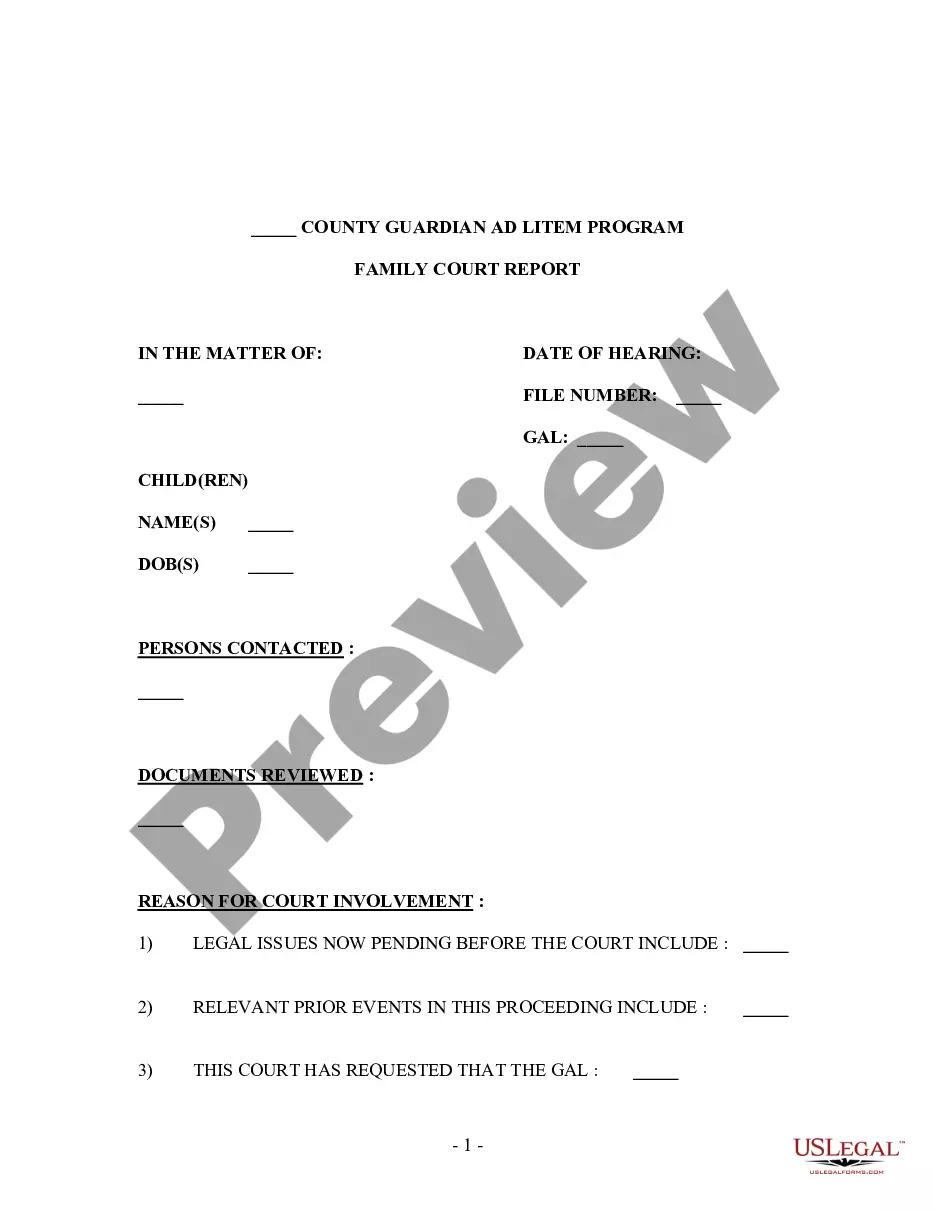

Letter Of Administration Example

Description

How to fill out Sample Letter For Estate Administration?

Managing legal documents can be perplexing, even for seasoned professionals.

When you are looking for a Letter Of Administration Sample and don’t have the time to find the right and current version, the procedures can be overwhelming.

US Legal Forms caters to all needs you may have, from personal to business documentation, all in one location.

Utilize sophisticated tools to complete and handle your Letter Of Administration Sample.

Here are the procedures to follow after obtaining the form you need.

Ensure this is the correct form by previewing it and reviewing its description.

Confirm that the template is accepted in your state or county.

- Explore a valuable repository of articles, guides, and resources related to your situation and needs.

- Conserve time and effort searching for the documents you require, and use US Legal Forms’ advanced search and Preview tool to locate Letter Of Administration Sample and obtain it.

- If you have a monthly subscription, Log In to your US Legal Forms account, search for the form, and obtain it.

- Check your My documents tab to see the documents you have previously downloaded and manage your files as desired.

- If this is your first encounter with US Legal Forms, create an account and gain unlimited access to all features of the library.

Click Buy Now when you are prepared.

Select a subscription option.

Choose the file format you desire, and Download, complete, eSign, print, and send your document.

Appreciate the US Legal Forms online library, supported by 25 years of experience and reliability.

Transform your daily document management into a seamless and straightforward process today.

- An efficient online form repository could be transformative for anyone aiming to handle these scenarios proficiently.

- US Legal Forms is a top player in digital legal forms, boasting over 85,000 state-specific legal documents available for you at any time.

- With US Legal Forms, you can access state- or county-specific legal and business forms.

Form popularity

FAQ

11, Rev. 2021, Individual Income Tax Return (Resident) Page 1. FORM. STATE OF HAWAII ? DEPARTMET OF TAXATIO.

Form G-49 - All filers must file an annual return and reconciliation (Form G-49) after the close of the taxable year. Form G-49 is a summary of your activity for the entire year.

Hawaii requires you to file 1099-NEC forms with the Hawaii Department of Taxation. Business owners in Hawaii can file Form 1099-NEC with Wave Payroll, and Wave completes both IRS and Hawaii Department of Taxation filing.

Several forms are on NCR paper and must be obtained from the tax office. If you need any forms which are not on this list, please call our Taxpayer Services Forms Request Line at 808-587-4242 or 1-800-222-3229. Viewing and printing forms and instructions, requires Adobe Reader.

Form N-196 is an Annual Summary and Transmittal of Hawaii Information Returns used to report total number of 1099 forms and total amount reported.

The Hawaii tax ID is entered on Hawaii Form N-11 is the "General Excise/Use and County Surcharge Tax (GE)" and is in the format of "GE-987-654-3210-01." Use the Hawaii Tax Online search engine to find the latest Hawaii Tax ID numbers.

Where to File ? File Form N-196 and State copies of Forms 1099 to the Hawaii Department of Taxation at: P.O. Box 3559, Honolulu, HI 96811-3559, or at 830 Punchbowl St., Room 126, Honolulu, HI 96813-5094 Shipping and Mailing ? If you are sending a large number of forms, you may send them in conveniently sized packages.

Hawaii Tax Online (HTO) Taxes, permits, and licenses can be filed and paid on Hawaii Tax Online. Filing taxes and making debit payments on HTO is free.