An Example Of Request Letter With Tax Id Number

Description

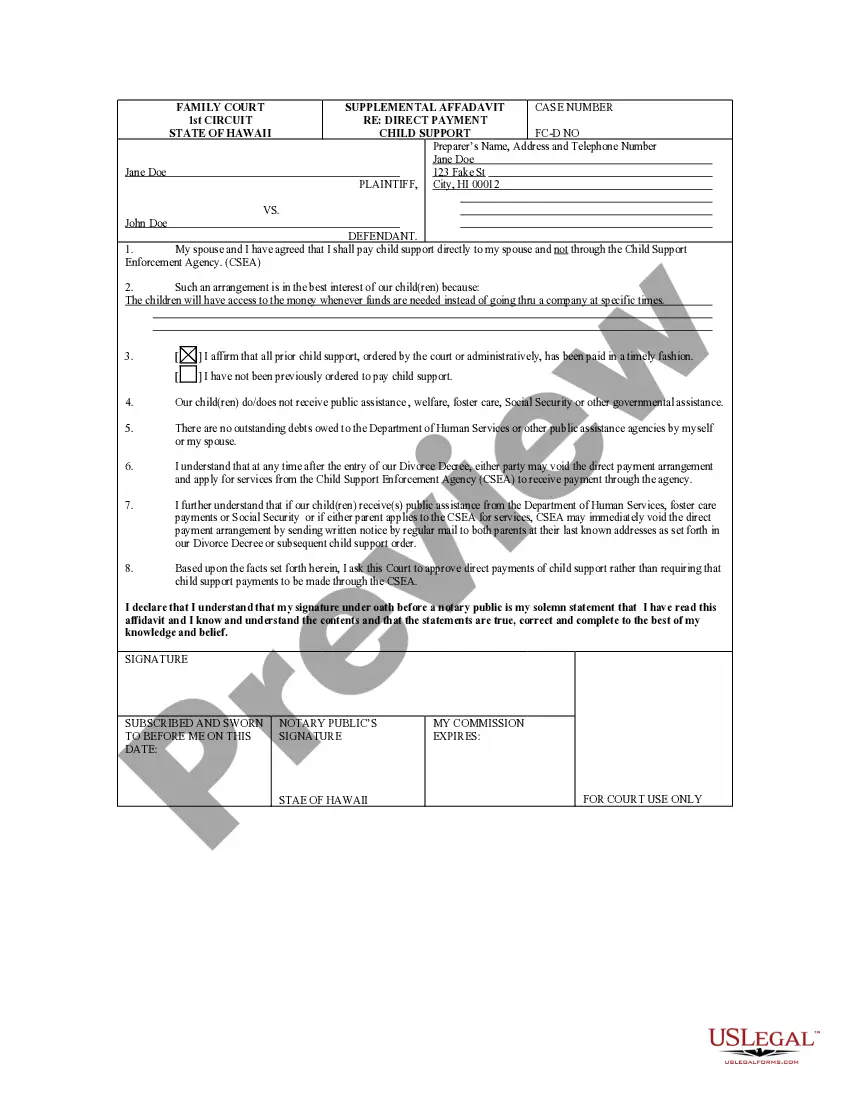

How to fill out Sample Letter For Estate Administration?

Whether for business purposes or for individual affairs, everybody has to manage legal situations sooner or later in their life. Completing legal documents demands careful attention, beginning from selecting the right form sample. For instance, if you select a wrong version of the An Example Of Request Letter With Tax Id Number, it will be declined once you send it. It is therefore essential to get a trustworthy source of legal documents like US Legal Forms.

If you need to get a An Example Of Request Letter With Tax Id Number sample, follow these easy steps:

- Find the sample you need by using the search field or catalog navigation.

- Look through the form’s information to make sure it matches your situation, state, and region.

- Click on the form’s preview to view it.

- If it is the incorrect document, go back to the search function to locate the An Example Of Request Letter With Tax Id Number sample you require.

- Download the file when it meets your needs.

- If you have a US Legal Forms account, simply click Log in to gain access to previously saved files in My Forms.

- In the event you do not have an account yet, you can download the form by clicking Buy now.

- Choose the proper pricing option.

- Finish the account registration form.

- Choose your transaction method: use a bank card or PayPal account.

- Choose the file format you want and download the An Example Of Request Letter With Tax Id Number.

- Once it is saved, you are able to fill out the form with the help of editing applications or print it and complete it manually.

With a vast US Legal Forms catalog at hand, you don’t need to spend time looking for the appropriate sample across the web. Use the library’s straightforward navigation to find the correct form for any situation.

Form popularity

FAQ

9 Form Instructions Line 1 ? Name. This should be your full name. ... Line 2 ? Business name. ... Line 3 ? Federal tax classification. ... Line 4 ? Exemptions. ... Lines 5 & 6 ? Address, city, state, and ZIP code. ... Line 7 ? Account number(s) ... Part I ? Taxpayer Identification Number (TIN) ... Part II ? Certification.

Dear (name of company or individual): Enclosed please find IRS Form W-9, ?Request for Taxpayer Identification Number and Certification?. We are required by the Internal Revenue Service to obtain this information from you to determine if we have to issue you a 1099 at the calendar year end.

Be transparent when asking for a completed W-9. Explain that you suspect a business relationship with the vendor might result in a required Form 1099 filing, at which point you'll need the information on the W-9. Mention your secure document management system that allows only key employees access to personnel files.

Use Form W-9 to provide your correct Taxpayer Identification Number (TIN) to the person who is required to file an information return with the IRS to report, for example: Income paid to you. Real estate transactions. Mortgage interest you paid.

Dear (name of company or individual): Enclosed please find IRS Form W-9, ?Request for Taxpayer Identification Number and Certification?. We are required by the Internal Revenue Service to obtain this information from you to determine if we have to issue you a 1099 at the calendar year end.