Sample Letter For Credit Card Settlement

Description

How to fill out Sample Letter For Request For Removal Of Derogatory Credit Information?

Legal documents handling can be exasperating, even for proficient professionals.

When you seek a Template for Credit Card Settlement and lack the time to invest in locating the appropriate and current version, the process can be overwhelming.

Tap into a repository of articles, guides, and resources pertinent to your requirements and circumstances.

Conserve time and effort in seeking the documents you require, and leverage US Legal Forms’ sophisticated search and Review feature to locate Template for Credit Card Settlement and obtain it.

Select Buy Now when you are prepared. Choose a monthly subscription plan. Locate the format you need, and Download, complete, sign, print, and submit your documents. Take advantage of the US Legal Forms online catalog, supported by 25 years of expertise and reliability. Transform your routine document management into a seamless and user-friendly experience today.

- If you possess a subscription, Log In to your US Legal Forms account, search for the document, and retrieve it.

- Check the My documents tab to review the documents you previously saved and manage your folders as needed.

- If it is your first occasion with US Legal Forms, create an account and gain unlimited access to all the platform's benefits.

- Here are the procedures to follow after retrieving the form you require.

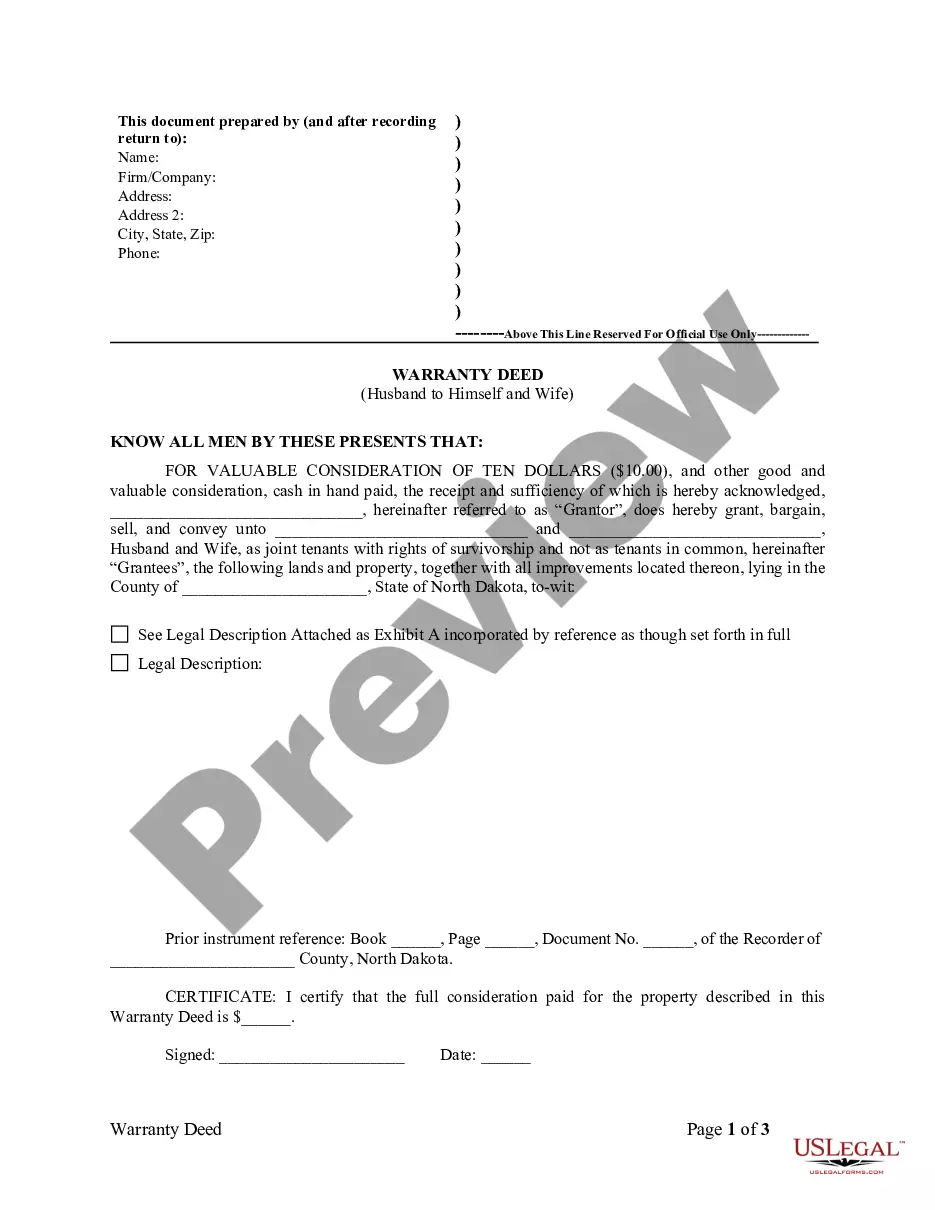

- Confirm that this is the correct document by previewing it and checking its details.

- Ensure that the template is approved in your state or county.

- Access state- or county-specific legal and business documents.

- US Legal Forms addresses any requirements you might have, from personal to corporate paperwork, all in one location.

- Utilize sophisticated tools to complete and manage your Template for Credit Card Settlement.

Form popularity

FAQ

Yes, you can ask your credit card company for a settlement figure. Initiating this conversation shows your willingness to resolve your debt while also potentially benefiting them. Many are open to negotiation, especially if you provide a sample letter for credit card settlement to outline your proposed terms and financial circumstances.

Credit card companies typically settle for around 40% to 60% of the total debt, depending on various factors such as your overall financial situation and the policies of the issuing bank. It's essential to negotiate with the bank to arrive at a fair agreement. Using a sample letter for credit card settlement can help structure your request effectively, ensuring you communicate your intentions clearly.

When speaking to creditors to settle debt, express your commitment to resolving the matter amicably. Clearly state your financial hardships, then propose a specific settlement amount. Make sure to listen to their response and negotiate respectfully. Using a sample letter for credit card settlement from USLegalForms can provide you with a solid foundation for these discussions.

