Repair Rent Deduction Without Hra

Description

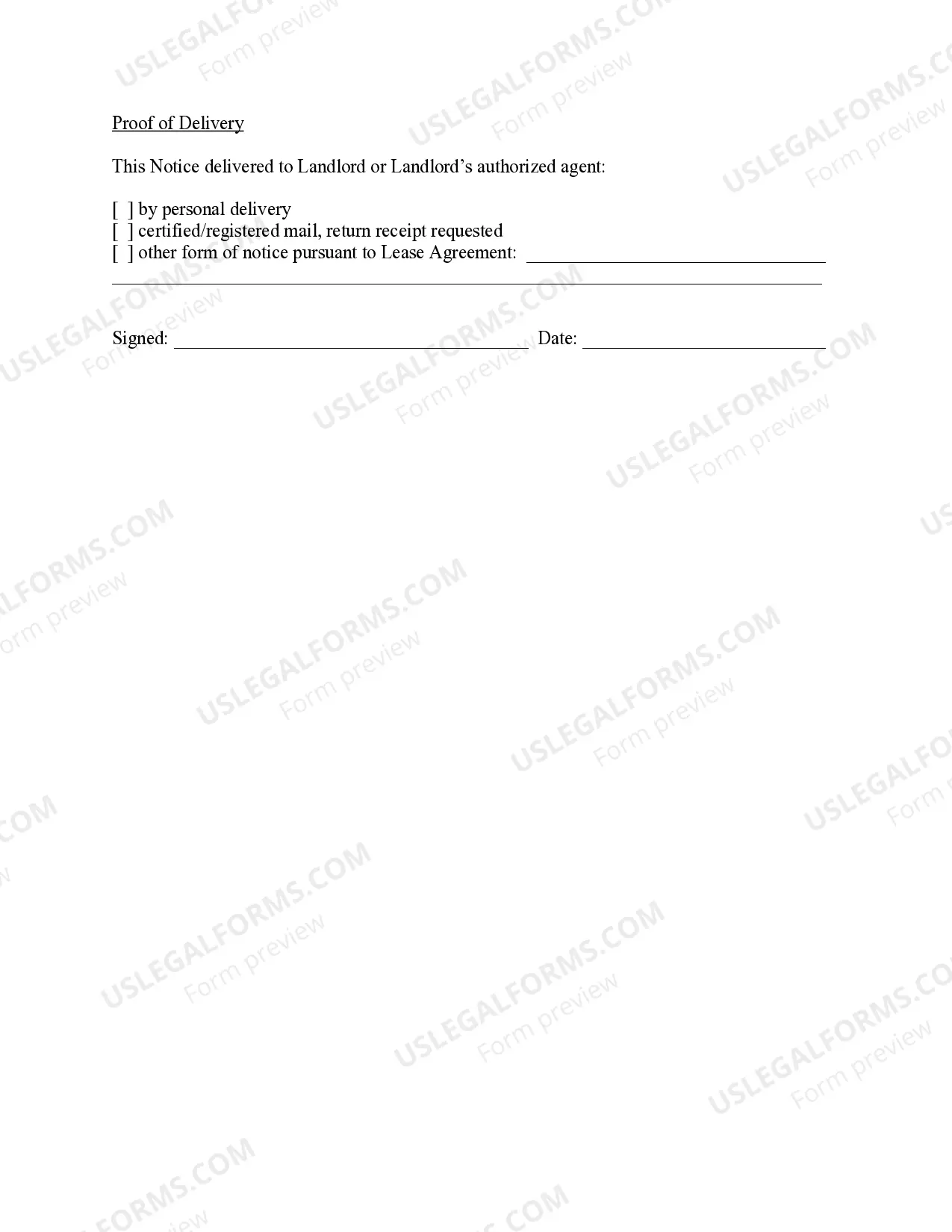

How to fill out Letter From Tenant To Landlord Containing Notice Of Use Of Repair And Deduct Remedy?

It’s clear that you cannot become a legal expert instantly, nor can you learn how to swiftly prepare Repair Rent Deduction Without Hra without having a specialized knowledge. Assembling legal documents is an extensive process that demands specific education and abilities. So why not entrust the preparation of the Repair Rent Deduction Without Hra to the professionals.

With US Legal Forms, one of the most extensive legal document repositories, you can discover anything from court filings to templates for in-office correspondence. We understand how crucial compliance and adherence to federal and state regulations are. That’s why, on our platform, all templates are location-specific and current.

Let’s begin with our website and acquire the form you need in just minutes.

You can regain access to your forms from the My documents tab at any time. If you’re an existing customer, you can simply Log In, and find and download the template from the same tab.

Regardless of the nature of your paperwork—whether financial and legal, or personal—our website has you covered. Try US Legal Forms today!

- Locate the document you require by utilizing the search bar at the top of the page.

- Preview it (if this option is available) and review the supporting description to determine if Repair Rent Deduction Without Hra is what you seek.

- Initiate your search again if you need any other template.

- Create a free account and choose a subscription plan to purchase the form.

- Select Buy now. Once the payment is completed, you can obtain the Repair Rent Deduction Without Hra, complete it, print it, and send it by post to the necessary individuals or organizations.

Form popularity

FAQ

Once you know the HRA claim amount, use the right ITR form and file for your ITR by following these steps: Enter your salary in 'Salary as per provisions contained in section 17(1) ' in Form 16 - Part B. Enter the HRA calculated above under 'Allowances exempt u/s 10' in the ITR 1 (select 10(13A) in the drop-down menu)

Rent is the amount of money you pay for the use of property that is not your own. Deducting rent on taxes is not permitted by the IRS. However, if you use the property for your trade or business, you may be able to deduct a portion of the rent from your taxes.

Types of itemized deductions Your state and local income or sales taxes. Property taxes. Medical and dental expenses that exceed 7.5% of your adjusted gross income. Charitable donations.

Is filing of Form 10BA mandatory? Yes, if an individual wants to claim the deduction for rent paid under section 80GG, they are required to file Form 10BA.

You generally must include in your gross income all amounts you receive as rent. Rental income is any payment you receive for the use or occupation of property. Expenses of renting property can be deducted from your gross rental income. You generally deduct your rental expenses in the year you pay them.