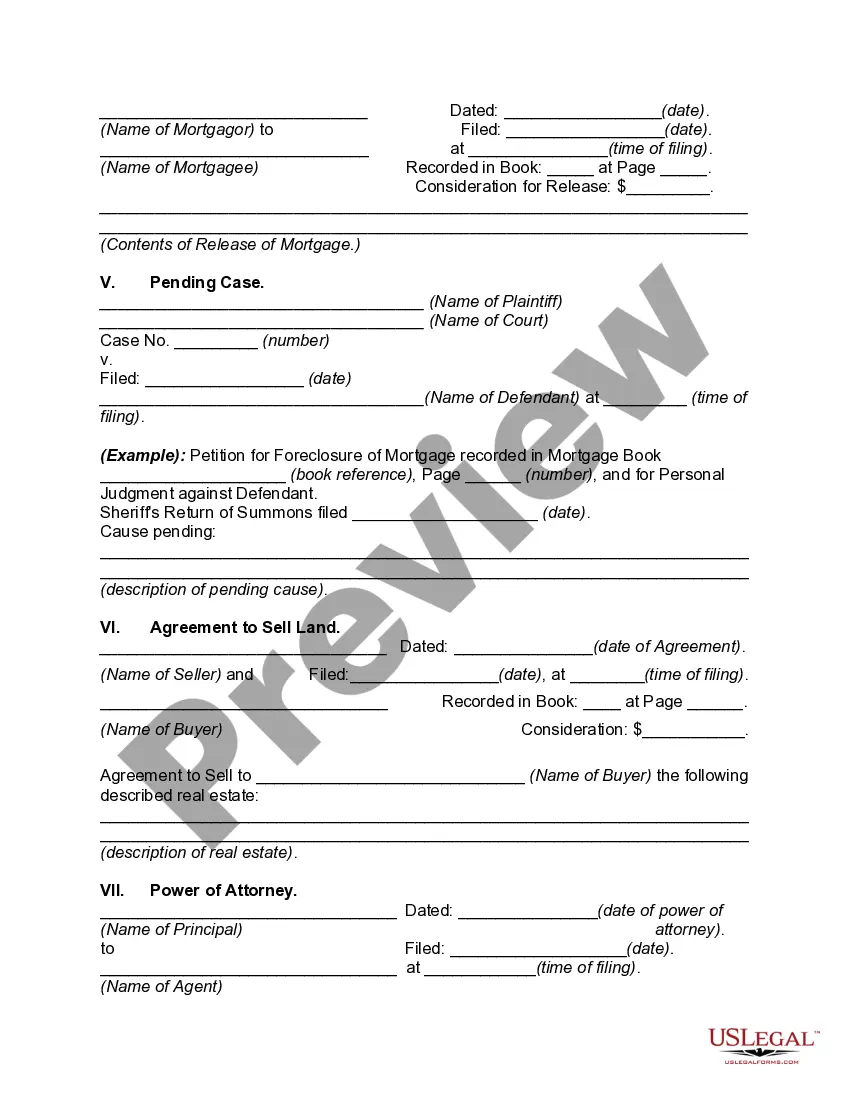

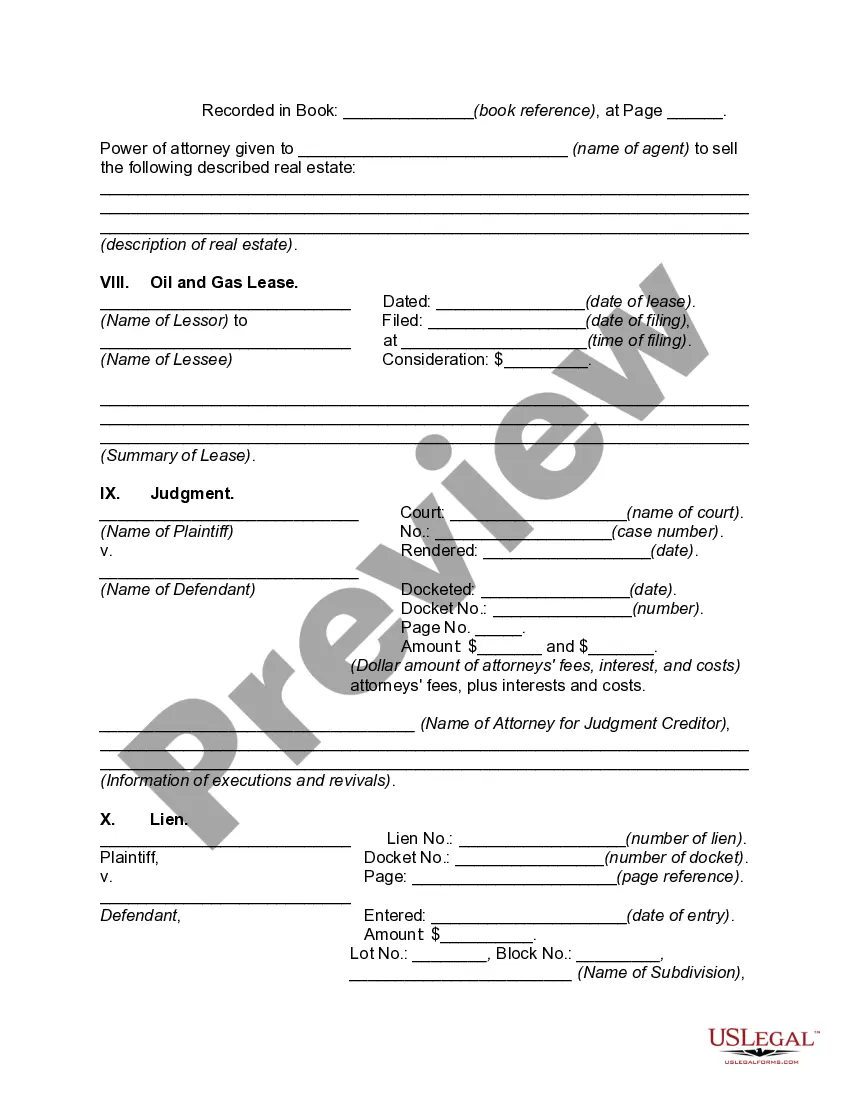

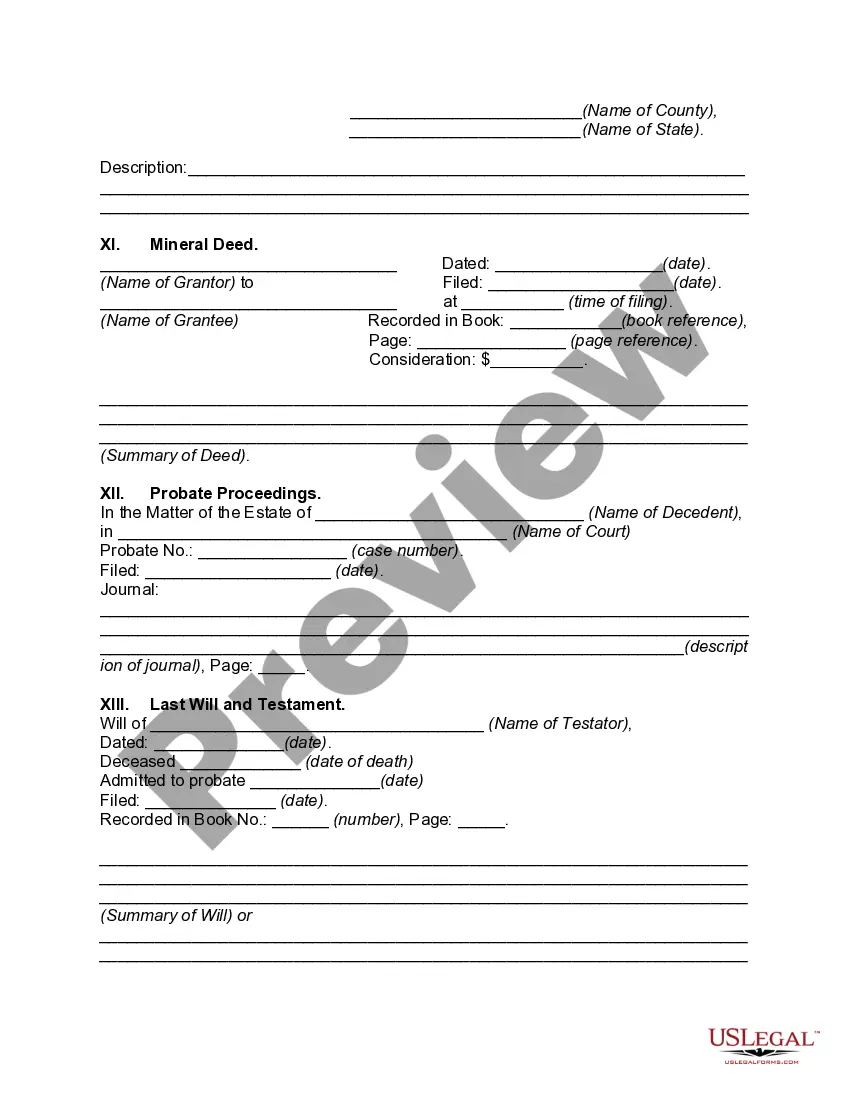

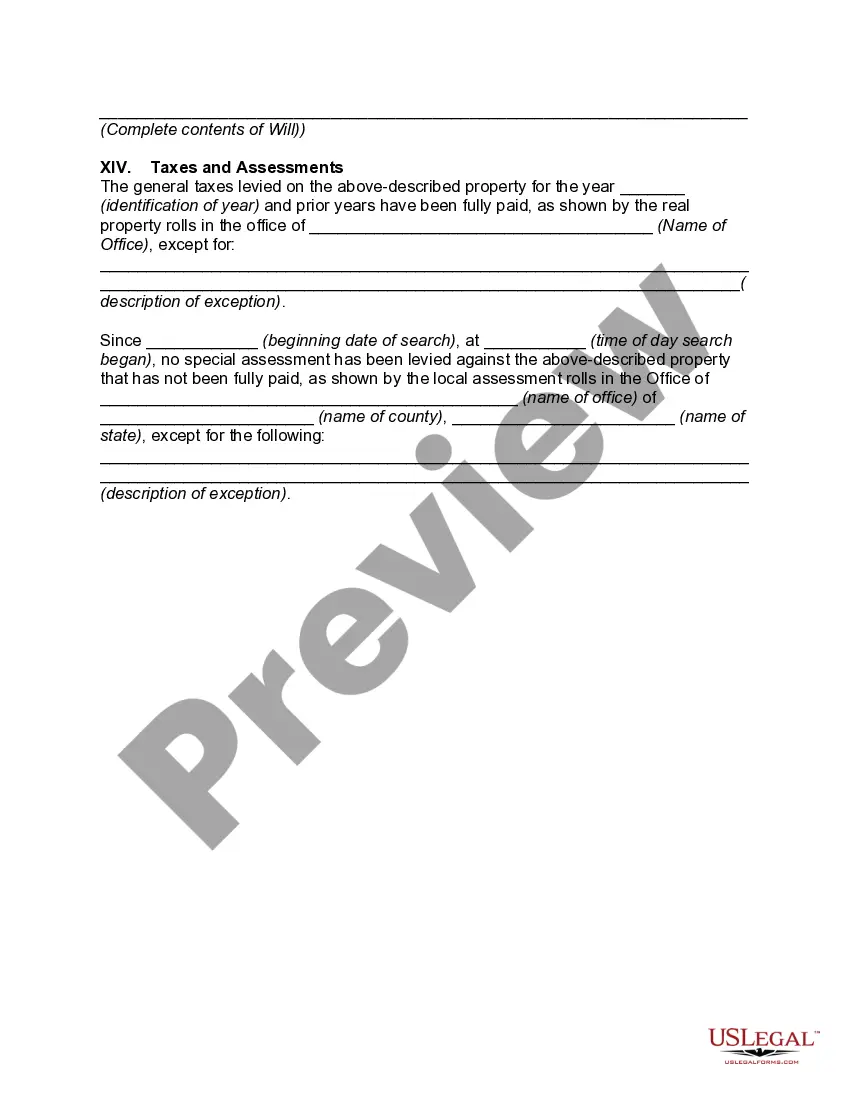

Title Abstract For The Property

Description

How to fill out Abstract Of Title?

Managing legal documentation and protocols can be an exhausting extension to your whole day.

Title Abstract For The Property and similar forms typically necessitate you to seek them out and comprehend how to fill them out correctly.

Consequently, whether you are handling financial, legal, or personal issues, utilizing a comprehensive and user-friendly online repository of forms readily available will be immensely helpful.

US Legal Forms is the premier online resource for legal templates, comprising over 85,000 state-specific forms and various tools to aid you in completing your documentation effortlessly.

Simply Log In to your account, search for Title Abstract For The Property, and obtain it instantly from the My documents section. You can also retrieve previously saved forms.