A reasonable settlement offer typically ranges from 30% to 70% of the total debt, depending on your financial circumstances and the creditor’s policies. It's important to balance what you can afford while making a compelling case for your offer. Always support your request with personal financial details, which can enhance your credibility. Using a sample letter for credit card settlement can help convince creditors to consider your offer.

Writing a letter for final settlement involves clearly stating that this is your last offer to resolve the debt. Begin with your account details, mention the original debt amount, and specify the settlement offer you propose. Make your intention clear regarding this being your final communication. Consider using a sample letter for credit card settlement from USLegalForms if you're unsure about the structure.

To write a settlement offer letter, start by addressing the creditor directly and stating the purpose of your letter. Clearly outline the amount you wish to offer as a settlement, and be sure to provide reasons why you believe this amount is fair. Include any necessary personal details and payment timelines. You can find a helpful sample letter for credit card settlement on platforms like USLegalForms that can guide you through the process.

To ask for a credit card settlement, initiate a conversation with your creditor by phone or through written communication. Be honest about your financial struggles and express your desire to reach a settlement. Follow up your verbal conversation with a formal letter, using a reliable sample letter for credit card settlement to strengthen your case. This approach enhances the chance of a successful negotiation.

To write a letter requesting a settlement, you should use a formal format and keep your tone professional. Include your account number and a brief explanation of your circumstances. Be sure to specify the settlement amount you are proposing and its justification. A sample letter for credit card settlement can serve as a useful template for your correspondence.

To request for credit card settlement, begin by contacting your credit card issuer directly. Explain your financial situation and express your desire to settle your debt. You might want to mention any financial hardships you are facing. Follow up your request with a sample letter for credit card settlement, clearly detailing your offer.

An example of a claim settlement letter typically includes the claimant's details, the claim being settled, and the agreed settlement amount. It also states that the payment will resolve all claims against the debtor. Referring to a sample letter for credit card settlement can help illustrate the proper layout and tone for your example.