Llc Fees For California

Description

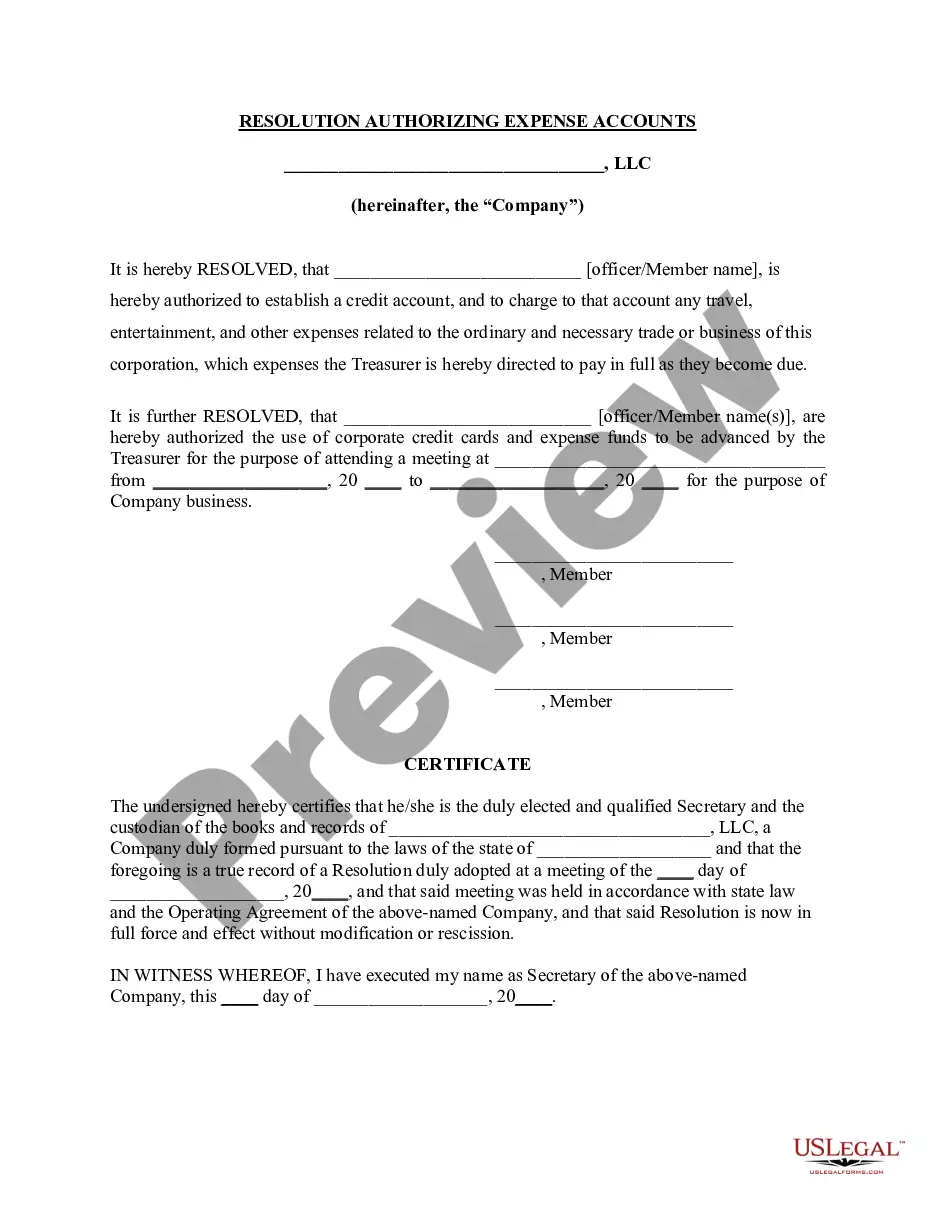

How to fill out Resolution Of Meeting Of LLC Members To Authorize Expense Accounts?

Dealing with legal documents and processes can be a lengthy addition to your daily routine.

Llc Fees For California and similar forms often necessitate that you search for them and comprehend how to fill them out accurately.

Consequently, whether you are managing financial, legal, or personal issues, having a comprehensive and functional online collection of forms readily available will be extremely beneficial.

US Legal Forms is the premier online resource for legal templates, featuring over 85,000 state-specific forms and a variety of tools to help you complete your paperwork with ease.

Is this your first time using US Legal Forms? Register and create an account in a few moments, and you'll gain access to the form library and Llc Fees For California. Then, follow the steps outlined below to complete your form: Ensure you have the correct form by utilizing the Review option and checking the form details. Choose Buy Now when ready, and pick the monthly subscription plan that suits your requirements. Click Download, then fill out, sign, and print the form. US Legal Forms has twenty-five years of experience assisting clients with their legal documentation. Find the form you require today and streamline any process effortlessly.

- Explore the library of relevant documents available to you with just one click.

- US Legal Forms offers state- and county-specific forms ready for download at any time.

- Protect your document management processes with high-quality support that enables you to assemble any form within minutes without extra or concealed fees.

- Simply Log In to your account, find Llc Fees For California, and download it instantly from the My documents section.

- You can also retrieve previously downloaded forms.

Form popularity

FAQ

You can pay the fee with a few simple steps! Just go to California's Franchise Tax Board website, and under 'Business,' select 'Use Web Pay Business. ... Select 'LLC' as entity type and enter your CA LLC entity ID. Once you verify your identity, select 'Estimated Fee Payment (Form 3536)'

All California LLCs or corporations that choose S Corp taxation must pay a 1.5% state franchise tax on their net income. This is paid by the business itself, not the LLC members or corporate shareholders. Also, all LLCs and S Corps must pay a minimum franchise tax of $800 annually, except for the first year.

Estimated Fee for LLCs ($900 ? $11,790) The Estimated Fee for LLCs only applies to LLCs that make $250,000 or more during a taxable year. This is filed on Form 3536 and is calculated based on your California LLC's gross receipts (total revenue). The larger the gross receipts, the higher the fee.

However, LLCs doing business in California must pay an $800 annual franchise tax (though it's currently waived for the first year after formation for LLCs organized between 2021 and the end of 2023), and most LLCs also are required to pay a California total income fee starting at $900.

Your LLC pays California corporation taxes. If taxed like a C Corp, you pay a flat 8.84% tax on net income. If taxed like an S Corp, pay a 1.5% tax on net income.