Agreement Third Party Form Form For Mortgage

Description

How to fill out Software License Agreement Involving Third-Party?

How to obtain professional legal documents that comply with your state regulations and create the Agreement Third Party Form for Mortgage without hiring a lawyer.

Numerous online services provide templates for various legal situations and requirements. However, it may require time to ascertain which of the accessible samples meet both your specific use case and legal standards.

US Legal Forms is a reliable platform that assists you in locating official documents crafted in accordance with the most recent state law updates and helps you save costs on legal services.

If you do not have an account with US Legal Forms, follow the instructions below: Review the webpage you have opened and verify if the form fulfills your requirements. To accomplish this, utilize the form description and preview options, if available. Search for an alternative sample in the header providing your state, if needed. Click the Buy Now button when you identify the appropriate document. Select the most suitable pricing plan, then Log In or register for an account. Choose your payment method (by credit card or through PayPal). Alter the file format for your Agreement Third Party Form for Mortgage and click Download. The downloaded documents remain yours: you can always access them in the My documents section of your profile. Subscribe to our library and draft legal documents independently like a seasoned legal professional!

- US Legal Forms is not a conventional online directory.

- It comprises over 85,000 validated templates for diverse business and personal situations.

- All documents are organized by category and state to streamline your searching experience.

- Additionally, it offers integration with advanced solutions for PDF editing and electronic signatures, allowing users with a Premium subscription to efficiently complete their paperwork online.

- Acquiring the necessary documentation requires minimal time and effort.

- If you already possess an account, Log In to verify your subscription status.

- Download the Agreement Third Party Form for Mortgage using the corresponding button adjacent to the file name.

Form popularity

FAQ

Mortgage is a loan taken to purchase property and guaranteed by the same property. An example of a mortgage is the loan you took out when you bought your house.

Begin the document with the official title, "Loan Agreement" and the current date. Then state who the loan agreement is between; list the borrowers' first with their middle and last names, followed by the lender. Indicate each party with the designation "Borrower" and "Lender" after each name.

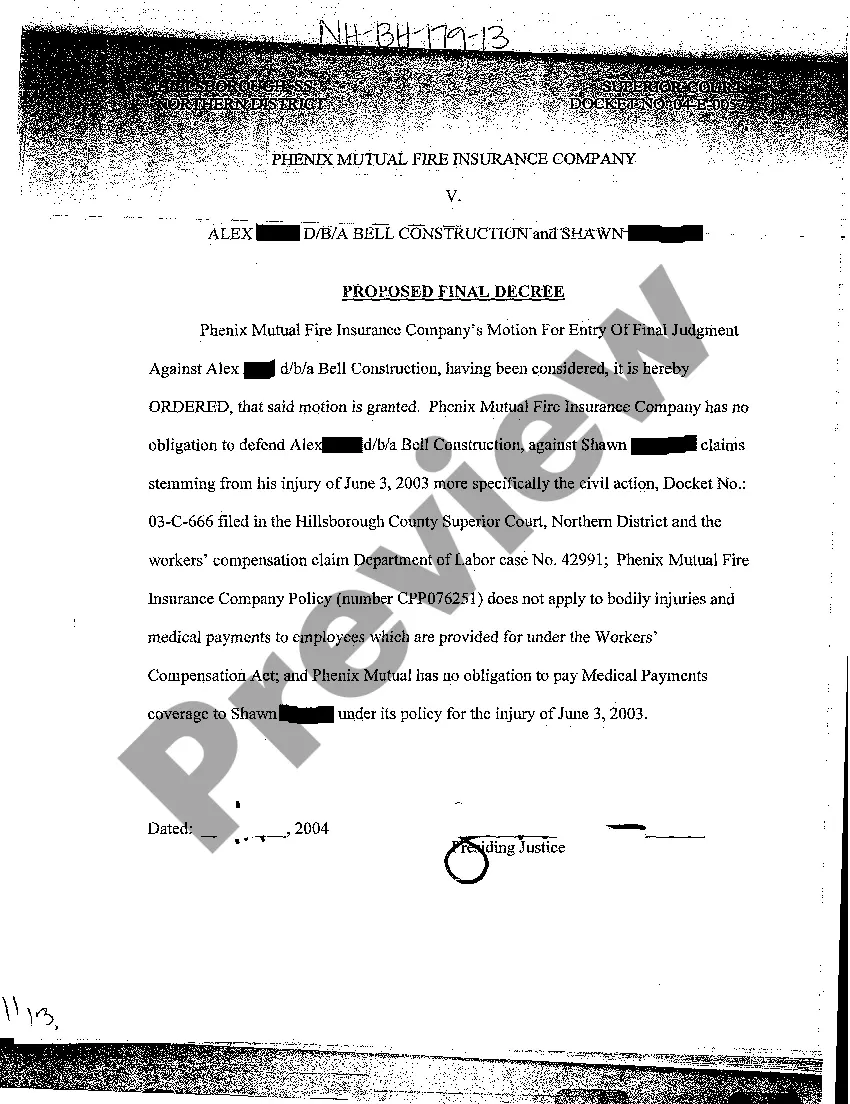

A third party authorization form says to your mortgage company that you allow a third party to receive information about you and your mortgage. It may allow the third party to take actions for you. There is no single form used by every mortgage company.

A Mortgage Agreement is a contract between a borrower (called the mortgagor) and the lender (called the mortgagee) where a lien is created on the property in order to secure repayment of the loan.

For a personal loan agreement to be enforceable, it must be documented in writing and signed by both parties. You may choose to keep a copy in your county recorder's office if you wish, though it's not legally necessary. It's sufficient for both parties to store their own copy, ideally in a safe place.