Crummey Letter For Ilit

Description

How to fill out Sample Letter For History Of Deed Of Trust?

There’s no further justification to waste time searching for legal documents to fulfill your local state obligations.

US Legal Forms has compiled all of them in one location and simplified their availability.

Our site offers over 85k templates for any business or personal legal matters categorized by state and purpose.

Utilize the search field above to look for another template if the current one does not suit your needs.

- All forms are properly drafted and confirmed for accuracy, so you can trust in acquiring a current Crummey Letter For Ilit.

- If you are acquainted with our platform and already possess an account, verify that your subscription is active before accessing any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all saved documents at any time by clicking the My documents tab in your profile.

- If you haven’t previously used our platform, the process will require a few additional steps to finish.

- Here's how new users can locate the Crummey Letter For Ilit in our database.

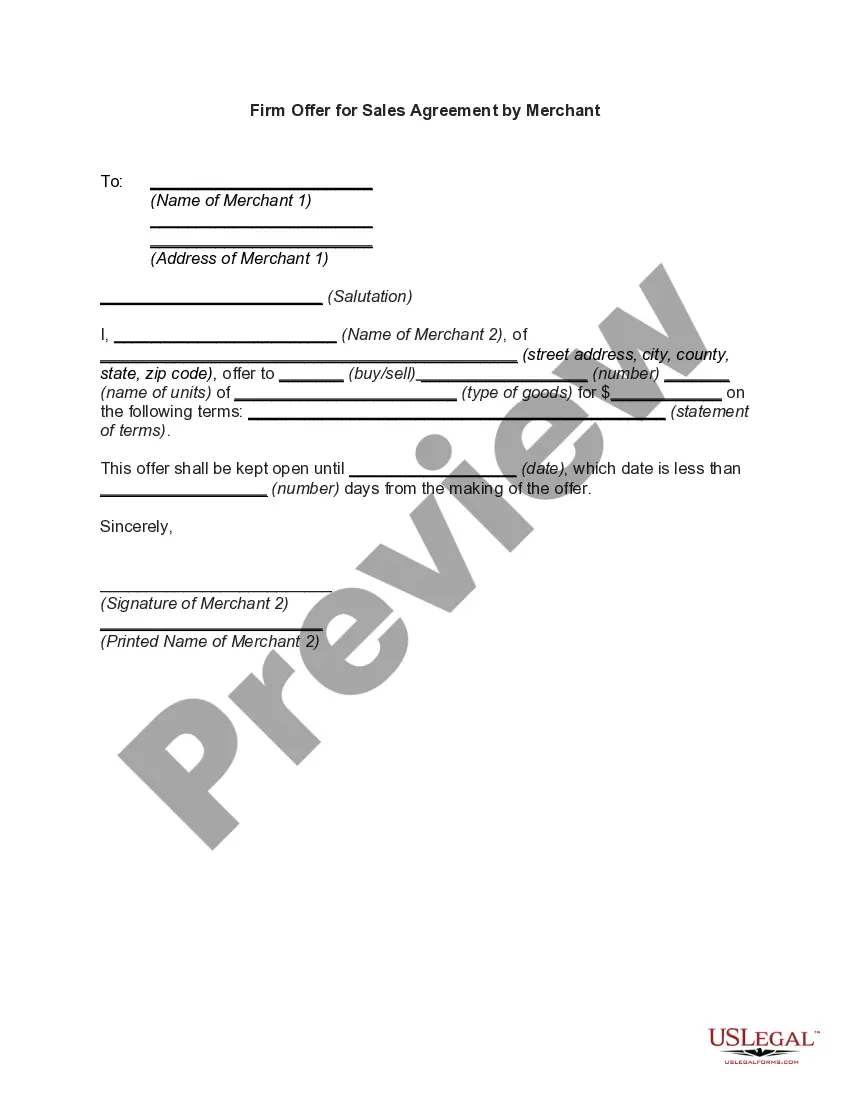

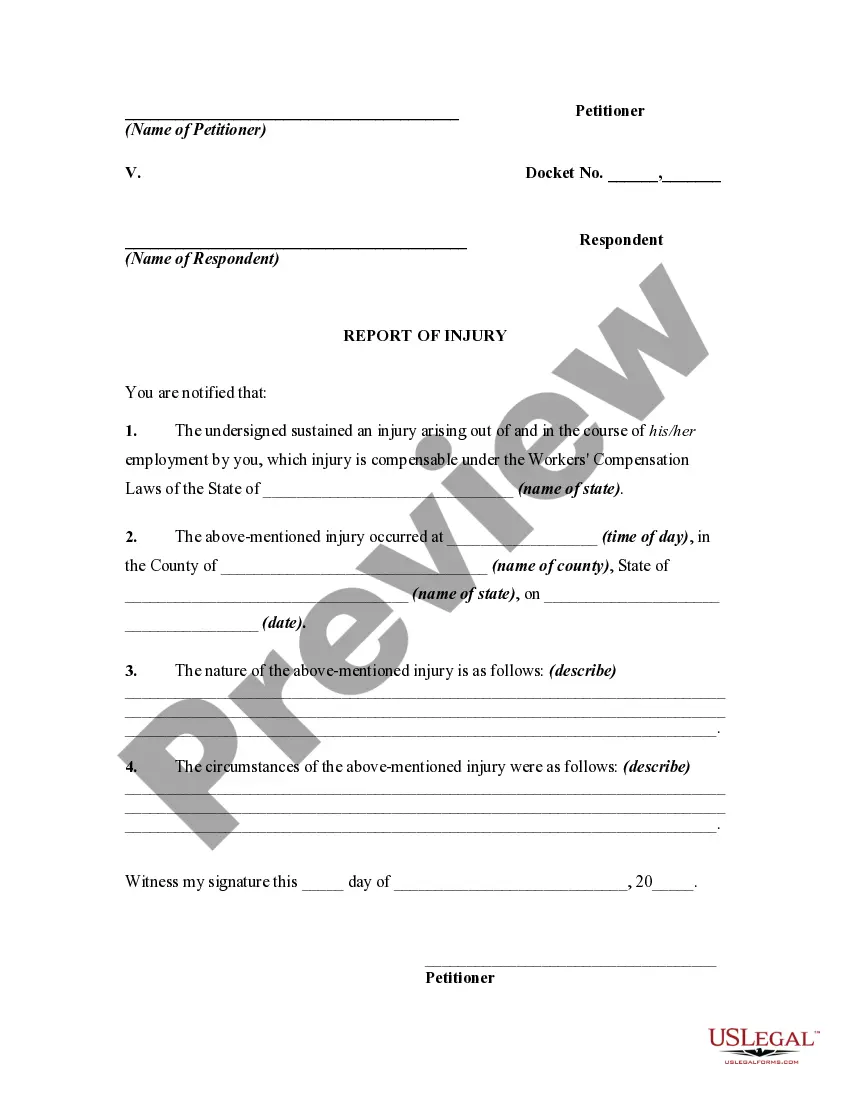

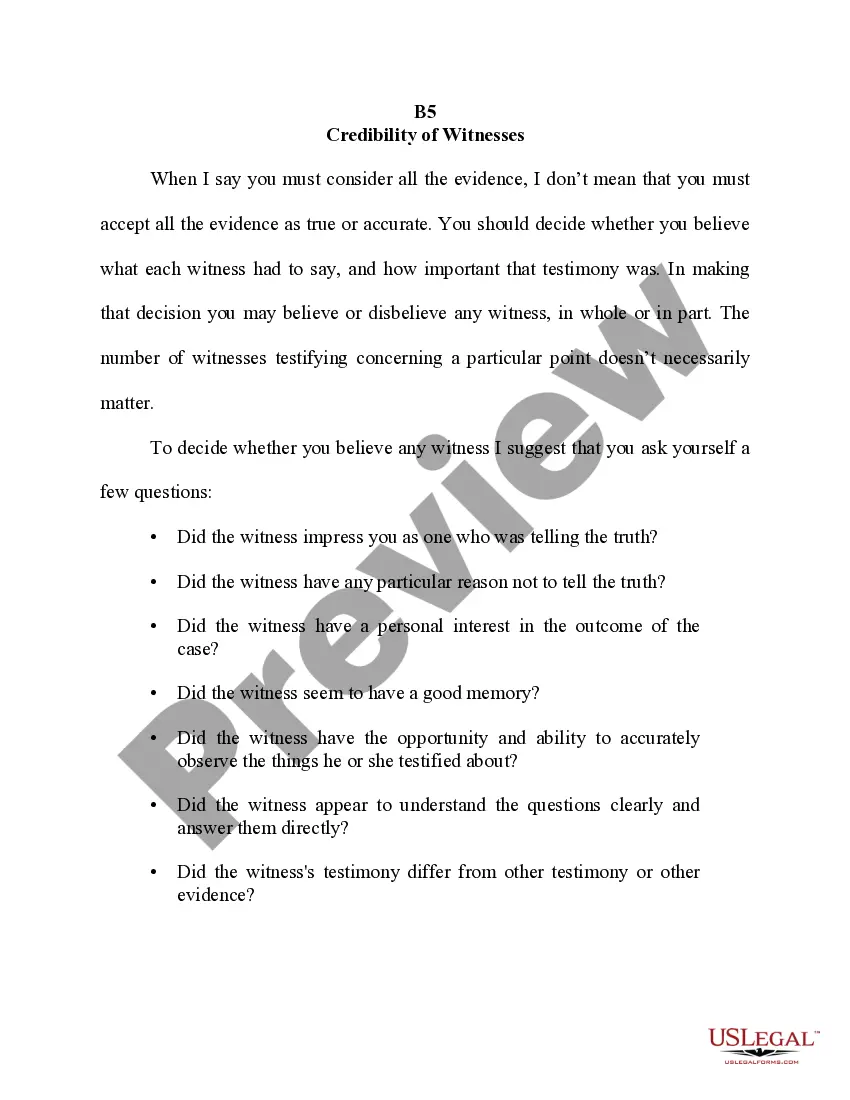

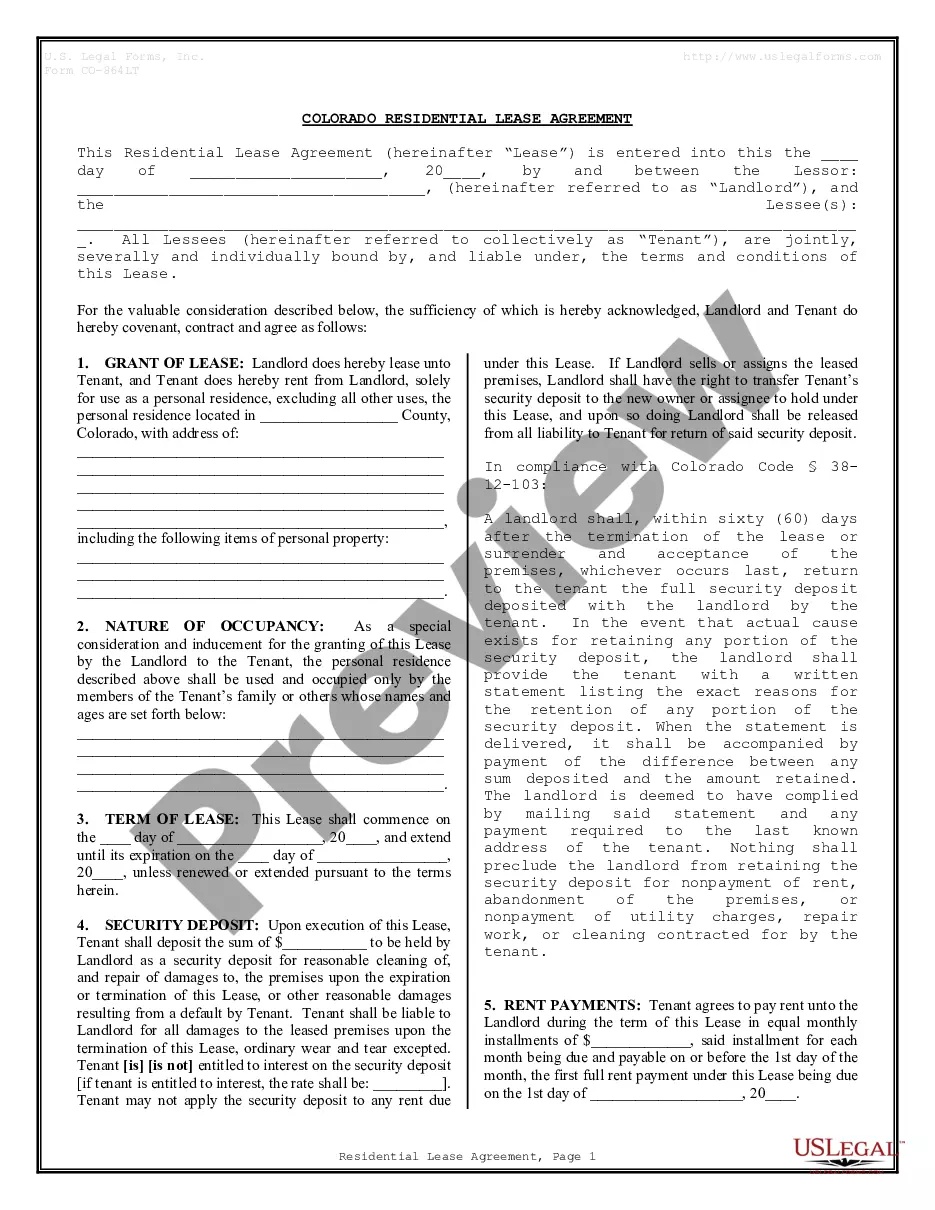

