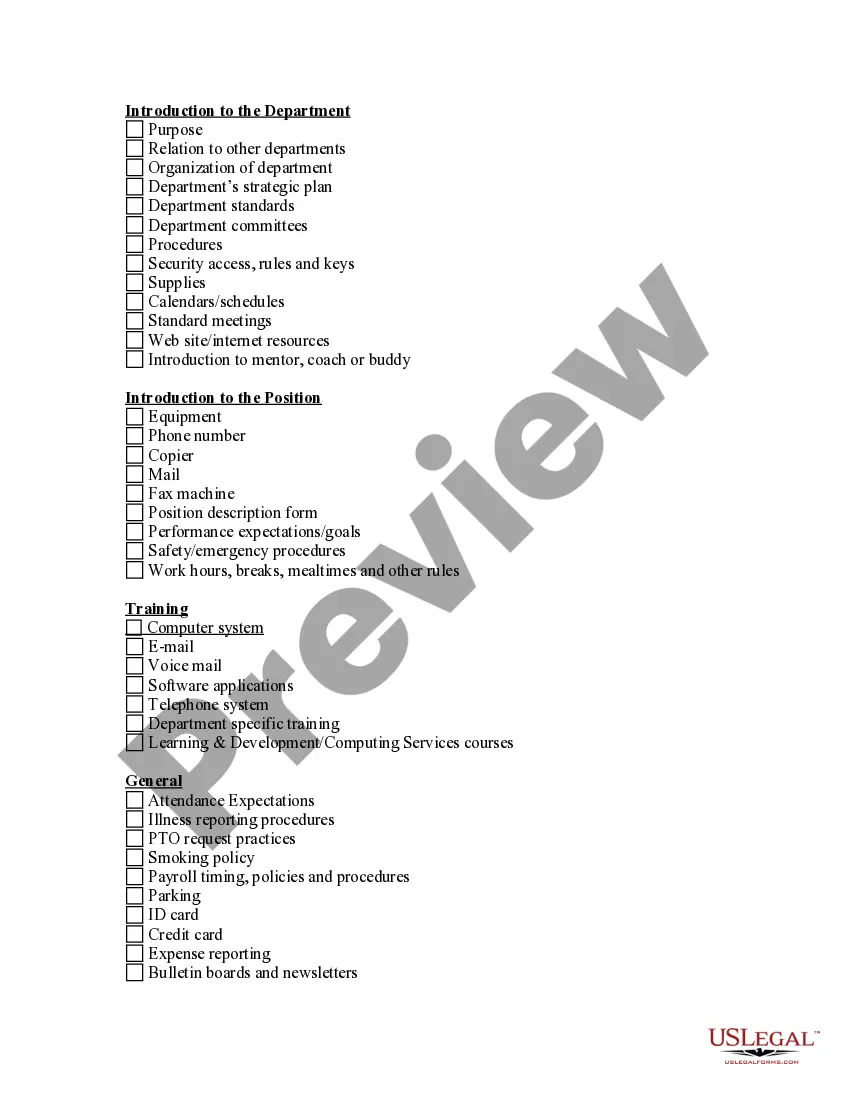

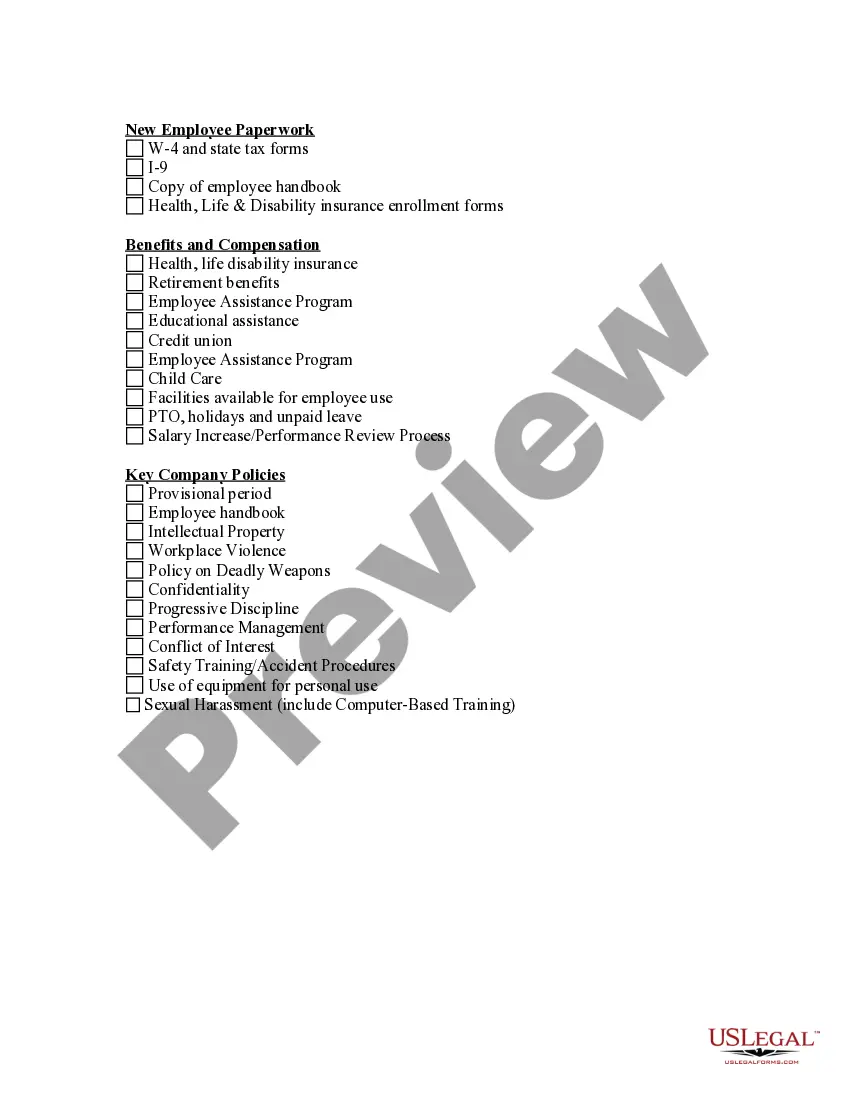

Orientation Checklist Sample With Data

Description

How to fill out Orientation Checklist For Supervisors?

Managing legal documents and processes can be a lengthy addition to your whole day.

Orientation Checklist Example With Information and forms like it typically require you to search for them and grasp the most effective way to complete them accurately.

Consequently, whether you are dealing with financial, legal, or personal affairs, possessing a comprehensive and efficient online repository of forms when you require it will greatly assist.

US Legal Forms is the premier online platform for legal templates, boasting over 85,000 state-specific documents and a range of tools to facilitate your paperwork seamlessly.

Is this your first experience with US Legal Forms? Register and create your account in just a few minutes, and you will gain access to the form library and Orientation Checklist Example With Information. Then, follow the steps below to complete your form.

- Explore the archive of relevant documents available to you with just one click.

- US Legal Forms provides you with state- and county-specific documents that can be downloaded anytime.

- Protect your document management processes with a reliable service that allows you to prepare any form in minutes without any extra or hidden costs.

- Simply Log In to your account, locate Orientation Checklist Example With Information, and download it instantly from the My documents tab.

- You can also access forms that you have saved previously.

Form popularity

FAQ

