Sample Letter Of Consent For Adoption Format

Description

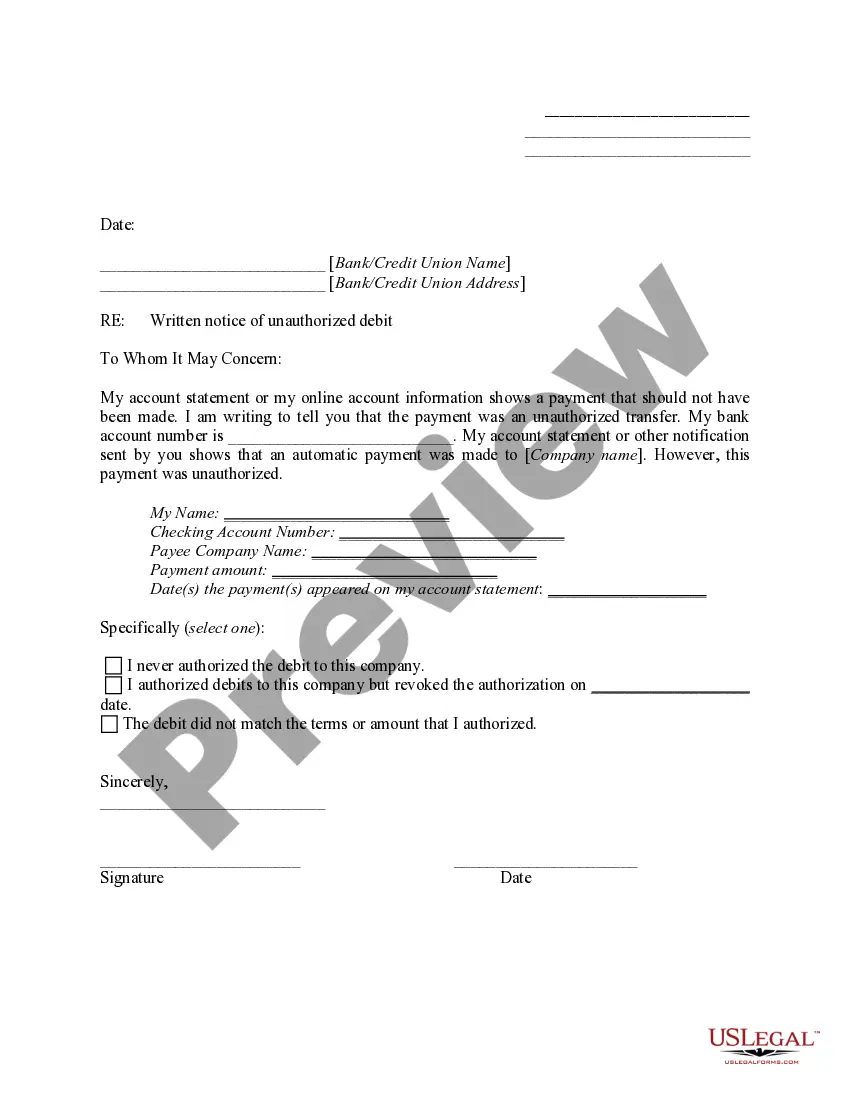

How to fill out Sample Letter Regarding Consent To Adoption?

Whether for commercial reasons or for private matters, everyone must handle legal circumstances at some point in their lives.

Completing legal documentation requires meticulous attention, beginning with choosing the right form template.

Choose the file format you desire and download the Sample Letter Of Consent For Adoption Format. After saving it, you can fill out the form using editing software or print it and complete it manually. With an extensive US Legal Forms catalog available, you will never need to waste time searching for the correct sample online. Utilize the library’s straightforward navigation to obtain the suitable form for any situation.

- For instance, if you select an incorrect version of a Sample Letter Of Consent For Adoption Format, it will be rejected once submitted.

- Thus, it is vital to have a reliable source for legal documents like US Legal Forms.

- If you need to procure a Sample Letter Of Consent For Adoption Format template, follow these straightforward steps.

- Locate the sample you require using the search field or catalog navigation.

- Review the form’s description to ensure it aligns with your circumstances, state, and area.

- Click on the form’s preview to examine it.

- If it is the wrong document, return to the search function to find the Sample Letter Of Consent For Adoption Format sample you need.

- Obtain the file when it fulfills your requirements.

- If you have a US Legal Forms account, simply click Log in to access previously saved templates in My documents.

- If you don’t have an account yet, you can acquire the form by clicking Buy now.

- Choose the appropriate pricing option.

- Complete the account registration form.

- Select your payment method: utilize a credit card or PayPal account.

Form popularity

FAQ

A more compassionate way to express 'given up for adoption' is to say 'placed for adoption.' This phrasing emphasizes the positive intention behind the decision rather than a sense of loss. When communicating this sensitive choice, utilizing resources like a sample letter of consent for adoption format can help convey your thoughts gently.

Connecticut LLC Annual Report filing fee The fee for a Connecticut LLC Annual Report is $80. This is due every year. Note: The Annual Report fee used to be $20 per year. However, in July 2020, the Connecticut Secretary of State increased the LLC Annual Report fee to $80 per year.

The ID number issued by the Secretary of the State is called the Business ID. To look up your Business ID: Go to the business search and search by the business name.

A Connecticut tax power of attorney (LGL-001) designates an agent to represent the principal in front of the Connecticut Department of Revenue Services. The agent, usually a trusted accountant or tax advisor, can file returns, obtain information, or ask the agency representatives for answers on behalf of the principal.

If you're looking to relocate and start your new business, Wyoming is a great choice. Not only is it the first state to make LLCs a legal business structure in 1977, but Wyoming also has no state income tax, a cheap sales tax rate which currently sits at 4% and a relatively inexpensive LLC filing fee of $100.

How long does it take to get an LLC in Connecticut? If you file your LLC by mail, it will be approved in 7-10 business days (plus mail time). But if you file online, your LLC will be approved in 2-3 business days.

You simply confirm the information (like your business address and registered agent name) on the Annual Report, file it with the Connecticut Secretary of State, and pay the Annual Report fee. The Connecticut LLC Annual Report costs $80 per year.

New York LLC Costs - Summary Fee/CostAmountArticles of Organization Fee$200New York Publication Fee$50Newspaper Publication Costs$80 ? $2,000Annual LLC Fee$25 ? $4,5007 more rows