Tax Id For Intentionally Defective Grantor Trust

Description

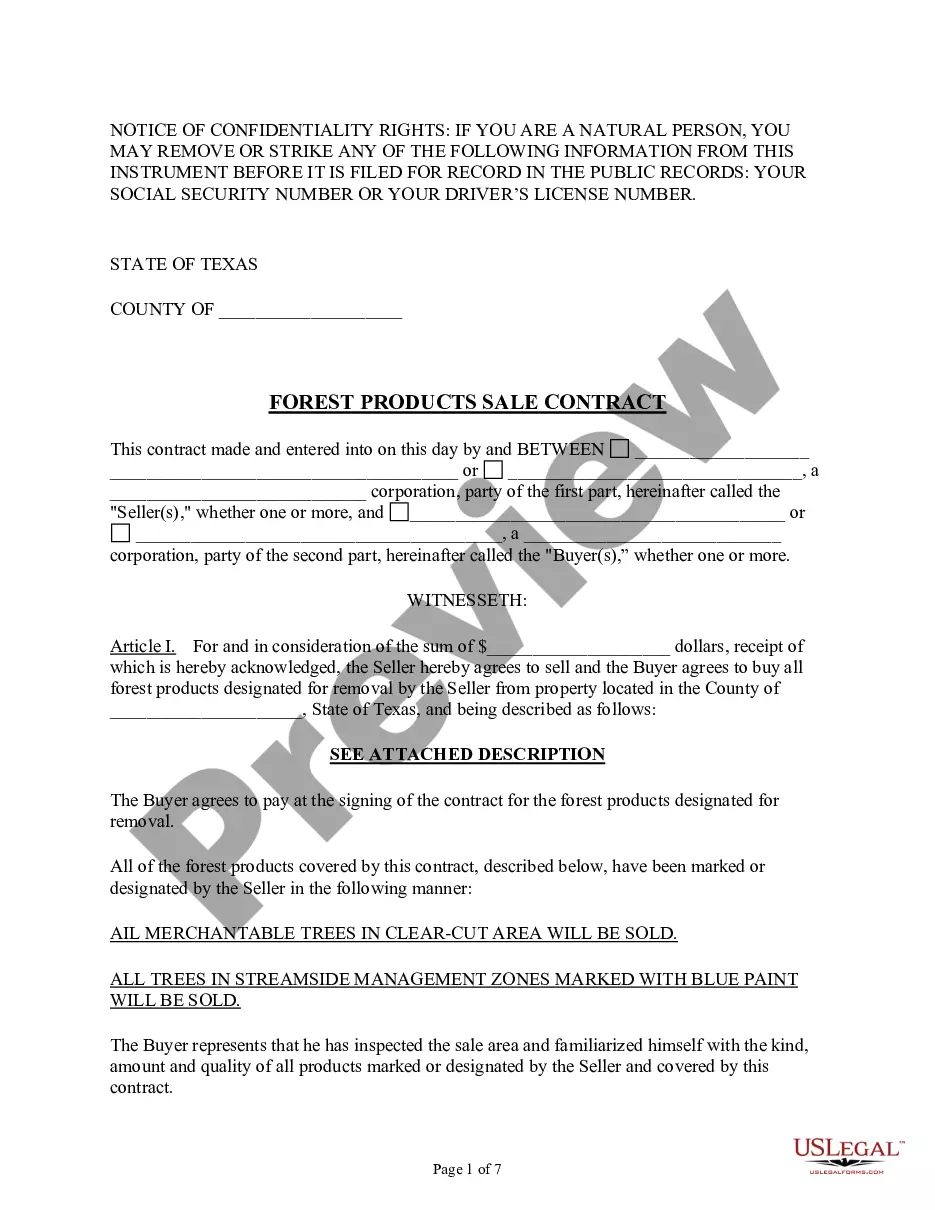

Because the grantor must pay the taxes on all trust income annually, the assets in the trust are allowed to grow tax-free, and thereby avoid gift taxation for the grantor’s beneficiaries. Thus, it is a loophole used to reduce estate tax exposure. This form contains some alternate provisions that the user may modify to suit the particular desires and needs of the grantor.

How to fill out Intentionally Defective Grantor Trust?

Securing a reliable source for obtaining the most current and pertinent legal documents is half the challenge of navigating bureaucracy.

Finding the appropriate legal forms demands accuracy and careful consideration, which is why it is crucial to obtain Tax Id For Intentionally Defective Grantor Trust samples solely from trustworthy providers, such as US Legal Forms.

Once the document is on your device, you can modify it using the editor or print and fill it out manually. Eliminate the stress related to your legal documentation by exploring the extensive US Legal Forms library where you can locate legal templates, review their applicability to your situation, and download them instantly.

- Employ the catalog navigation or search bar to find your document.

- Review the form’s description to determine if it meets the criteria for your state and county.

- Preview the form, if available, to ensure it is indeed the document you are seeking.

- Return to the search and identify the correct template if the Tax Id For Intentionally Defective Grantor Trust does not meet your requirements.

- If you are confident about the document’s relevance, download it.

- If you are an authorized user, click Log in to verify and access your selected documents in My documents.

- If you do not have an account, click Buy now to acquire the form.

- Select the pricing option that fits your needs.

- Proceed to the registration to complete your purchase.

- Finalize your purchase by choosing a payment option (credit card or PayPal).

- Select the file format for downloading Tax Id For Intentionally Defective Grantor Trust.

Form popularity

FAQ

If any supplier of materials, a worker or subcontractor is not paid, a lien may be filed against your property to force you to pay the debt. You could end up paying twice for the same work. Or worse, an unpaid lien could lead to foreclosure on your home.

There are three types of liens that can be placed on your property: Consensual Lien. Statutory Lien. Judgment Lien.

The lien must be filed and recorded with the county recorder or auditor in the county in which the work was performed or the materials provided. If you do not file the lien within this timeframe, you lose your lien rights.

If you would like to record the mechanics lien yourself, you can do so at the following King County Recorder's Offices: 500 Fourth Ave #430, Seattle, WA 98104. kingcounty.gov/depts/records-licensing/recorders-office.aspx.

How to file a mechanics lien in Rhode Island Prepare your Rhode Island Notice of Intention form. ... Serve the Rhode Island Notice of Intention as a preliminary notice. ... Record the Rhode Island Notice of Intention as a mechanics lien. ... File Notice of Lis Pendens and enforce the mechanics lien.

RHODE ISLAND A lien executed against real property is deemed discharged after twenty years from the date of the judgment. R.I. Gen. Laws § 9-26-33.

Filing your mechanics lien with the project's county recorders' office can cost between $95 and $125, depending on the project's location. You'll have to visit the project's county clerk's office in Florida as well. Filing your own lien in Florida has varying costs.

You can submit your documents electronically through a third party submitter, or directly through a King County Agent Account. If you are interested in this process, you can contact the Recorder's Office directly.