Commitment Agreement Letter Without Court

Description

How to fill out Loan Commitment Agreement Letter?

Whether you handle paperwork regularly or need to turn in a legal document occasionally, it is crucial to obtain a resource where all the examples are relevant and up to date.

One task you need to perform with a Commitment Agreement Letter Without Court is to verify that it is indeed the latest version, as it determines whether it can be submitted.

If you wish to streamline your search for the newest document samples, seek them on US Legal Forms.

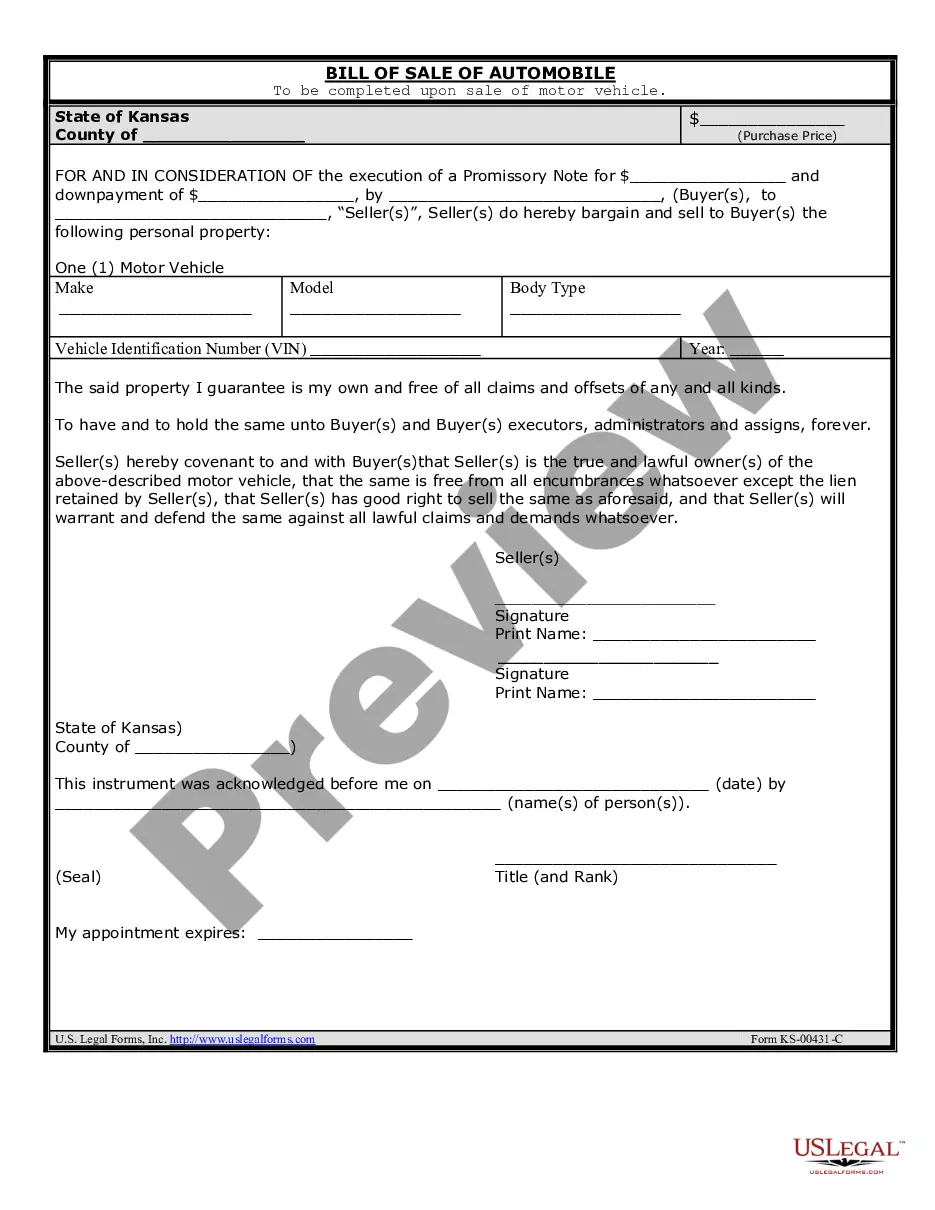

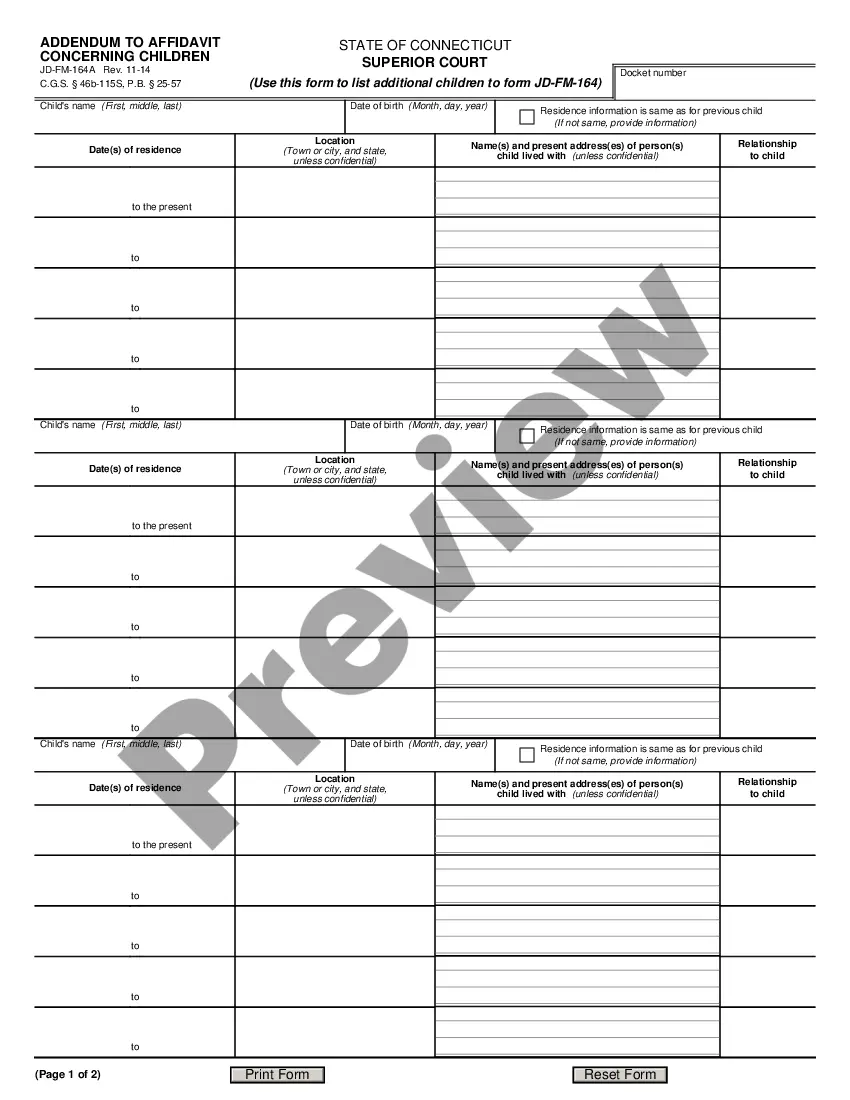

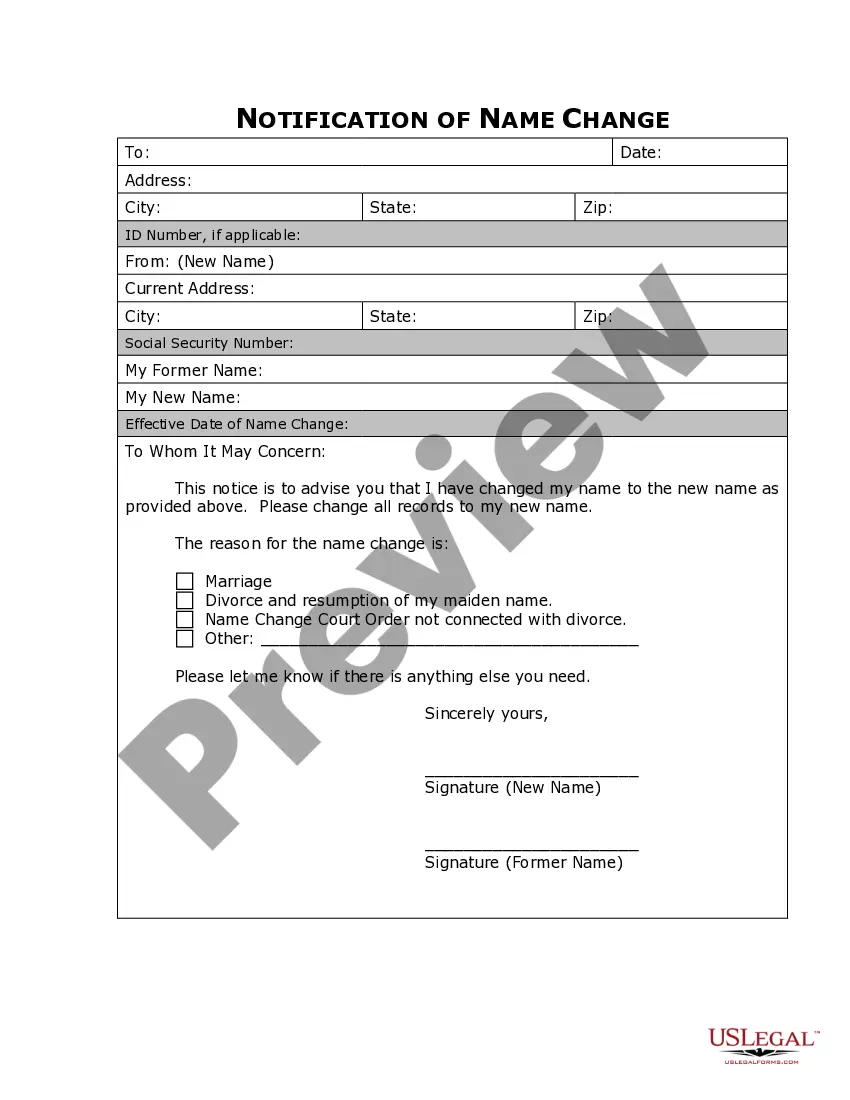

To acquire a form without an account, carry out these steps: Use the search menu to locate the form you need. Review the preview and description of the Commitment Agreement Letter Without Court to confirm it is indeed what you are looking for. After double-checking the form, simply click Buy Now. Select a subscription plan that suits you. Create an account or Log In to your existing one. Use your credit card details or PayPal account to finalize the purchase. Choose the document format for download and confirm it. Eliminate any confusion associated with legal documents. All your templates will be systematically organized and authenticated with an account at US Legal Forms.

