Llc Business Owner Former

Description

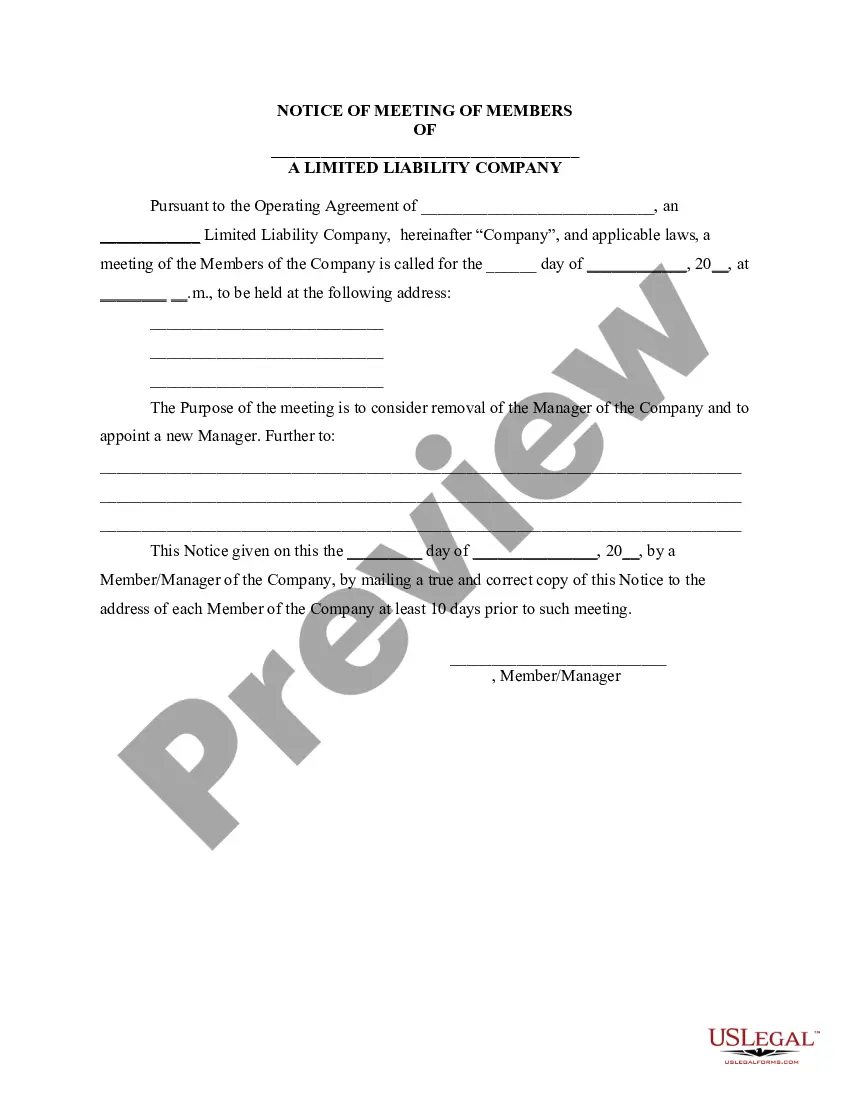

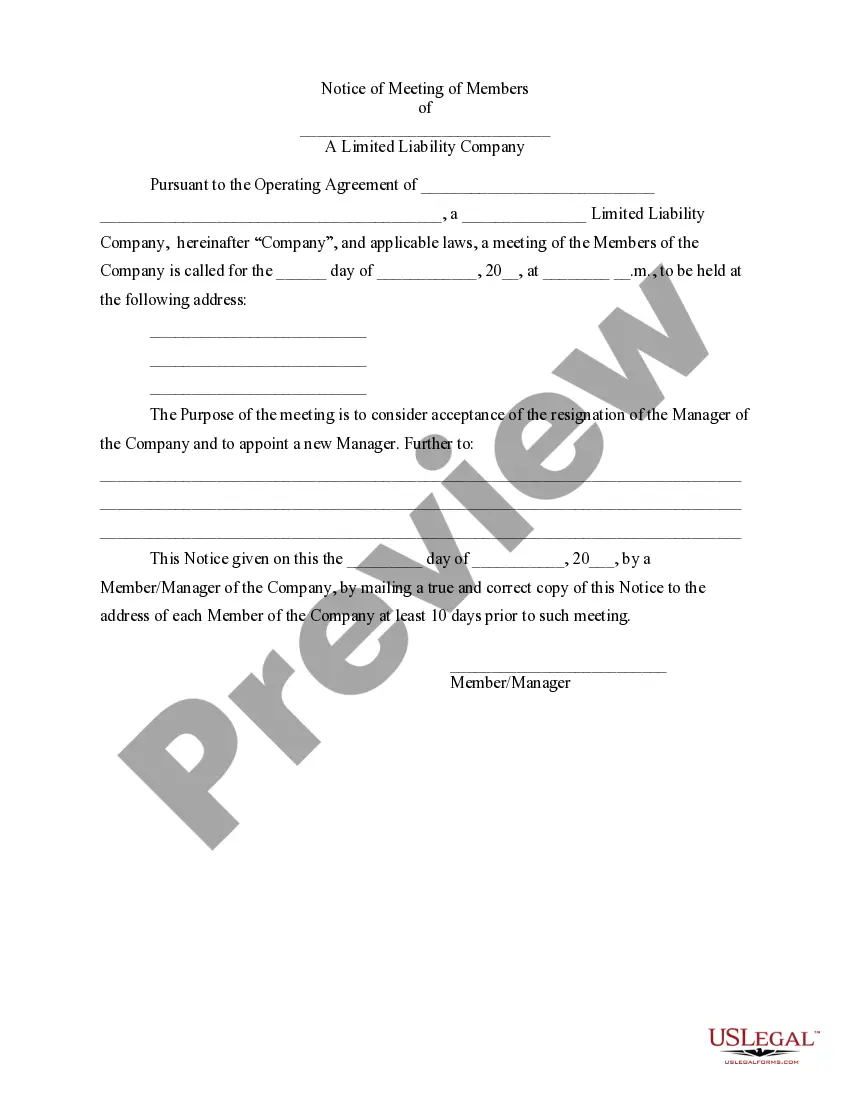

How to fill out Resolution Of Meeting Of LLC Members To Remove The Manager Of The Company And Appoint A New Manager?

Managing legal paperwork and procedures can be a lengthy addition to your day.

Llc Business Owner Former and similar forms generally necessitate that you search for them and comprehend the optimal method to complete them accurately.

Thus, whether you are handling financial, legal, or personal issues, utilizing an extensive and useful online library of forms when needed will be greatly beneficial.

US Legal Forms is the premier online platform for legal templates, featuring over 85,000 state-specific forms and a variety of tools to assist you in completing your documents with ease.

Is this your first time using US Legal Forms? Create and setup an account in a few minutes, and you’ll gain access to the form library and Llc Business Owner Former. Then, follow the steps below to finish your form: Ensure you have selected the correct form by using the Preview option and reviewing the form description. Choose Buy Now when ready, and select the subscription plan that suits your requirements. Click Download then fill out, sign, and print the form. US Legal Forms has 25 years of experience assisting users in managing their legal documents. Locate the form you need right now and simplify any process effortlessly.

- Explore the collection of relevant documents available to you with just a single click.

- US Legal Forms offers state- and county-specific forms available for download anytime.

- Safeguard your document management processes by utilizing a high-quality service that enables you to create any form in minutes without additional or concealed costs.

- Simply Log In to your account, find Llc Business Owner Former, and obtain it immediately via the My documents tab.

- You can also access previously downloaded forms.

