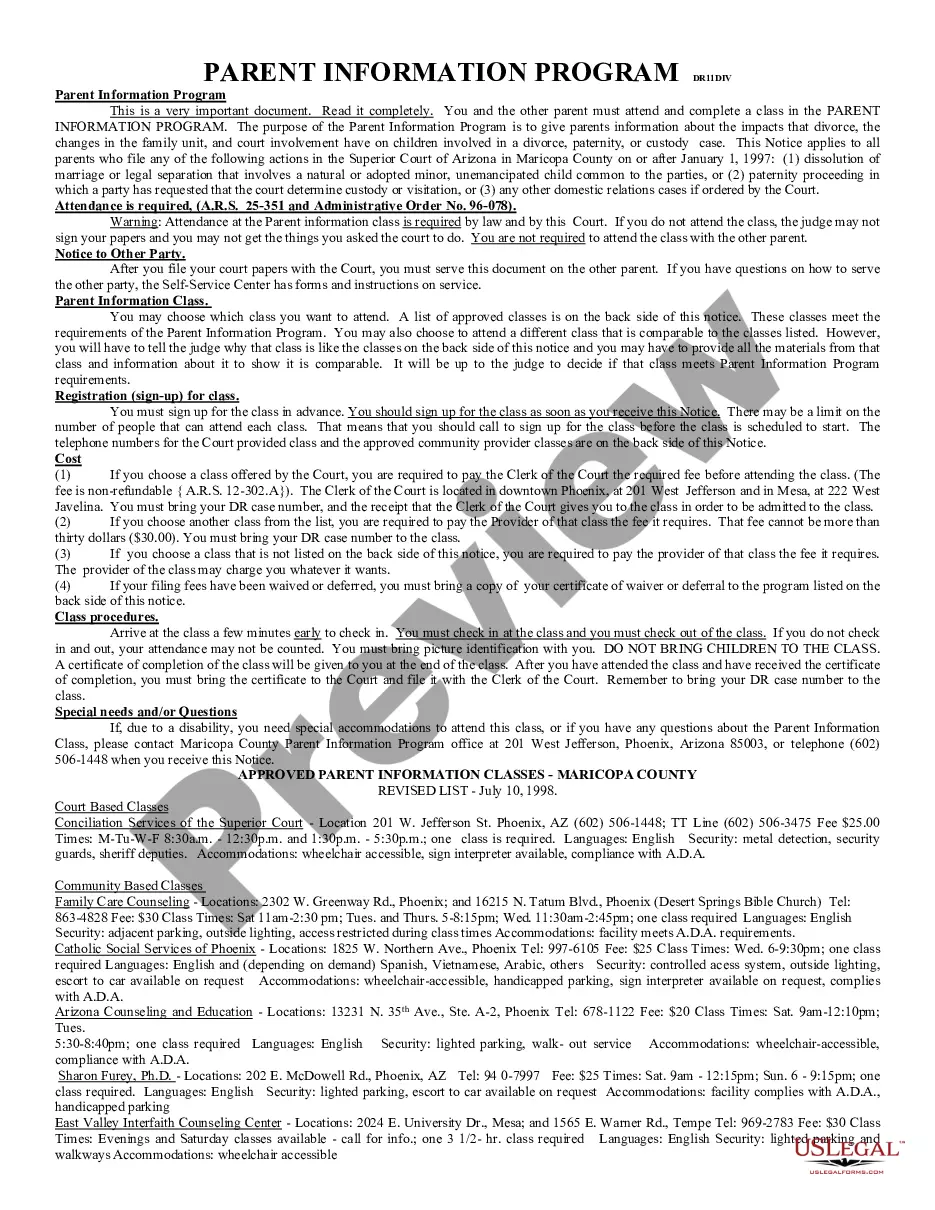

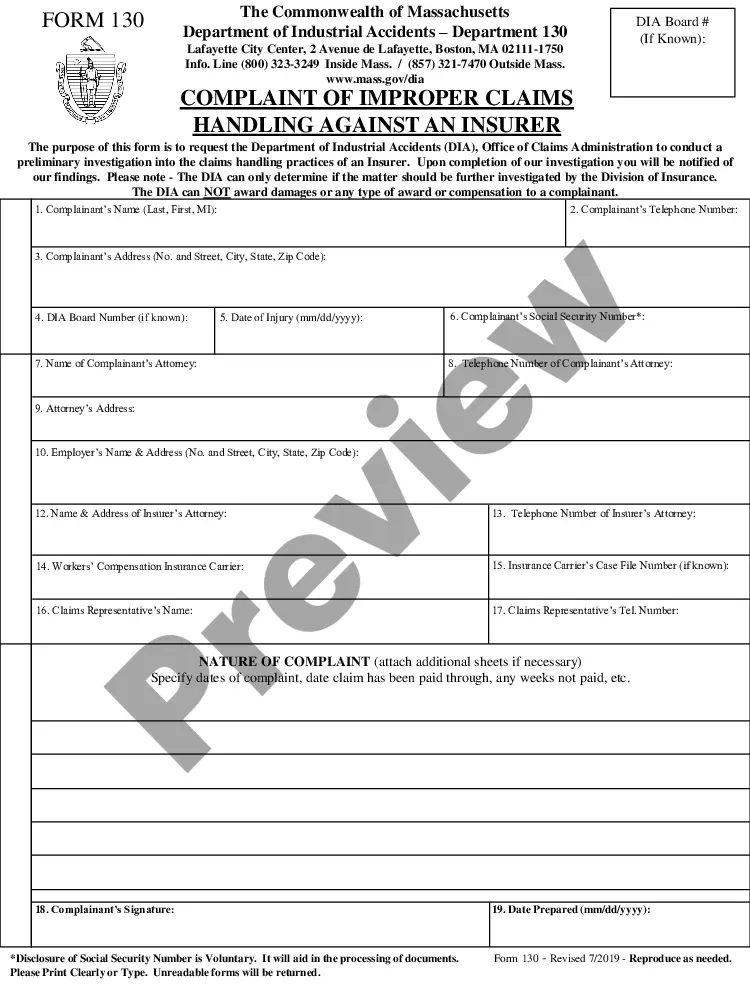

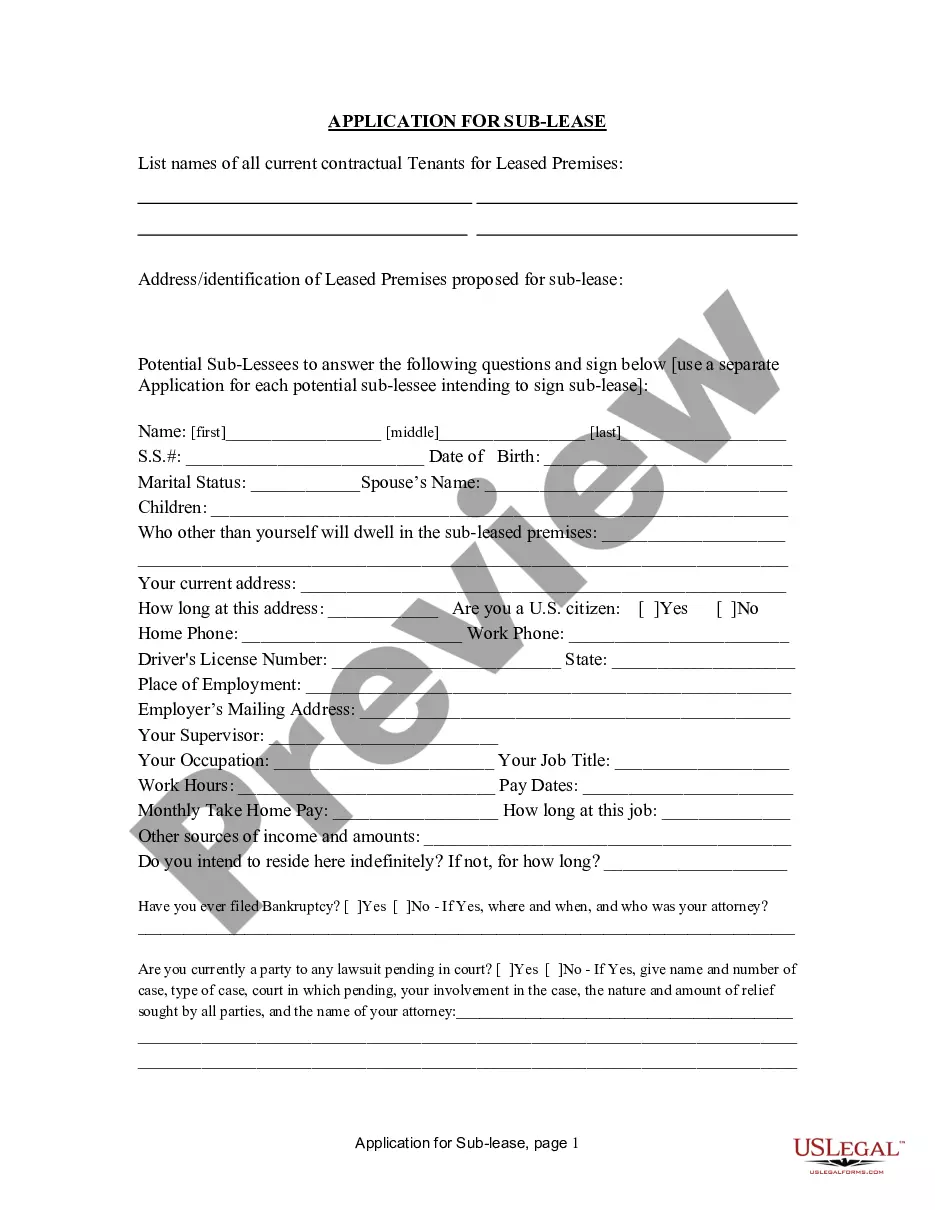

Amended Claim Form Example

Description

How to fill out Sample Letter Regarding Proposed Amended Complaint?

It’s clear that you cannot become a legal expert instantly, nor can you swiftly learn how to prepare an Amended Claim Form Example without possessing a specialized skill set.

Compiling legal documents is a lengthy endeavor that necessitates specific education and abilities. Therefore, why not entrust the preparation of the Amended Claim Form Example to the experts.

With US Legal Forms, one of the most extensive legal template repositories, you can find everything from court documents to in-office communication templates.

You can revisit your forms from the My documents tab at any time. If you are a current client, you can simply Log In and find and download the template from the same section.

Regardless of the purpose of your documents—be it financial, legal, or personal—our platform has you covered. Give US Legal Forms a try today!

- Recognize the document you require by utilizing the search bar situated at the top of the page.

- Examine it (if this option is available) and read the accompanying description to determine whether the Amended Claim Form Example is what you are looking for.

- Initiate your search anew if you need another form.

- Sign up for a free account and select a subscription plan to acquire the form.

- Click Buy now. Once the purchase is completed, you can obtain the Amended Claim Form Example, complete it, print it, and forward or dispatch it to the relevant individuals or entities.

Form popularity

FAQ

