Work Sick Ill For Chronically

Description

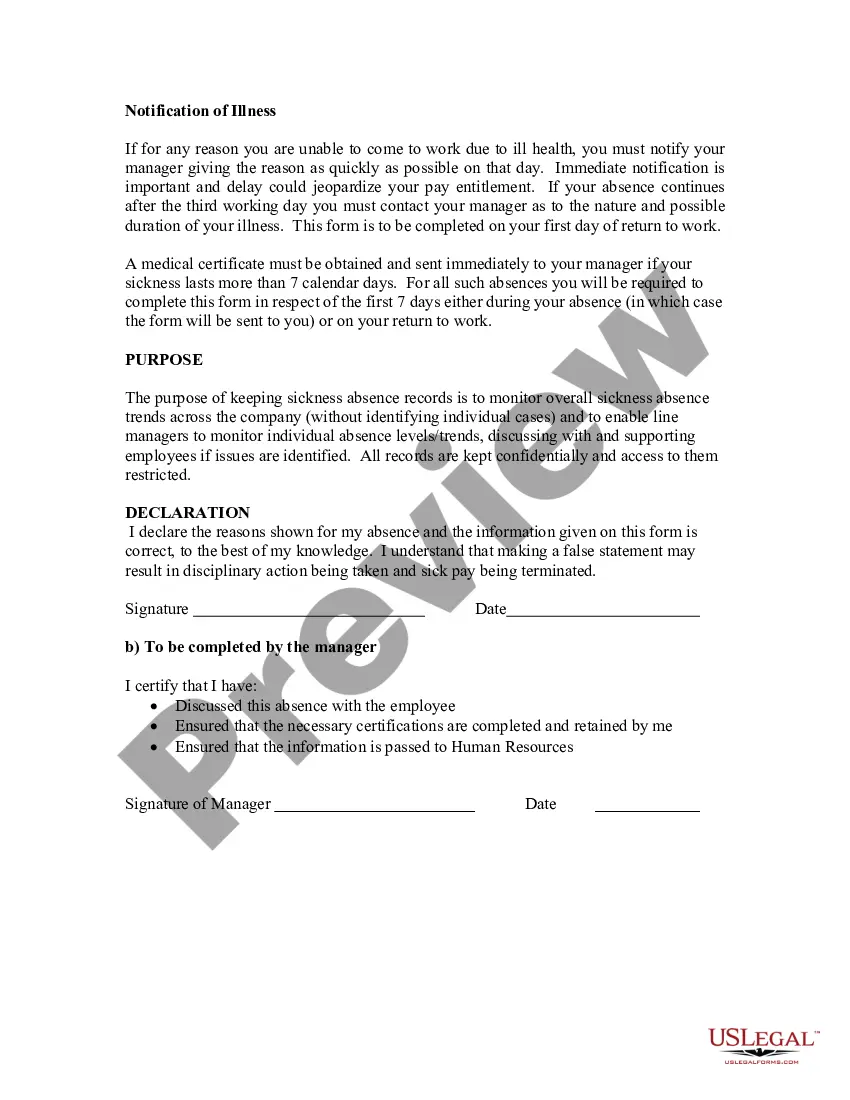

How to fill out Record Of Absence - Self-Certification Form?

Acquiring legal templates that comply with federal and state regulations is crucial, and the web provides numerous choices.

However, why waste time rummaging through the internet for the appropriate Work Sick Ill For Chronically example when the US Legal Forms online library has already compiled such templates in one location.

US Legal Forms is the largest online legal repository with more than 85,000 editable templates created by attorneys for any professional and life circumstance.

Maximize the benefits of the most comprehensive and user-friendly legal paperwork service!

- They are simple to navigate with all documents categorized by state and intended use.

- Our specialists stay informed about legislative changes, ensuring your documents are always current and compliant when acquiring a Work Sick Ill For Chronically from our site.

- Getting a Work Sick Ill For Chronically is straightforward for both existing and new users.

- If you possess an account with an active subscription, Log In and store the document template you require in your preferred format.

- If you are new to our platform, follow the steps below.

Form popularity

FAQ

Wyoming's charging order protection laws are effective for members to protect their LLC assets and ownership from creditors. However, that protection does not extend outside of Wyoming. Members living out of state will have to deal with different laws protecting their LLC assets from garnishment by creditors.

Best state to open an llc Wyoming only charges $62 a year to renew an LLC. Another great benefit of a Wyoming LLC is that it has the best asset protection laws. Wyoming has LLC privacy and does not require the members or managers to be listed on the public records. Wyoming has no income taxes on companies or people.

Wyoming does not levy state and business taxes on LLCs. This is helpful for Wyoming residents since they won't have to pay double taxes. Being one of the zero-income tax states, Wyoming remains appealing to many LLC owners. It also implements zero corporate tax, franchise tax, and stock tax.

We commonly use the Wyoming Secretary of State's website to search for business filings. Their online portal allows you to see what company names are available, what filings have been accepted and provides a snapshot of each company's corporate history. Every company document can be searched, viewed and downloaded.

An LLC generally requires less business formalities than a corporation. An LLC may be managed directly by members and there is no need to have a separate board of directors, annual shareholder meetings or periodic directors meetings with minutes.

Wyoming does not have any state taxes, as such has no need for S Corporations. If you want S Corporation status, you must file Form 2553 with the IRS, which is included in the corporate kit we send you, within 75 days from the date of formation of the company or by March 15th of any given tax year.

Why Incorporate in Wyoming? Wyoming is a popular corporate haven due to its lack of taxes and endemic privacy concerns. These factors drive many new incorporations. Wyoming also has the added benefit of allowing you to hold your shares in a Wyoming LLC or a Wyoming Trust for additional asset protection.