Form popularity

FAQ

Yes, you can call yourself the owner of an LLC. This is an accepted description of your relationship to the business, especially if you are a member. Identifying as an LLC business owner former can also signify your past involvement in managing the business. If you want to formalize your title or role, consider utilizing US Legal Forms for necessary documentation.

As the owner of an LLC, you can refer to yourself as a member or simply an LLC owner. This title highlights your role and connection to the business. When you identify as an LLC business owner former, it indicates both your ownership and possible transition away from active management. Many find resources on US Legal Forms helpful in properly designating titles and responsibilities.

An owner of an LLC includes anyone who has a financial interest in the business. This can be individuals, partners, or other legal entities. When you become an LLC business owner former, your ownership can vary in terms of voting rights and profit sharing. Understanding these dynamics is essential, and using US Legal Forms can provide guidance on ownership structures.

The owners of an LLC are typically referred to as members. This term reflects the individual or entity's stake in the business. As an LLC business owner former, you may hold membership shares that define your rights and responsibilities. Utilizing platforms like US Legal Forms can help clarify these terms and provide useful resources for LLC members.

To file a final return for your LLC, you need to complete your tax return for the year, marking it as the last one for your business. Ensure you settle any outstanding debts and distribute any remaining assets among owners. Provide any necessary documentation to your state and the IRS, ensuring compliance with all regulations. As an LLC business owner former, thorough preparation will simplify the winding-up process for your business.

