Template Sample Answer To Summons For Credit Card Debt

Description

How to fill out General Form Of Civil Answer With Affirmative Defenses And Counterclaim?

It’s no secret that you can’t become a legal expert overnight, nor can you grasp how to quickly prepare Template Sample Answer To Summons For Credit Card Debt without the need of a specialized set of skills. Putting together legal forms is a long venture requiring a particular education and skills. So why not leave the creation of the Template Sample Answer To Summons For Credit Card Debt to the professionals?

With US Legal Forms, one of the most comprehensive legal template libraries, you can access anything from court documents to templates for in-office communication. We know how important compliance and adherence to federal and local laws and regulations are. That’s why, on our platform, all templates are location specific and up to date.

Here’s how you can get started with our website and obtain the form you need in mere minutes:

- Find the document you need by using the search bar at the top of the page.

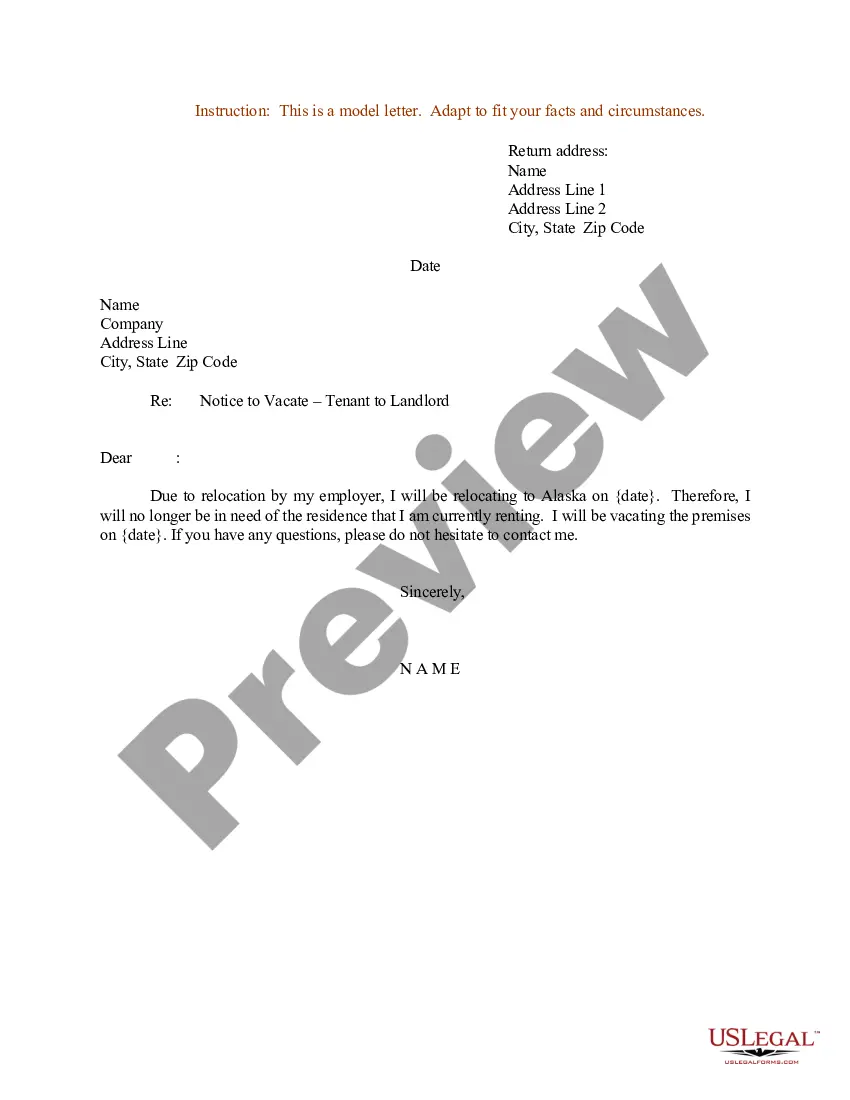

- Preview it (if this option provided) and read the supporting description to determine whether Template Sample Answer To Summons For Credit Card Debt is what you’re looking for.

- Begin your search again if you need any other form.

- Set up a free account and select a subscription plan to buy the form.

- Pick Buy now. As soon as the transaction is through, you can get the Template Sample Answer To Summons For Credit Card Debt, fill it out, print it, and send or mail it to the designated people or entities.

You can re-gain access to your forms from the My Forms tab at any time. If you’re an existing client, you can simply log in, and locate and download the template from the same tab.

No matter the purpose of your documents-be it financial and legal, or personal-our website has you covered. Try US Legal Forms now!

Form popularity

FAQ

Credit Card Debt: Guide to Responding to Court Summons Review the Complaint and The Summon. You should review the summon and look out for important details including: ... Calculate the Deadline for Filing A Response. ... Draft A Response to The Complaint. ... File the Answer Form. ... Serve Copies to The Plaintiff.

You must fill out an Answer, serve the other side's attorney, and file your Answer form with the court within 30 days. If you don't, the creditor can ask for a default. If there's a default, the court won't let you file an Answer and can decide the case without you.

I am responding to your contact about collecting a debt. You contacted me by [phone/mail], on [date] and identified the debt as [any information they gave you about the debt]. I do not have any responsibility for the debt you're trying to collect.

Resolving debt before a lawsuit A partial one-time payment is often the least expensive way to pay off a debt. ... You may be able to negotiate payments in monthly installments. ... If you are being harassed by debt collectors, you can ask them to stop. ... When debt expires, you can't be sued for it.

An affirmative defense is a defense that brings up new facts or issues not in the Complaint that, if true, would be a legal reason why the plaintiff should not win, or should win less than they're asking for. It is not a denial that you did what the plaintiff says you did.