Employee Final Pay Within 30 Days

Description

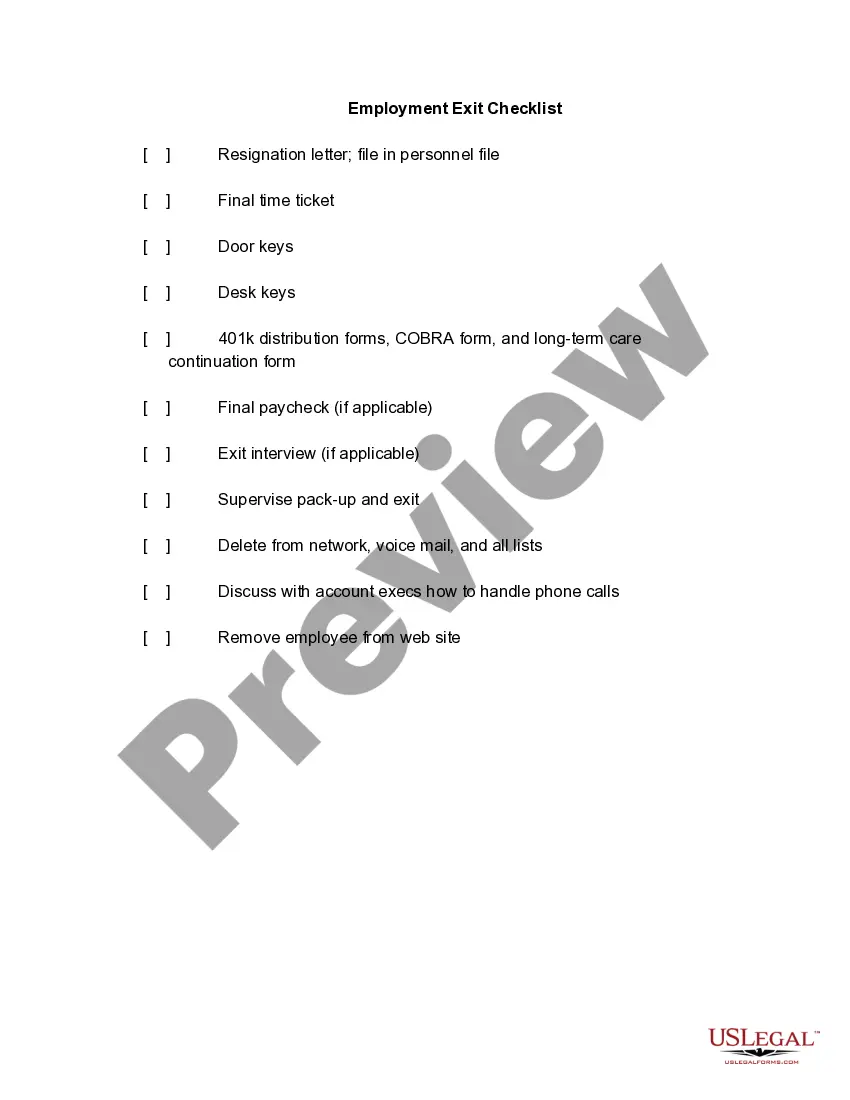

How to fill out Termination Meeting Checklist?

Acquiring legal document examples that adhere to federal and state laws is essential, and the web provides many alternatives to choose from.

However, what is the benefit of spending time searching for the suitable Employee Final Pay Within 30 Days example online when the US Legal Forms digital library already compiles such templates in one location.

US Legal Forms stands as the largest online legal repository featuring over 85,000 fillable documents created by legal professionals for any occupational and personal situation.

Examine the template using the Preview function or via the text description to confirm it aligns with your requirements.

- They are simple to navigate with all papers organized by state and intended use.

- Our experts remain informed about legislative updates, ensuring your documents remain current and compliant when obtaining an Employee Final Pay Within 30 Days from our site.

- Acquiring an Employee Final Pay Within 30 Days is quick and straightforward for both existing and new members.

- If you possess an account with an active subscription, Log In and retrieve the document sample needed in your desired format.

- If you are visiting our site for the first time, adhere to the instructions below.

Form popularity

FAQ

If you resign effectively immediately, your employer must still provide your employee final pay within 30 days. This includes any remaining wages, unused vacation days, and other compensation owed. Immediate resignation can sometimes complicate the process, but you are entitled to receive your final payment. To safeguard your rights, consider using US Legal Forms, which offers guidance tailored to your situation.

Employers are generally required to issue employee final pay within 30 days of the employee's last working day. This time frame ensures you receive the wages owed without unnecessary delays. If your employer fails to meet this deadline, you may have the right to take legal action or seek assistance. US Legal Forms provides resources to help you navigate disputes regarding final pay.

The timeline for receiving your employee final pay within 30 days can vary based on company policies and state laws. Generally, employers are required to issue your final paycheck promptly after your last working day. If your company follows the appropriate regulations and processes, you should receive the payment without unnecessary delays. For a smooth experience, consider using platforms like US Legal Forms, which provide resources to ensure compliance with legal requirements regarding final pay.

To calculate your employee final pay within 30 days, start by gathering all relevant payment information, including wages earned, overtime hours, and any bonuses. Add up the total earnings for the pay period, and then subtract any deductions, such as taxes or retirement contributions. Make sure to review company policies and state laws, as they may dictate additional requirements for calculating final pay. If you need further assistance, consider using the US Legal Forms platform to help streamline your process.

If the regular payday for the last pay period an employee worked has passed and the employee has not been paid, contact the Department of Labor's Wage and Hour Division or the state labor department. The Department also has mechanisms in place for the recovery of back wages.

Divide their annual salary by 52 to get their weekly pay. Then, divide their weekly pay by the number of days in their working week (so 5 if full time) to get their daily pay. Lastly, multiply their daily pay by the number of days worked since the end of the last pay period.

How to calculate gross final pay Calculate how much they earn in a day. Employee on a salary. Annual salary ÷ 52 (no. ... Work out how many days they've worked. Now that you've worked out the employee's daily pay, all you need to do is multiply this by the amount of days they have worked in that pay period.