- US Legal Forms serves as a repository of legal documents that includes nearly any example you might need.

- Look for the templates you need, check their relevance immediately, and learn more about their applications.

- With US Legal Forms, you gain access to over 85,000 form templates across various fields.

- Obtain the Commitment Agreement Letter Without Court examples in just a few clicks and save them anytime in your account.

- Having a US Legal Forms account allows you to access all the samples you need with added ease and less hassle.

- You simply have to click Log In on the website header and navigate to the My documents section where all the necessary forms are available to you.

- This way, you won’t have to waste time searching for the right template or verifying its suitability.

Form popularity

FAQ

A mortgage commitment letter is a formal document from your lender stating that you're approved for the loan. Lenders issue a mortgage commitment letter after an applicant successfully completes the preapproval process.

Here are the steps to write a letter of agreement:Title the document. Add the title at the top of the document.List your personal information.Include the date.Add the recipient's personal information.Address the recipient.Write an introduction paragraph.Write your body.Conclude the letter.More items...?

Tips for writing letters of commitmentAgree upon terms before writing.Keep letters short and succinct.Use correct formatting.Be direct.Write clearly.Only include the terms that both parties have agreed on.Consider the terms for availability.Be fair.More items...?

The basic contents of a letter of commitment include the following details:Names and addresses of the borrower and lender.The type of loan applied for.The loan amount.The agreed upon loan repayment period.The interest rate for the loan.Date of lock expiration (if the loan is locked in) for the interest rate.More items...

A document that's legally binding can be upheld in court. Any agreement that two parties make can be legally enforced, whether it's written or verbal. A signed document is important to have since it provides proof that an agreement exists and shows both parties agreed to identical terms.