When filling out Form 1040X for the recovery rebate credit, first ensure you have the correct amount of the credit you qualify for. Next, complete the form by highlighting your changes in the appropriate columns and provide supporting documentation if necessary. For more straightforward navigation, utilizing an amended claim form example can clarify how to claim this credit effectively.

To fill out an amended tax form, start by entering your personal information at the top of Form 1040X. Next, use columns to compare your original figures, the corrected amounts, and the difference. Maintaining clarity is crucial; using an amended claim form example can help ensure you stay organized and accurate with your amendments.

In your explanation of changes section on Form 1040X, clearly state the reason for the amendment and detail what information has changed. Use simple language and be direct; this clarity helps the IRS understand your situation. For added insight, check out an amended claim form example that showcases effective explanations.

Generally, you won’t incur a penalty simply for amending your tax return. However, if you owe additional taxes due to the amendment, interest may accumulate on the unpaid balance. To prevent surprises, it is wise to review an amended claim form example which outlines any monetary implications associated with changes to your return.

Filling out an amended tax return involves several steps. First, you should gather your original tax return and any supporting documents. Then, using the IRS Form 1040X, accurately enter the information you want to update, including the reason for the amendment. For a clear understanding, you can refer to an amended claim form example to guide you through the process.

You certainly can amend your claim if there are changes or corrections needed. This can include updating amounts, correcting errors, or providing new information. An amended claim form example offers an effective reference for what to include in your updated submission. Uslegalforms can assist you in creating a comprehensive amendment that meets all requirements.

Yes, you can amend an insurance claim if new evidence emerges or if you discover errors in your initial submission. This helps ensure that your claim accurately reflects your situation. An amended claim form example can provide clarity on the information needed for such revisions. Using uslegalforms not only helps you draft your amendment but also keeps your documentation organized.

You can amend a proof of claim when you need to correct inaccuracies or add additional information. It's important to do this in a timely manner, especially before the claims bar date. An amended claim form example can guide you through the process, ensuring you include any necessary details. Accessing templates from uslegalforms can simplify your amendments.

To amend a claim form, you should first review the original claims and identify areas that need clarification or modification. Follow the specific guidelines provided by the USPTO or relevant authority for changes needed. Utilizing an amended claim form example can provide insights into structuring your amendments effectively. Additionally, tools and resources from platforms like USLegalForms can simplify this process, making it easier to create a precise and compliant amended claim form.

Yes, it is possible to amend a proof of claim, particularly during bankruptcy proceedings. An amended proof of claim allows creditors to update information, such as the amount owed or the nature of the claim. Utilizing an amended claim form example can help in accurately documenting these changes, which is essential for ensuring your rights are protected. Always check guidelines to make sure you follow the appropriate procedures for amending a proof of claim.