Return Work Form Sample For Single

Description

How to fill out Return To Work Interview Form?

Managing legal documentation and procedures can be a labor-intensive addition to your routine.

Return Work Form Example For Single and similar forms usually necessitate that you locate them and navigate the path to fill them out correctly.

For this reason, if you are handling financial, legal, or personal issues, utilizing a comprehensive and accessible online library of forms at your disposal will be extremely beneficial.

US Legal Forms is the premier online resource for legal templates, offering over 85,000 state-specific forms and a range of tools to help you complete your documents smoothly.

Is this your first time using US Legal Forms? Register and create a free account in just a few minutes to gain access to the form library and Return Work Form Example For Single. Then, follow these steps to complete your form: Ensure you have identified the correct form by utilizing the Preview feature and reviewing the form description. Select Buy Now when you are prepared, and choose the monthly subscription plan that suits you best. Click Download, then fill out, eSign, and print the form. US Legal Forms has 25 years of experience assisting users in managing their legal documents. Find the form you need today and streamline any process effortlessly.

- Peruse the library of pertinent documents available to you with just one click.

- US Legal Forms provides state- and county-specific forms accessible anytime for download.

- Protect your document management processes with a high-quality service that enables you to prepare any form in a few minutes without extra or concealed charges.

- Simply Log In to your account, search for Return Work Form Example For Single, and obtain it instantly from the My documents section.

- You can also access previously saved documents.

Form popularity

FAQ

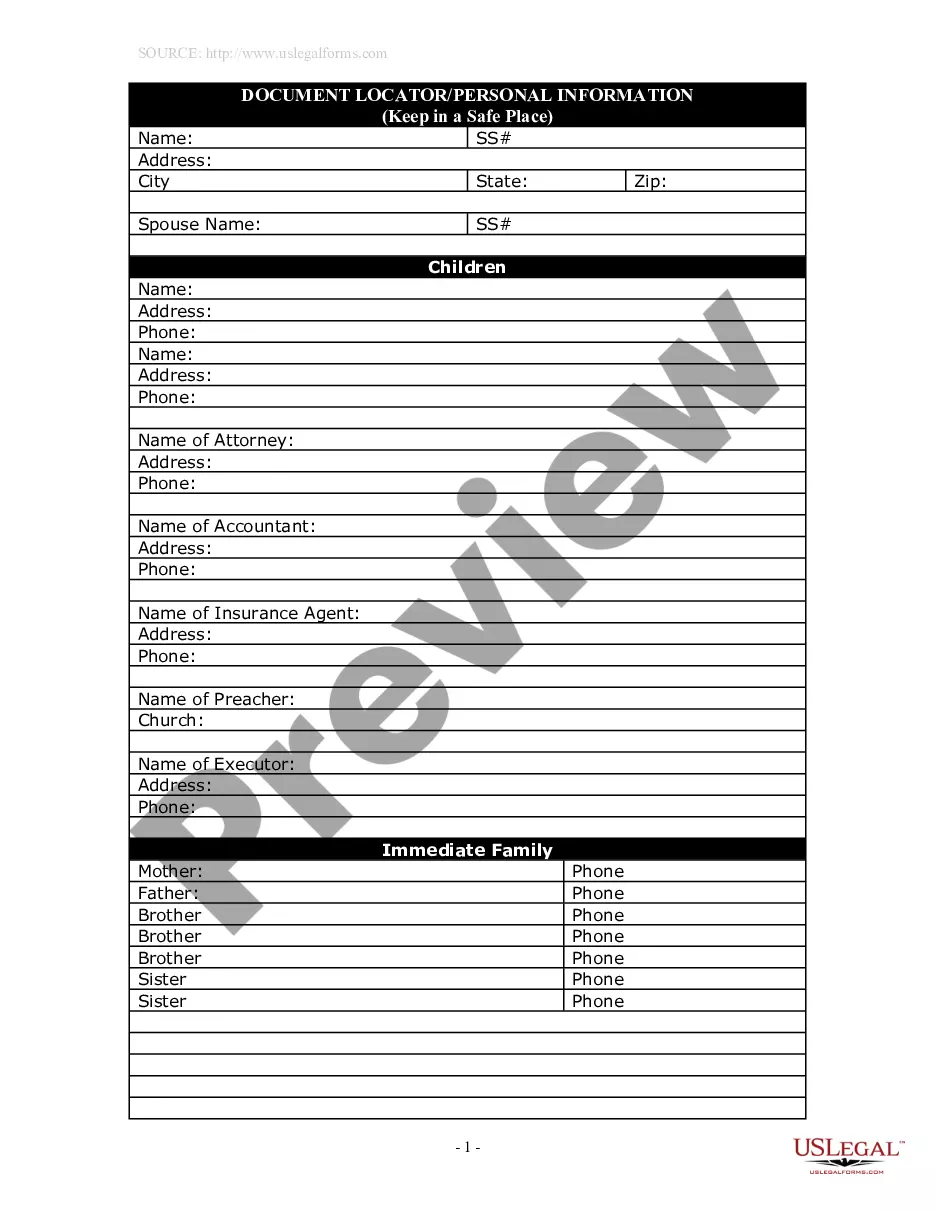

Within the return to work form, managers and employees will need to typically provide details relating to their absence, such as: the duration of absence; the method used by employees to notify of their absence; the reason for absence; details about previous absences over the past calendar year (if applicable);

For single filers with one job, it can be difficult to decide whether to claim 0 or 1 allowances. If you'd rather get more money with each paycheck instead of having to wait for your refund, claiming 1 on your taxes is typically a better option.

By placing a ?0? on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. 2. You can choose to have no taxes taken out of your tax and claim Exemption (see Example 2).

Filling out a fit to return to work form The duration of absence. The process used to record absence. The reason for absence. GP recommendations (if any). Request for reasonable adjustments (if any).

If you are single, have one job, have no children, have no other income and plan on claiming the standard deduction on your tax return, you only need to fill out Step 1 (your name, address, Social Security number and filing status) and Step 5 (your signature).