- Browse the collection of relevant documents available to you with just a single click.

- US Legal Forms offers you state- and county-specific forms that can be downloaded anytime.

- Safeguard your document management tasks using a reliable service that lets you generate any form in mere minutes without any additional or concealed fees.

Form popularity

FAQ

Determine whether you need to complete the Short Form or the Long Form. ... Fill in your Personal Information. ... Identify Your Gross Weekly Income. ... Identify the Deductions from your Gross Weekly Income. ... Identify your Weekly Expenses. ... Identify your Assets. ... Identify your Liabilities. ... The Final Review.

The purpose of Form E2 is to help you to provide the court with details of your financial arrangements. You must send your filled-in Form E2 to the court and simultaneously exchange a copy with the other person, no more than 21 days after the date of the issue of the application.

What is Supplemental Probate and Family Court Rule 401? Rule 401 addresses financial statements and provides that within 45 days from service of the divorce summons, spouses must exchange complete and accurate financial statements detailing their assets, liabilities, income and expenses.

It will help you to get a clear idea of the cost to run your home. Filling in the Financial Statement template. ... Enter your personal details. ... Enter your income. ... Enter your expenditure totals. ... Calculate how much you have left for all debts. ... Enter your debt details. ... Calculate how much you have left for secondary debts.

Probate and Family Court Financial statement schedule A: Monthly self-employment or business income. To be completed in addition to Financial Statement if you receive self-employment or business income.

How to complete the Short Form Financial Statement in Massachusetts Section one: personal information. ... Section two: gross weekly receipts. ... Section three: itemized deductions. ... Section four: adjusted net weekly income. ... Section five: other deductions. ... Section six: net weekly income.