To prove ownership of an LLC, gather essential documents such as the Articles of Organization and the operating agreement that indicates your role as an LLC business owner. You can also provide a certificate of good standing from your state, which confirms that your LLC is active and compliant. If you are a former LLC business owner, these documents serve as strong evidence of your ownership. At US Legal Forms, we offer templates and resources to help you easily organize and access these vital documents.

To legally remove yourself from an LLC, you must follow the procedures defined in the operating agreement. This often involves notifying other members and formally documenting the withdrawal. You also need to ensure that any financial obligations or distributions are settled before leaving. Utilize uslegalforms to handle the paperwork involved for a smooth transition.

Transferring ownership of an LLC can be difficult due to regulations outlined in the operating agreement or state laws. Other members may need to approve the transfer to maintain operational integrity. Additionally, financial implications and tax considerations can complicate the process. Consulting with uslegalforms can clarify these challenges and assist you in navigating them.

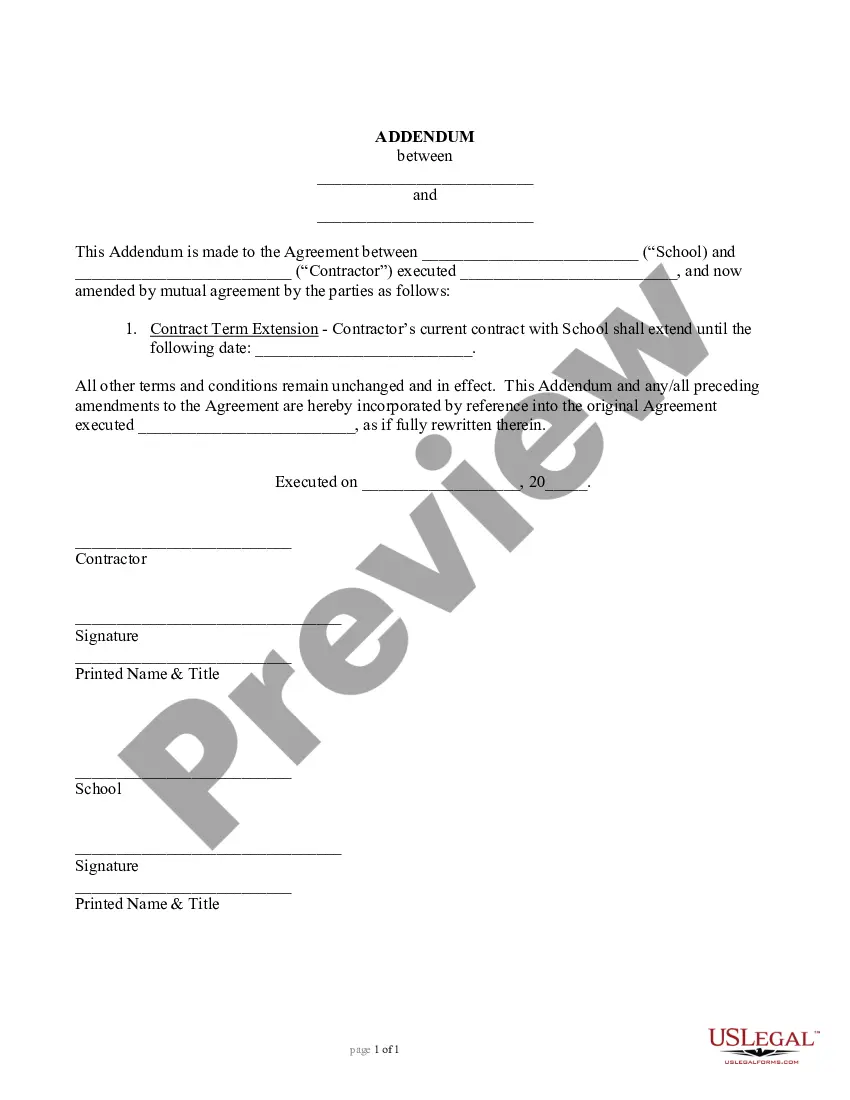

Changing the owner of your LLC involves transferring ownership interests according to your operating agreement. Usually, this process includes notifying the existing members and possibly drafting a new operating agreement. You must also file the necessary paperwork with your state to update the ownership records. Let uslegalforms help you streamline this transition.

Removing an owner from an LLC typically involves voting on the decision as per the rules outlined in your operating agreement. After a successful vote, you must file the appropriate documents with your state to formalize the change. Being thorough in this process is critical to avoiding future disputes. Our platform can provide the templates you need to complete the procedure efficiently.