Modelo Formulario Formato

Description

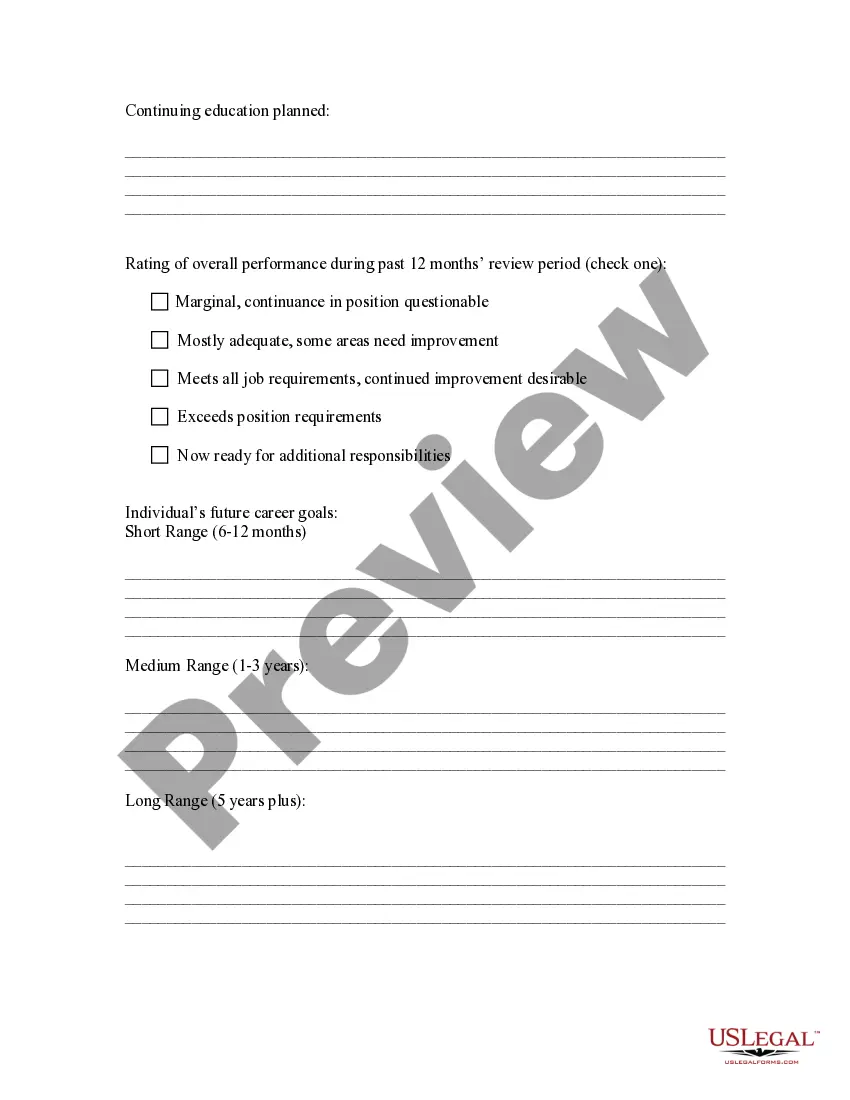

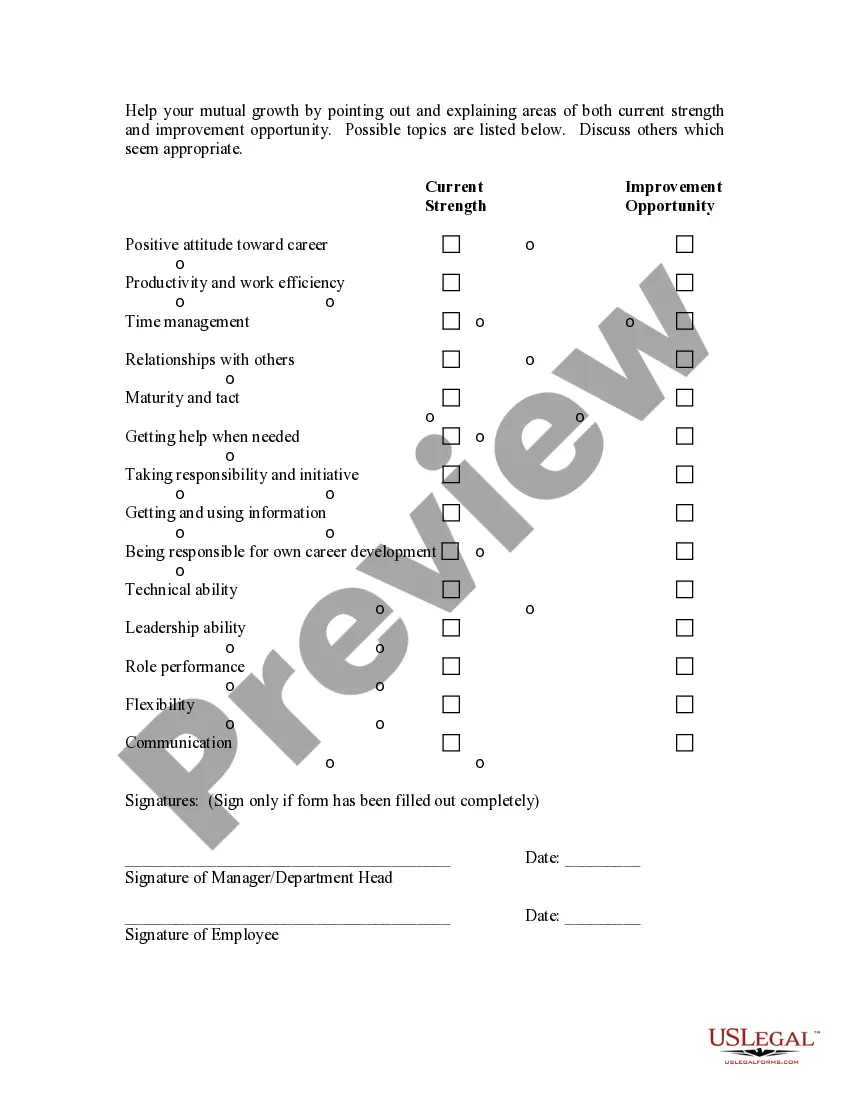

How to fill out Model Performance Evaluation - Appraisal Form For Hourly, Exempt, Nonexempt, And Managerial Employees?

The Modelo Formulario Formato displayed on this page is a reusable legal template created by expert attorneys in accordance with federal and state regulations.

For over 25 years, US Legal Forms has supplied individuals, businesses, and legal representatives with more than 85,000 validated, state-specific templates for any professional and personal situation. It’s the fastest, simplest, and most reliable way to obtain the documents you require, as the service ensures bank-level data protection and anti-malware safeguards.

Subscribe to US Legal Forms to have verified legal templates for every aspect of life readily available.

- Search for the document you require and examine it.

- Review the sample you found and preview it or look at the form description to confirm it meets your requirements. If it doesn’t, utilize the search function to find the appropriate one. Click Buy Now once you have located the template you are looking for.

- Register and Log In.

- Select the pricing option that best fits you and establish an account. Utilize PayPal or a credit card for a swift transaction. If you already possess an account, Log In and verify your subscription to proceed.

- Obtain the editable template.

- Choose the format you desire for your Modelo Formulario Formato (PDF, Word, RTF) and download the sample to your device.

- Fill out and sign the document.

- Print the template to fill it out by hand. Alternatively, use an online versatile PDF editor to quickly and accurately complete and sign your form with a legally-binding electronic signature.

- Retrieve your documents again.

- Access the same document as needed at any time. Visit the My documents tab in your profile to redownload any previously obtained forms.

Form popularity

FAQ

Filing an income tax form typically involves gathering your financial information, completing the correct forms, and submitting them through the appropriate channels. You can file online, through mail, or with the assistance of a tax professional. Ensuring you use the correct modelo formulario formato is crucial for accurate reporting and compliance. Consider leveraging platforms like uslegalforms for a guided filing experience.

The necessity to file form 1120 Pol depends on your business operations and the nature of your taxable activities. If your business fits the criteria defined by the IRS, you will need to complete this form. Knowing these requirements in advance helps you avoid compliance issues. Utilizing a streamlined modelo formulario formato can aid you in this filing process.

