Employee Withholding Exemption Certificate (l-4)

Description

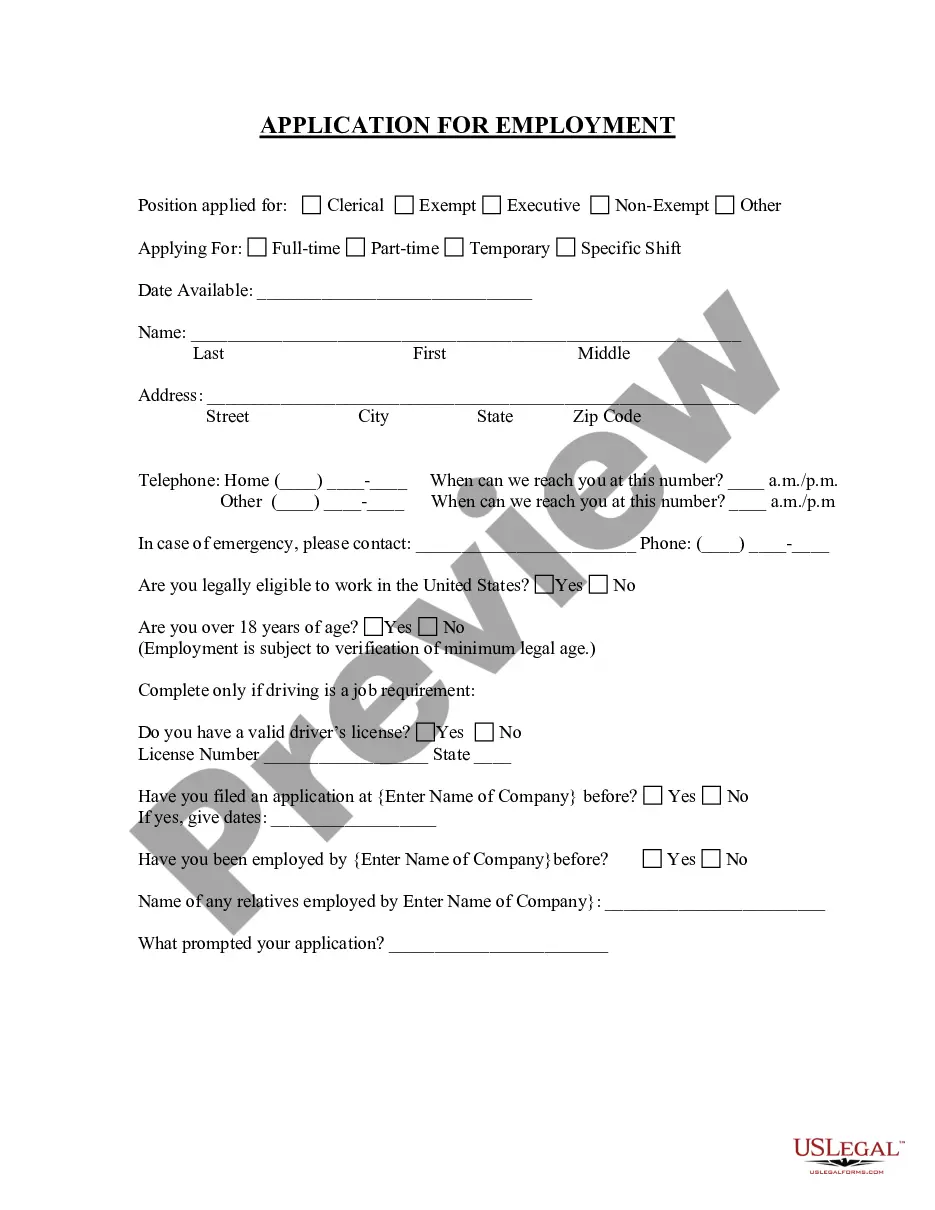

