Llc Remove With Quickbooks

Description

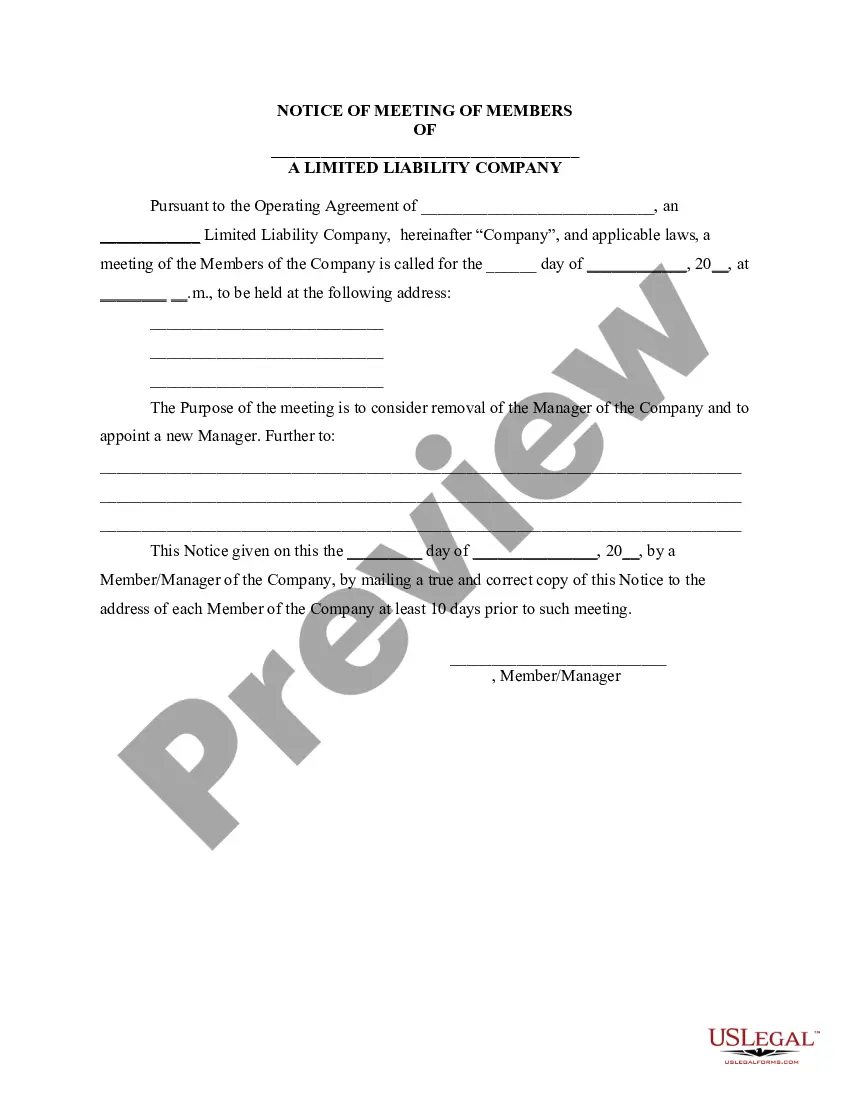

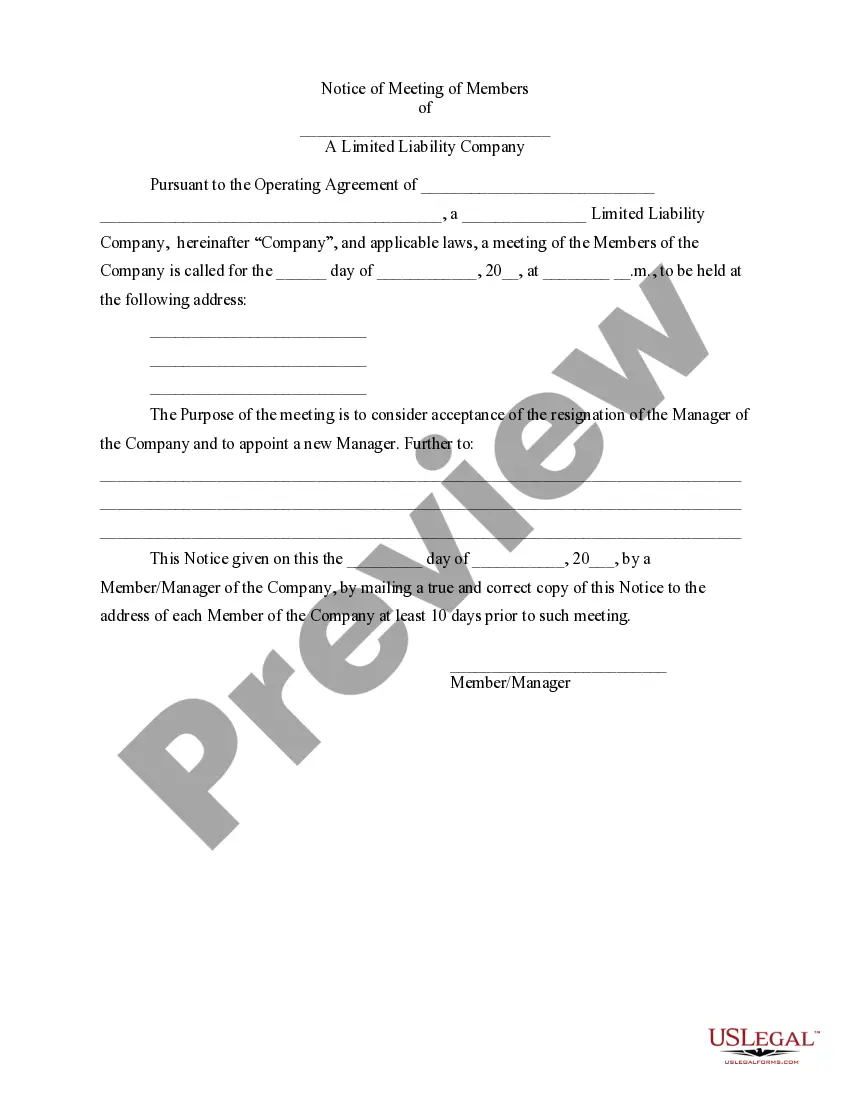

How to fill out Resolution Of Meeting Of LLC Members To Remove The Manager Of The Company And Appoint A New Manager?

Creating legal documents from the ground up can occasionally be daunting.

Certain situations may require extensive research and significant financial investment.

If you’re seeking a simpler and more cost-effective method for preparing Llc Remove With Quickbooks or any other documents without unnecessary complications, US Legal Forms is always available to assist you.

Our online catalog of over 85,000 current legal documents encompasses nearly every facet of your financial, legal, and personal affairs.

Before proceeding to download Llc Remove With Quickbooks, consider the following tips: Review the form preview and descriptions to ensure you have located the correct form. Verify that the template you select adheres to the laws and regulations of your state and county. Choose the appropriate subscription plan to purchase the Llc Remove With Quickbooks. Download the file, then complete, certify, and print it. US Legal Forms boasts an impeccable reputation and over 25 years of experience. Join us today and make document completion a straightforward and efficient process!

- With just a few clicks, you can quickly access state- and county-compliant templates meticulously crafted by our legal experts.

- Utilize our platform whenever you require trustworthy and dependable services to swiftly locate and download the Llc Remove With Quickbooks.

- If you’re familiar with our services and have previously registered with us, simply Log In to your account, find the form, and download it or re-download it later from the My documents section.

- Not signed up yet? No problem.

- It requires minimal time to set up and browse the catalog.

Form popularity

FAQ

To remove a company file from QuickBooks, first, ensure that you have backed up any important data. Then, access the file menu, select the company file you wish to remove, and follow the prompts to delete it. This is a vital part of the LLC remove with QuickBooks, helping you maintain an organized account.

Closing a business step by step involves several actions. Start with a thorough review of your financial status, then notify employees and stakeholders. Finally, use tools like QuickBooks for financial reporting and US Legal Forms for the required documentation, making the LLC remove with QuickBooks simpler.

