Transfer Servicing Mortgage With Credit Card

Description

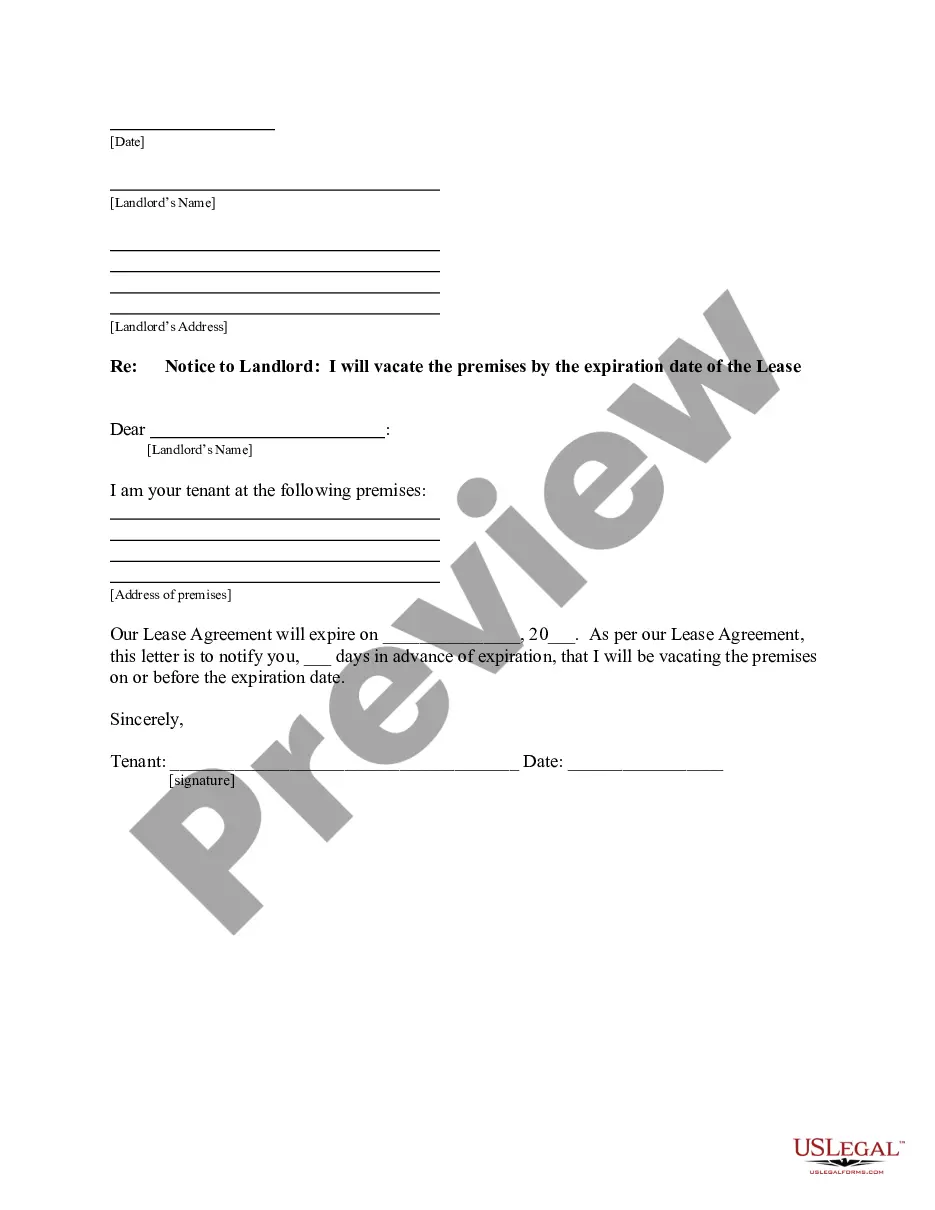

How to fill out Notice Of Assignment, Sale, Or Transfer Of Servicing Rights, Mortgage Loans?

Securing a reliable source for accessing the most up-to-date and pertinent legal templates is a significant part of navigating bureaucracy.

Selecting the appropriate legal documents requires accuracy and meticulousness, which is why obtaining samples of Transfer Servicing Mortgage With Credit Card exclusively from trustworthy providers, such as US Legal Forms, is crucial. An incorrect template may squander your time and impede your current situation.

Once you have the form on your device, you can modify it using the editor or print it out and complete it by hand. Eliminate the hassle associated with your legal paperwork. Explore the vast US Legal Forms library to discover legal templates, evaluate their applicability to your situation, and download them instantly.

- Employ the library navigation or search function to find your template.

- Review the form’s details to confirm it meets the criteria for your state and area.

- View the form preview, if accessible, to ensure the form is indeed the one you need.

- Return to the search to locate the appropriate document if the Transfer Servicing Mortgage With Credit Card does not meet your specifications.

- Once confident about the form’s applicability, download it.

- If you are an existing customer, click Log in to verify your identity and access your selected forms in My documents.

- If you don’t have an account yet, click Buy now to purchase the form.

- Select the payment plan that aligns with your needs.

- Proceed to register to complete your order.

- Finalize your purchase by choosing a payment method (credit card or PayPal).

- Select the file type for downloading Transfer Servicing Mortgage With Credit Card.

Form popularity

FAQ

Yes, any form of debt will be assessed in relation to your income when you apply for a mortgage. Lenders calculate your debt-to-income ratio to help make their decision about whether you can afford the size of the mortgage you're applying for.

While you're waiting to close on a home, you can still use your credit card, but it's best to only use it for small purchases and pay off the balance in full.

Quick answer: Absolutely you can. It's called a cash-out refinance and it's a great option for some people. Here's what it boils down to: home loans typically have lower interest rates compared to credit cards, which typically have high interest rates.

Section VI: Assets and liabilities In this section, you'll list assets including savings, checking and retirement accounts and any properties you own. Under liabilities, you'll include all debts such as car loans, credit cards, other mortgages and any alimony or child support you're obligated to pay.

The only thing that changes with the transfer of servicing rights for your mortgage is who you make your payment to. You'll receive communication from your current servicer with additional information, including contact information for your new servicer.