Form Reasonable Accommodation Without

Description

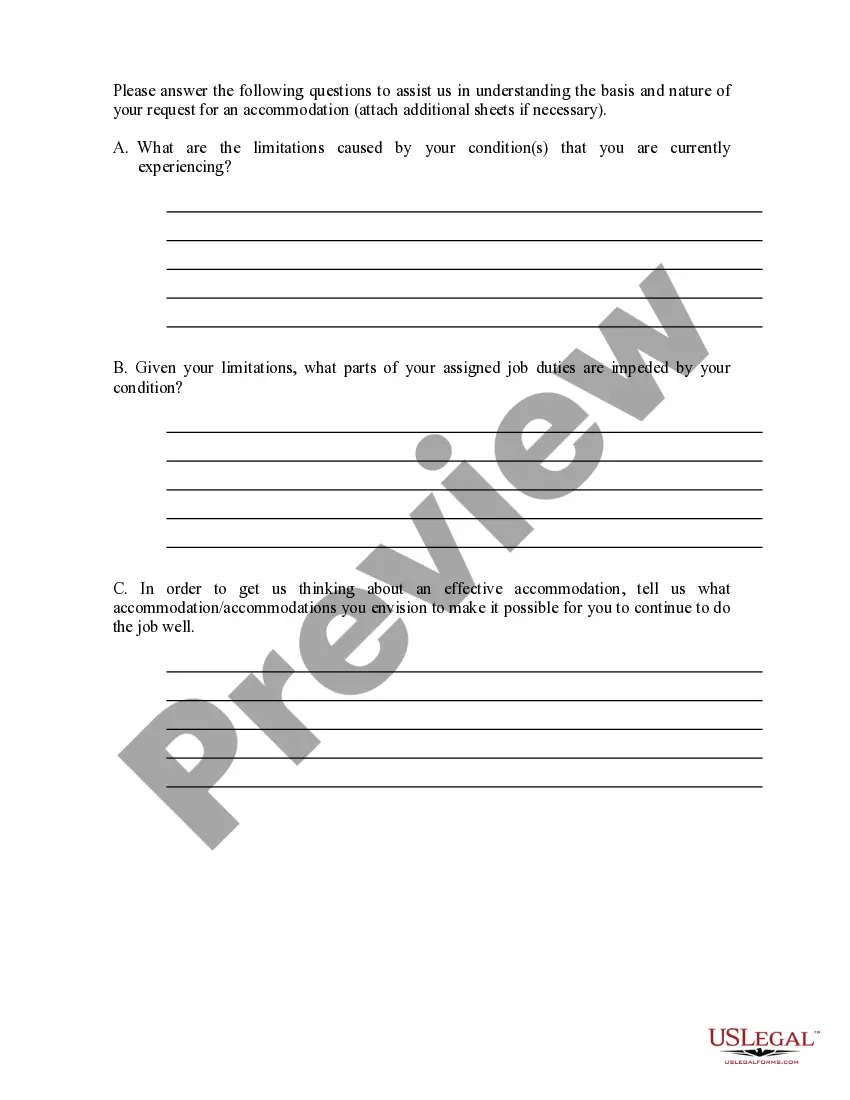

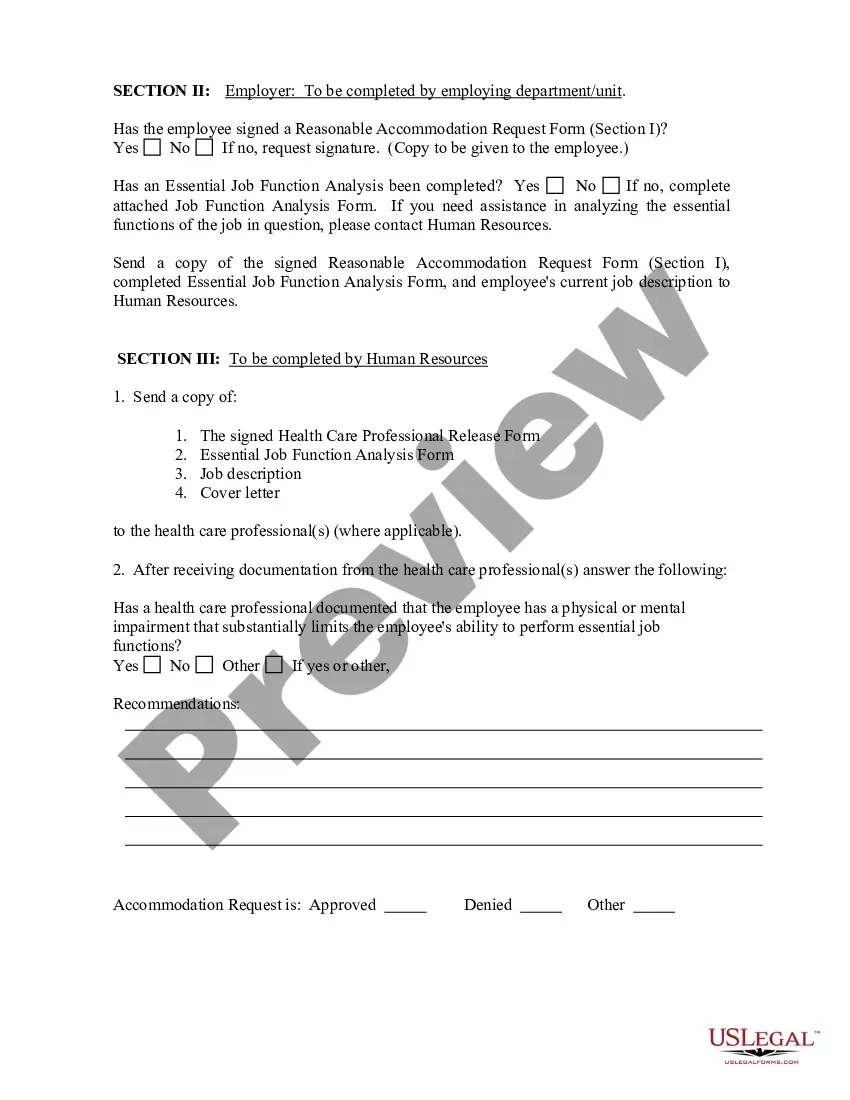

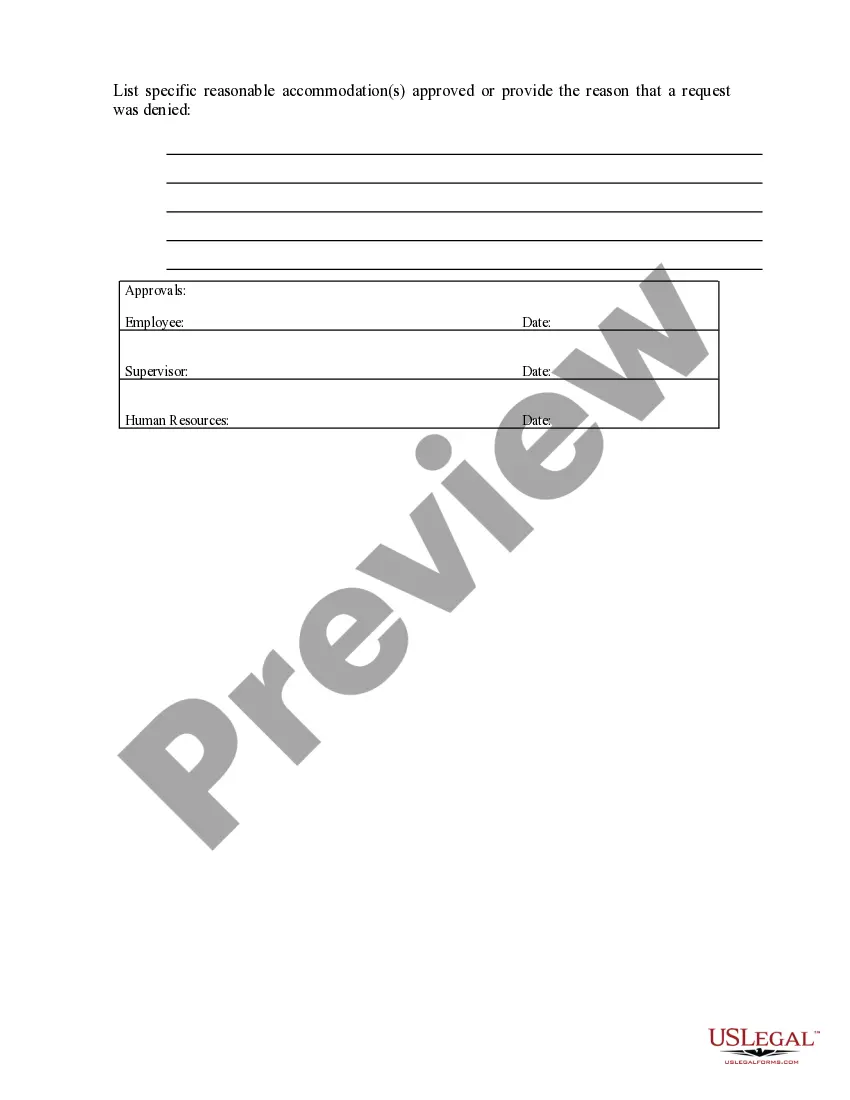

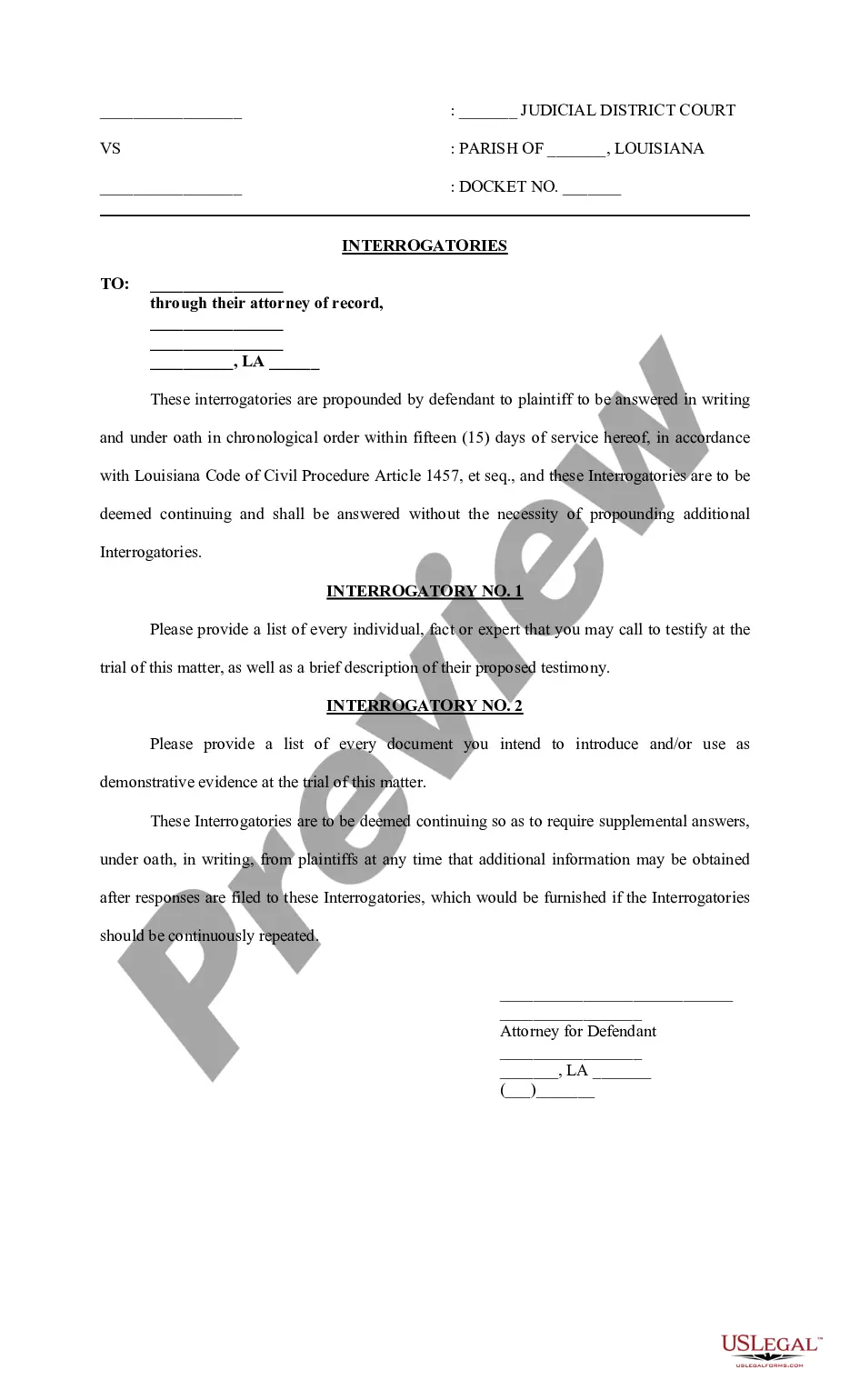

How to fill out Reasonable Accommodation Request Form?

Regardless of whether for professional reasons or personal matters, everyone must confront legal issues eventually in their lives. Completing legal documentation requires meticulous attention, starting with selecting the correct form template.

For instance, if you choose an incorrect version of the Form Reasonable Accommodation Without, it will be declined upon submission. Thus, it is vital to have a reliable source of legal documents like US Legal Forms.

With a vast US Legal Forms collection available, you never have to waste time searching for the right sample online. Utilize the library’s straightforward navigation to find the suitable form for any situation.