Indiana state law does not mandate that LLCs adopt an operating agreement. Indiana state code § 23-18-4-5 states that LLCs may enter into an operating agreement but does not require them to do so. Even so, it is in your company's best interest to have a written operating agreement.

An Illinois LLC operating agreement is a binding document that establishes the ownership, operations, officers, and responsibilities of company members. The agreement acts as the bylaws and oversees the day-to-day operations of the company.

Illinois LLC Approval Times Mail filings: In total, mail filing approvals for Illinois LLCs take 3-4 weeks. This accounts for the 7-14 business day processing time, plus the time your documents are in the mail. Online filings: In total, online filing approvals for Illinois LLCs take 5-10 business days.

There is no Illinois state law requiring an LLC to adopt an operating agreement. However, an operating agreement will help your LLC resolve disputes, open a bank account, and protect your limited liability status.

Your main cost when starting an LLC in Illinois will be the state's LLC registration fee, which is $150. On top of that, you'll need to shell out $75 each year to file your Illinois annual report. You'll also have additional expenses to think about, like hiring a registered agent and purchasing business insurance.

If you have a street address located in Illinois (such as a home or office), and are available during regular business hours, you can list yourself as the Registered Agent. If you don't have a street address in Illinois, you can use a friend or family member's address and they can be your Illinois Registered Agent.