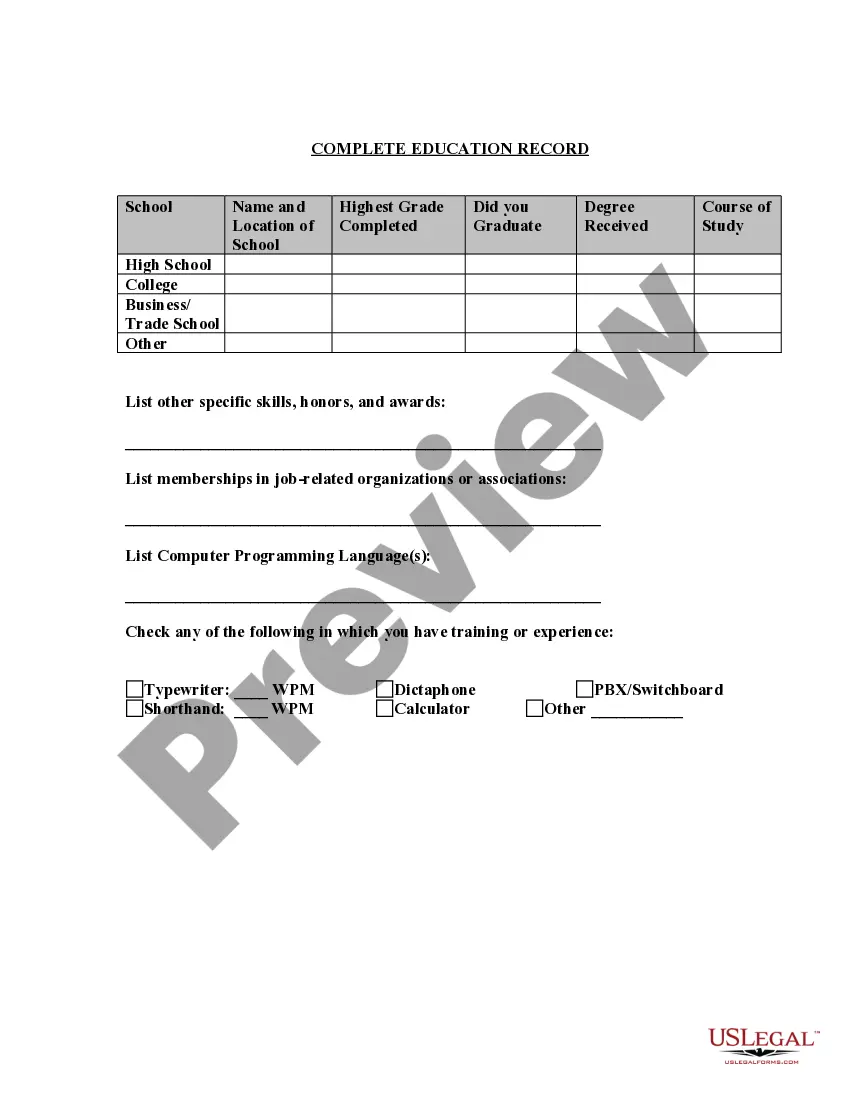

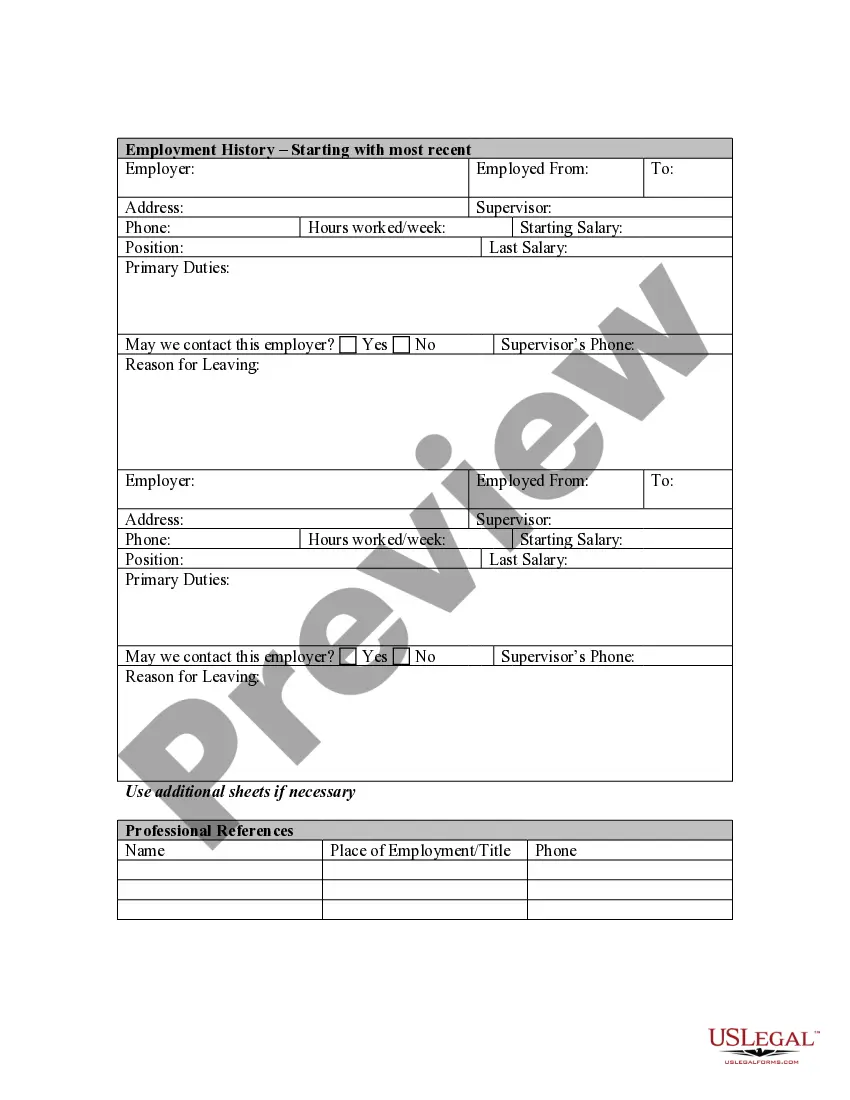

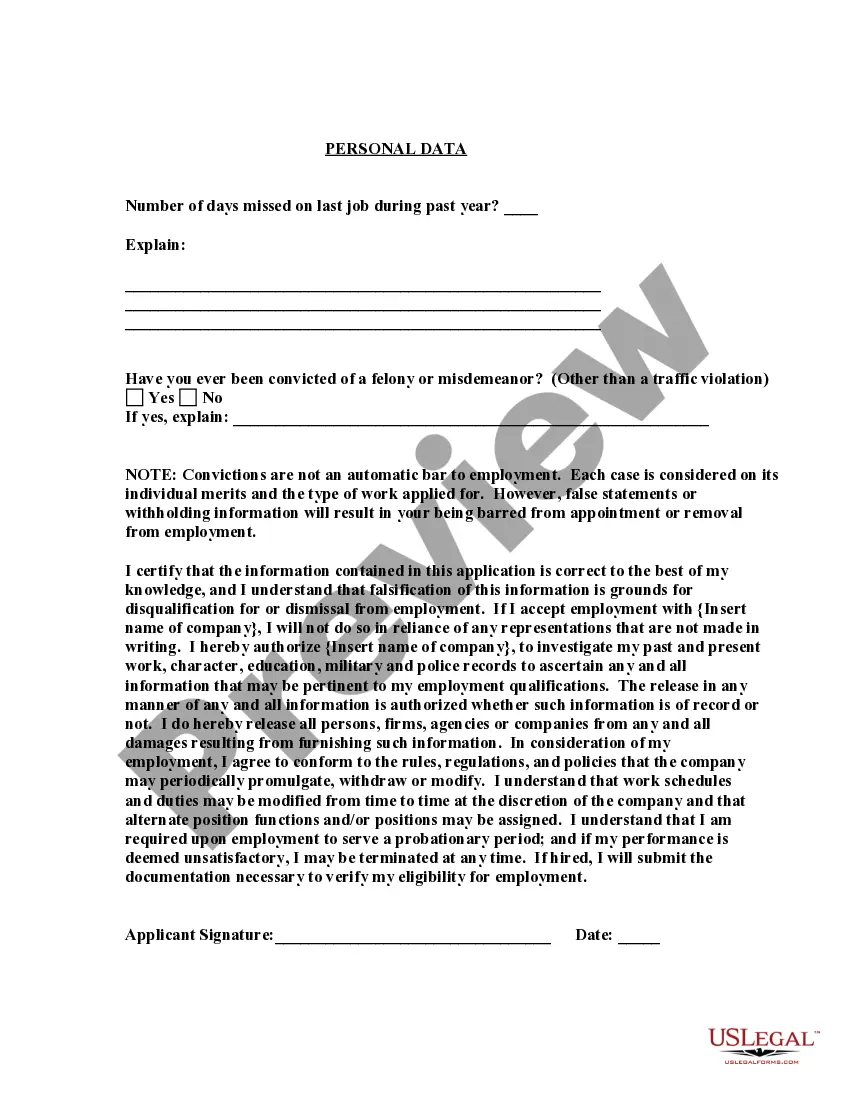

How to fill out Application For Work Or Employment - Clerical, Exempt, Executive, Or Nonexempt Position?