- Obtain the sample you need by using the search bar or catalog navigation.

- Review the form’s description to confirm it matches your situation, state, and county.

- Click on the form’s preview to inspect it.

- If it is the wrong form, return to the search feature to locate the Form Reasonable Accommodation Without sample you require.

- Acquire the template once it fulfills your requirements.

- If you already have a US Legal Forms account, simply click Log in to access previously saved documents in My documents.

- If you don’t have an account yet, you can obtain the form by clicking Buy now.

- Select the appropriate pricing option.

- Complete the profile registration form.

- Choose your payment method: you can use a credit card or a PayPal account.

- Select the document format you prefer and download the Form Reasonable Accommodation Without.

- Once downloaded, you can complete the form using editing software or print it and fill it out by hand.

Form popularity

FAQ

SBA 7(a) loan guarantee program This is one of the most popular and flexible federal loan programs. The 7(a) loan guarantee program is generally used to help finance startups or growing businesses.

Determine how much funding you'll need. Fund your business yourself with self-funding. Get venture capital from investors. Use crowdfunding to fund your business. Get a small business loan. Use Lender Match to find lenders who offer SBA-guaranteed loans. SBA investment programs.

The U.S. Small Business Administration (SBA) has several programs to help finance small business loans. Many SBA loan programs combine business coaching and technical assistance, as well as access to financing, on more flexible terms. One example is the 7 (a) Loan Program, SBA's most widely-used loan guarantee program.

If You Think You are a Victim of a Predatory Loan? Contact an attorney. Most communities have offices that provide free legal services to individuals with limited income.

SBA Express It features the easiest SBA application process and accelerated approval times, plus it offers longer terms and lower down payment requirements than conventional loans.

Escaping from a predatory loan is trickier than avoiding it in the first place, but there are a few things you can try. Report the Lender. First of all, report the lender who sold you the predatory loan. ... Use Your Right of Rescission. ... Sue the Lender. ... Refinance the Loan.

Loans guaranteed by SBA range from small to large and can be used for most business purposes, including long-term fixed assets and operating capital. Some loan programs set restrictions on how you can use the funds, so check with an SBA-approved lender when requesting a loan.

Lending and mortgage origination practices become "predatory" when the borrower is led into a transaction that is not what they expected. Predatory lending practices may involve lenders, mortgage brokers, real estate brokers, attorneys, and home improvement contractors.