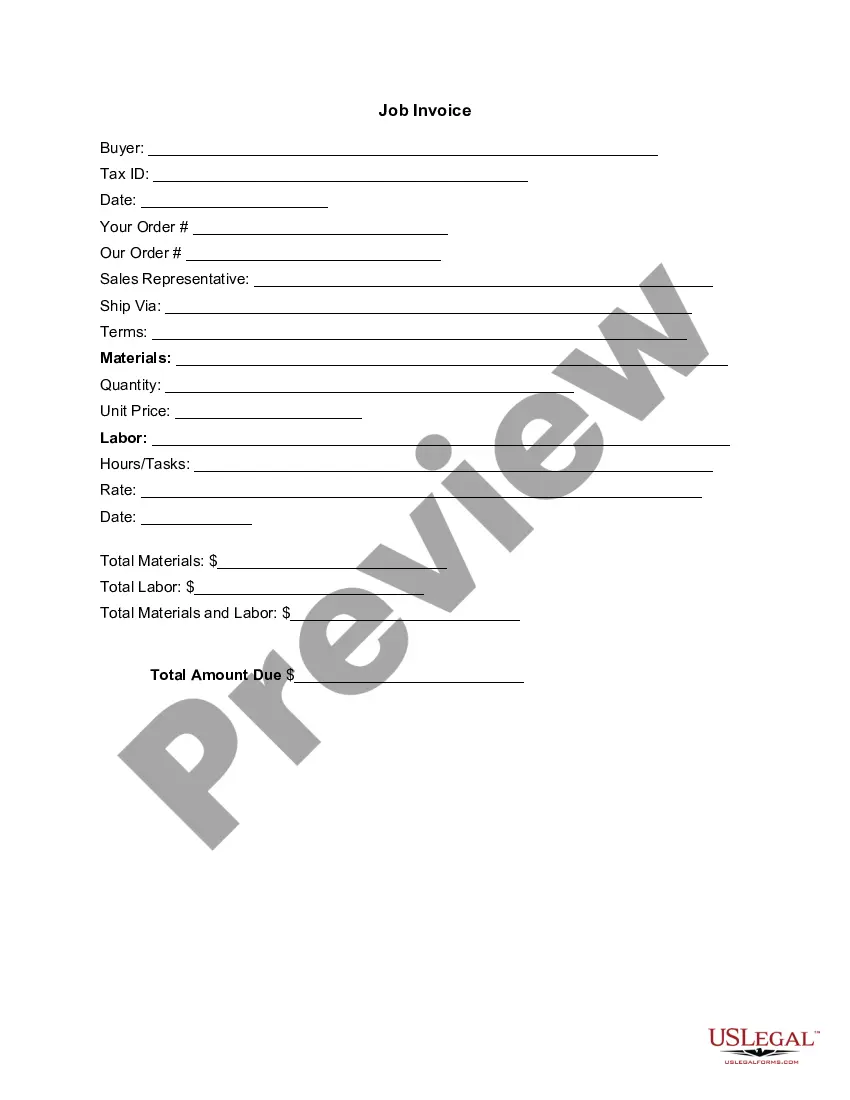

To write off expenses as business deductions, you must first identify eligible costs that directly relate to your business operations. Use a detailed business deductibility checklist for taxes to ensure you include all allowable expenses, such as office supplies, travel, and utilities. Keep thorough records, including receipts and invoices, since accurate documentation supports your deductions. Utilizing tools like the US Legal Forms platform can simplify the process, helping you access the necessary forms and guides for efficient tax preparation.

Many business owners overlook crucial items in their business deductibility checklist for taxes, leading to costly mistakes. Common errors include misclassifying expenses, failing to keep receipts, and not staying updated on tax law changes. Additionally, some business owners forget to claim all eligible deductions, which can significantly affect their tax bill. To avoid these pitfalls, consider using US Legal Forms for expert guidance and resources tailored to your needs.

To create a comprehensive taxes checklist, focus on gathering all relevant documents concerning your income and expenses. A thorough business deductibility checklist for taxes should include profit and loss statements, invoices, and any relevant receipts. By organizing these documents ahead of time, you streamline your tax preparation and minimize the risk of errors or missed deductions. US Legal Forms can assist you in preparing these documents efficiently.

In your business deductibility checklist for taxes, you will find that certain expenses are fully deductible. This includes items like advertising costs, business insurance, and travel expenses related to business purposes. It's essential to keep accurate records and receipts for these expenses to ensure you maximize your deductions at tax time. Consider using tools from US Legal Forms to simplify the process of tracking these expenses.

A deductible business expense must be both necessary and ordinary for your type of business operations. Examples include costs for supplies, rent, and salaries. Using a business deductibility checklist for taxes ensures you recognize all eligible deductions, maximizing potential tax benefits.

In addition to previously mentioned items, advertising expenses and employee reimbursements for necessary business expenses also qualify for full deductibility. Training expenses for your team can also fall under this category. Check your business deductibility checklist for taxes to ensure you capture these key deductions.

Deductible business expenses include necessary and ordinary costs incurred for running your business. These can range from operational costs, like supplies and salaries, to advertising expenses. Using a well-organized business deductibility checklist for taxes helps ensure you include every possible deduction.

The $75 rule allows businesses to deduct expenses for gifts to clients or employees as long as the value is under $75. This simplifies reporting and encourages businesses to give. To maximize your tax savings, refer to the business deductibility checklist for taxes that outlines these crucial limits.

Typically, business-related items such as marketing costs, office supplies, and certain equipment depreciation qualify for 100% tax deductibility. Meals and entertainment expenses can also be fully deductible if they meet specific criteria. Consider consulting our business deductibility checklist for taxes to ensure you're capturing all available deductions.

Yes, in many cases, the IRS requires you to provide proof of deductions claimed. When you handle your business deductibility checklist for taxes with diligence, you minimize risks associated with audit requests. Accurate documentation can confirm your claims and protect you against potential disputes. Utilizing services such as uslegalforms can aid you in properly documenting these deductions.