Yes, if you are required to file a modelo 720, it is typically an annual obligation. This form is important for reporting specific financial activities. Consistent submission helps maintain compliance with tax regulations and can prevent unwanted penalties. To ensure accuracy and ease, using a clear modelo formulario formato can guide you through the necessary steps.

Certain entities, such as S corporations and foreign corporations without income effectively connected to a U.S. trade or business, are typically not required to file form 1120. It's vital to identify your business status to ensure compliance. Understanding these distinctions helps you manage your tax obligations effectively. You might consider discussing your situation with a tax professional for clarity.

Filing an 1120-pol is important for specific types of organizations, particularly those involved in certain industries. If your business operates under particular conditions, you may be required to complete this form. It’s advisable to assess your business structure to determine the need for this form. Leveraging the right modelo formulario formato can simplify this process greatly.

If you fail to file form 1120, the IRS may impose penalties. These penalties can accumulate over time, resulting in significant financial consequences. Additionally, not filing can affect your company's tax standing and lead to further complications down the road. It's essential to understand the importance of timely submissions, and using a reliable modelo formulario formato can help ensure compliance.

Los cuatro tipos de formularios más comunes abarcan formularios de solicitud, formularios de declaración, formularios de registro, y formularios de confirmación. Estos modelos formulario formato son utilizados en diversas áreas, desde la administración gubernamental hasta procesos empresariales. Conocer estos formatos te permitirá navegar con confianza por trámites y solicitudes.

En el contexto de TLE, los cuatro tipos comunes de formularios incluyen solicitudes de licencia, formularios de reclamo, formularios de informes de seguridad y formularios de uso de equipo. Estos formularios están diseados para optimizar la gestión de operaciones y garantizar el cumplimiento. Utilizar un modelo formulario formato adecuado puede ayudar a mantener la organización y la claridad.

Los cuatro tipos de formularios más comunes incluyen los formularios fiscales, los formularios de inmigración, los formularios de empleo, y los formularios de seguros. Cada tipo cumple una función específica y tiene su propio modelo formulario formato. Familiarizarse con estos formularios puede simplificar muchos procesos importantes en tu vida personal y profesional.

El formulario para solicitar la Residencia Permanente en los Estados Unidos es el Formulario I-485, que se utiliza para registrar tu solicitud de ajuste de estatus. Este modelo formulario formato permite a los solicitantes proporcionar información sobre su elegibilidad, antecedentes y requisitos específicos para la residencia. Es crucial llenar este formulario con precisión para asegurar un proceso fluido.