The Employee Withholding Exemption Certificate (l-4) displayed on this page is a reusable legal document crafted by experienced attorneys in accordance with national and local laws.

For more than 25 years, US Legal Forms has supplied individuals, businesses, and legal practitioners with over 85,000 authenticated, state-specific documents for various professional and personal events. It’s the fastest, simplest, and most reliable method to acquire the paperwork you require, as the service ensures bank-level security for your data and protection against malware.

Choose the desired format for your Employee Withholding Exemption Certificate (l-4) (PDF, Word, RTF) and save the document on your device.

- Search for the document you require and examine it.

- Browse the sample you looked for and preview it or review the form details to ensure it meets your requirements. If it doesn’t, use the search feature to find the correct one. Click Buy Now once you have identified the template you need.

- Register and Log In.

- Select the subscription plan that fits your preference and create an account. Use PayPal or a credit card to quickly complete the payment process. If you already possess an account, Log In and check your subscription to proceed.

- Acquire the fillable template.

Form popularity

FAQ

To claim exemption on your W4, you must meet specific criteria set by the IRS, such as not expecting to owe any federal income tax for the year. You will indicate your exempt status directly on the W4 form. It’s important to ensure your eligibility for the Employee withholding exemption certificate (l-4) to avoid under-withholding your taxes.

The percentage you should withhold on the W4 form depends on your overall financial circumstances, including the number of allowances you can claim. Generally, the IRS provides guidelines that suggest a certain percentage based on your income level and filing status. To maximize accuracy, utilize the Employee withholding exemption certificate (l-4) and consider consulting with a tax professional.

Completing the employee's withholding allowance certificate Form W-4 is essential for proper tax withholding. It allows employers to accurately assess how much tax to withhold from an employee’s paycheck based on their specific financial situation. This prevents employees from owing taxes at the end of the year, making the Employee withholding exemption certificate (l-4) critical for effective tax planning.

Determining the right amount for tax withholding involves calculating your expected tax liability for the year. Review your previous year’s tax returns and consider any changes in your income or family status. It may help to use the IRS withholding estimator or consult the Employee withholding exemption certificate (l-4) for detailed guidance.

To choose your withholding on the W4 form, start by understanding your financial situation. Consider factors like your income, dependents, and anticipated deductions. You want to ensure you withhold enough tax throughout the year to avoid penalties. The Employee withholding exemption certificate (l-4) can help clarify these decisions.

Step 4 on the employee withholding certificate involves providing additional information that may affect your tax withholding, such as other income, deductions, or extra withholding amounts. This step is crucial as it allows you to fine-tune your withholding based on your unique financial situation. By accurately completing this part of the Employee Withholding Exemption Certificate (L-4), you can better manage your tax liabilities throughout the year. Take your time to ensure this section reflects your reality.

The DE4 form is not mandatory for all employees; however, it is necessary for those who wish to adjust their state tax withholdings in California. If you do not submit a DE4, your employer will typically withhold taxes based on standard withholding tables. For those who qualify and want to optimize their withholdings, filling out the Employee Withholding Exemption Certificate (L-4) can improve tax planning. Always consider your situation when determining if you should complete this form.

The employee's withholding certificate is completed by the employee themselves. This process involves providing personal tax information, such as allowances and exemptions, on forms like the Employee Withholding Exemption Certificate (L-4). It's an important tool that enables you to communicate your withholding preferences to your employer effectively. Taking the time to fill this out correctly can help you manage your tax withholding more efficiently.

The number of allowances you should claim on your DE4 form can vary based on your financial situation, dependents, and overall income. Generally, the more allowances you claim, the less tax will be withheld from your paycheck. However, claiming too many allowances may lead to a tax bill at the end of the year. Use the guidelines provided in the Employee Withholding Exemption Certificate (L-4) to help make an informed decision.

The DE4 form is typically filled out by employees who want to adjust their state tax withholdings in California. If you are an employee seeking to claim a specific number of allowances or an exemption, you will need to complete this form. The Employee Withholding Exemption Certificate (L-4) is similar in nature, as it helps employees determine their tax withholding status. Ensure to provide accurate information to avoid discrepancies in your withholding.