When closing a small business, it is important to settle all debts and obligations. Make sure to inform your customers and suppliers of the closure. Additionally, consider using platforms like US Legal Forms to assist with the necessary legal paperwork, ensuring a smooth LLC remove with QuickBooks.

Closing out a business in QuickBooks requires careful planning. Begin by ensuring all financial records are up to date, then access the company settings. Finally, choose the option to close your business, which simplifies the LLC remove with QuickBooks and keeps your financial records tidy.

To delete a company and start over in QuickBooks, you need to back up your data first. After backing up, go to the company file, and choose the delete option. This action allows for a fresh beginning, making the LLC remove with QuickBooks process straightforward and efficient.

Closing a business in QuickBooks involves a few clear steps. First, ensure all transactions are recorded and reconciled. Then, navigate to the company settings and select the option to close your business. This step is crucial for an effective LLC remove with QuickBooks, allowing you to manage your records accurately.

To remove a company from your Intuit account, start by signing in to your account. Next, navigate to the company you wish to remove. Follow the prompts to delete the company file. This process is essential for a smooth LLC remove with QuickBooks, ensuring your account remains organized.

To remove an accounting firm from QuickBooks Online, go to the 'Settings' menu and select 'Manage Users'. From there, find the accounting firm you wish to remove and select 'Delete'. This action will revoke their access to your account while preserving your financial data. If you are looking to streamline your LLC's financial management, using QuickBooks can simplify your bookkeeping tasks.

Yes, you can use QuickBooks for an LLC. The software provides features that cater specifically to the needs of LLCs, such as tracking business expenses and generating tax forms. With QuickBooks, you can efficiently manage your financial transactions and ensure compliance with tax regulations. For optimal results, consider integrating your QuickBooks with platforms that specialize in LLC formation and management.

To remove a company from QuickBooks, you need to delete the company file from your system. First, open QuickBooks and select 'File', then 'Close Company'. Locate the company file on your computer and delete it from your storage. If you’re managing an LLC, using QuickBooks can simplify your accounting needs, making it easy to track expenses and income.