- Scrutinize the page content thoroughly to ensure it features the sample you require.

- To do this, utilize the form description and preview options if available.

Form popularity

FAQ

Crummey provisions of an irrevocable trust refer to the specific terms that enable beneficiaries to withdraw contributions for a limited time. This setup not only offers tax benefits but also ensures that beneficiaries can access funds when needed. To capitalize on the annual gift tax exclusion, it is crucial for donors to properly draft these provisions. USLegalForms can assist you in creating an effective Crummey letter for ILIT to optimize your trust.

Including Crummey powers in an irrevocable life insurance trust allows the donor to meet annual gift tax exclusion requirements. This strategy helps reduce the donor's taxable estate while providing beneficiaries immediate access to trust funds. Additionally, it maximizes the benefits of the permanent life insurance policy within the trust. Therefore, considering a well-crafted Crummey letter for ILIT enhances your estate planning.

The 5 and 5 rule permits beneficiaries to withdraw up to the greater of $5,000 or 5% of the trust's value each year without incurring gift tax. This rule provides flexibility, allowing beneficiaries to access funds while preserving the trust's tax advantages. By properly structuring these withdrawals, donors ensure they comply with tax regulations. Understanding how this rule works is essential when drafting a Crummey letter for ILIT.

Crummey provisions allow beneficiaries to withdraw contributions made to an irrevocable trust, typically during a specific period. These provisions ensure that gifts qualify for the annual gift tax exclusion. In simple terms, they create a temporary window where beneficiaries can access funds, enhancing the trust's tax benefits. For more detailed guidance, consider consulting USLegalForms to understand how to effectively implement a Crummey letter for ILIT.

Crummey notices can be signed electronically, depending on state laws. Many jurisdictions now recognize electronic signatures as valid. However, you should confirm the legal requirements in your area to avoid any issues regarding the validity of the Crummey letter for ILIT.

For a Crummey letter for ILIT concerning a minor, the legal guardian or custodian typically signs the letter. This individual acts on behalf of the minor to ensure that the letter is executed correctly. It's important to document the signature process properly to provide clear evidence of consent.

Crummey notices should be sent immediately after contributions are made to the ILIT. This timing helps ensure beneficiaries are fully aware of their rights before they need to act. Sending them promptly can prevent misunderstandings and maintain compliance with IRS requirements.

Failing to send Crummey letters may result in the loss of crucial tax benefits for your ILIT. Without these letters, contributions may not qualify for the annual gift tax exclusion. It could also lead to disputes among beneficiaries regarding their rights to withdraw funds, so sending these letters is vital.

Yes, you can email a Crummey letter for ILIT, but you should ensure that all beneficiaries receive it. Email provides a quick way to deliver the information; however, having a signed physical copy is ideal for records and potential audits. Consider using both methods to ensure proper documentation.

A Crummey letter for ILIT must inform the beneficiaries about their right to withdraw funds. It should clearly state the amount available, the timeframe for exercising this right, and the potential tax implications. Following these rules can help you maintain tax advantages while providing clarity to the beneficiaries.