Termination Final Pay For Salaried Employee

Description

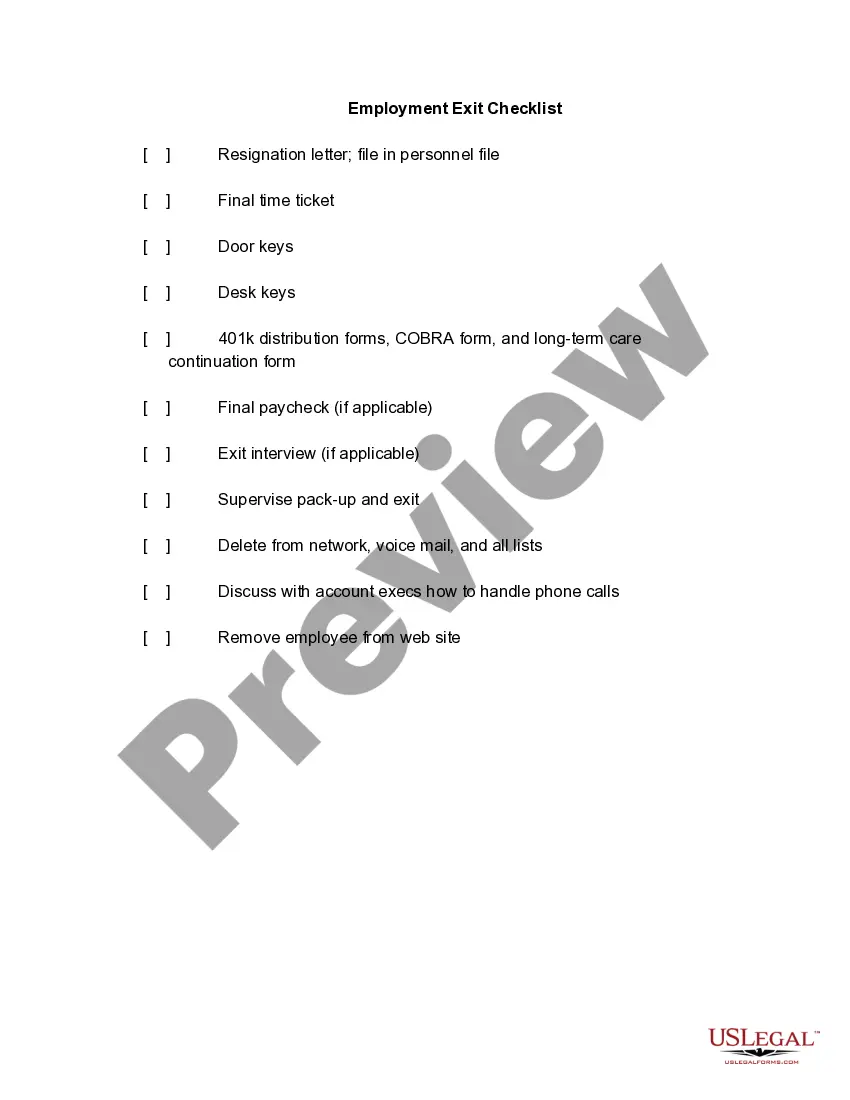

How to fill out Termination Meeting Checklist?

Managing legal documents and protocols can be a lengthy addition to your schedule.

Termination Final Pay For Salaried Employee and similar forms generally necessitate that you look for them and comprehend how to fill them out efficiently.

Therefore, whether you are addressing financial, legal, or personal issues, utilizing a comprehensive and user-friendly online database of forms will be immensely beneficial.

US Legal Forms is the premier online source for legal templates, boasting over 85,000 state-specific documents and various tools to assist you in completing your forms swiftly.

Simply Log In to your account, search for Termination Final Pay For Salaried Employee, and download it right away from the My documents section. You can also retrieve previously downloaded forms.

- Browse the collection of relevant documents available with just one click.

- US Legal Forms provides you with state- and county-specific documents accessible at any time for download.

- Protect your document management processes with a top-tier service that allows you to generate any form in a matter of minutes with no extra or concealed charges.

Form popularity

FAQ

Working out your final salary requires reviewing your pay stubs and employment contract. Start by noting your last working days to determine the salary owed for that period. Additionally, factor in any accrued leave or bonuses that apply to your situation. Understanding how these elements contribute to your termination final pay for salaried employees will help you ensure you receive what you are rightfully owed.

To calculate your final salary, take your total earned wages and subtract any deductions. Include any payments for unused vacation days, bonuses, or other entitlements that may apply. This calculation ensures that you receive the correct termination final pay for salaried employees, which is crucial to your financial planning after leaving a job. Using a payroll calculator might simplify this process.

Yes, superannuation is typically payable on termination payments in many cases. If you receive termination final pay for a salaried employee, your employer may need to contribute to your superannuation fund based on those payments. It's essential to check the specific regulations in your location to confirm how super applies to your situation. Consulting resources like USLegalForms can provide clarity on this topic.

Yes, you will receive your last paycheck upon termination. Employers are required to provide termination final pay for salaried employees, which usually includes any unpaid salary up to the termination date. It's important to review your employment agreement, as it may outline specific payment procedures. Additionally, you can check your state laws, as they may have specific requirements regarding final pay.

West Virginia is one of several states with a so-called ?second chance? law. It lets people with a felony criminal record appeal to a judge to reduce their charge to a misdemeanor. The goal? To help them find work.

Under West Virginia Code §61-11-26, a person may petition the circuit court in the county where the conviction or convictions occurred. A person is eligible for expungement one (1) year after the conviction and completion of any sentence of incarceration and any period of supervision.

Under § 61-7-7(g) persons prohibited from possessing a firearm under § 61-7-7(a) may regain their rights rights by expungement or set-aside, or by a pardon.

The West Virginia criminal record expungement statutes allow for two types of expungements: Dismissed/Acquitted Criminal Charges (acquitted/found not guilty at a trial or charges that were otherwise dismissed) Criminal Convictions (found guilty after a trial or plead guilty/no contest as part of a plea agreement).

If your expungement is approved, you will have to pay a $100 fee to the West Virginia State Police. This fee cannot be waived, unless you file for expungement because you have participated in an approved Substance Abuse Treatment or have completed approved Adult Training Programs.

Section 61-7-7(f) provides that a person dispossessed by virtue of a felony conviction may petition the circuit court of the county in which they reside to regain the ability to possess a firearm ?if the court finds by clear and convincing evidence that the person is competent and capable of exercising the ...