Payoff Request For Shellpoint Mortgage

Description

How to fill out Sample Letter Requesting Payoff Balance Of Mortgage?

Managing legal documents can feel daunting, even for the most seasoned professionals.

When you're looking for a Payoff Request For Shellpoint Mortgage and lack the time to dedicate to finding the correct and updated version, the process can be taxing.

US Legal Forms meets all your needs, ranging from personal documents to business paperwork, all in a single location.

Utilize sophisticated tools to finalize and manage your Payoff Request For Shellpoint Mortgage.

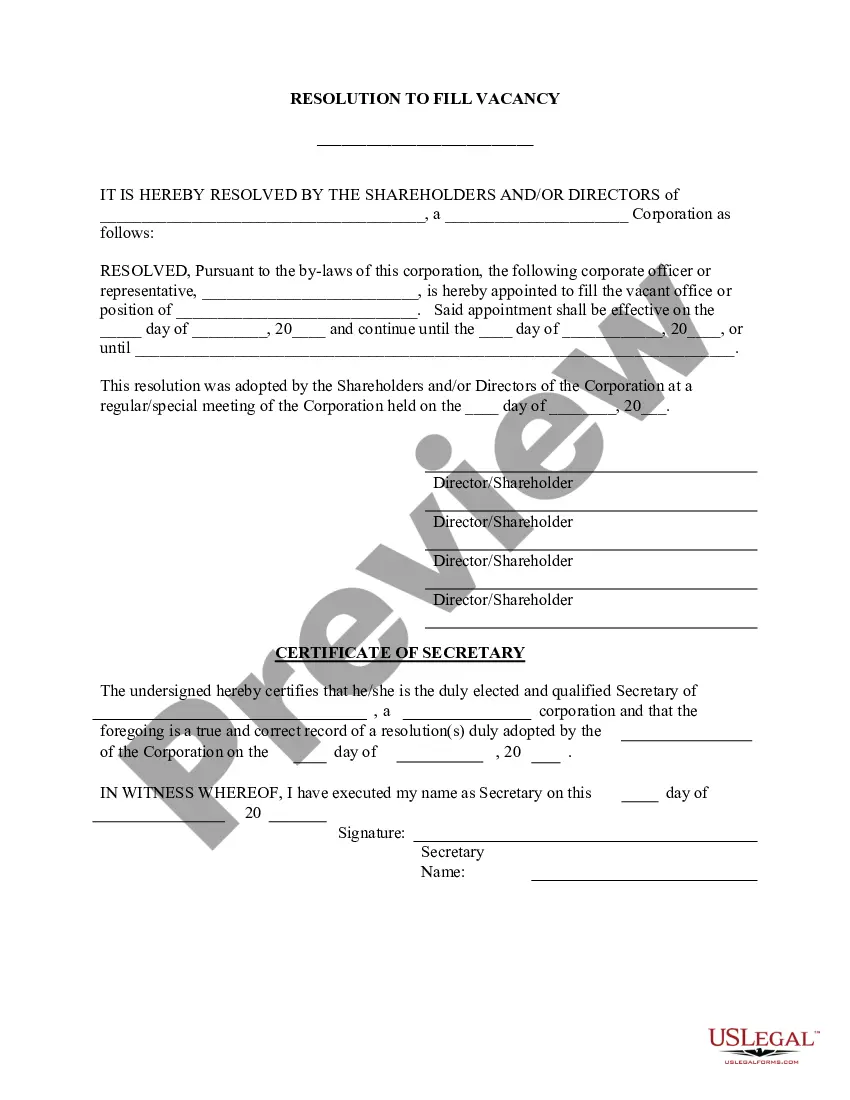

After downloading the necessary form, here are the steps to follow: Validate that it is the correct form by previewing it and reviewing its description.

- Access a valuable repository of articles, guides, manuals, and resources pertaining to your circumstances and requirements.

- Conserve time and effort in locating the documents you seek, and take advantage of US Legal Forms’ advanced search and Review feature to locate Payoff Request For Shellpoint Mortgage and obtain it.

- For subscribers, Log In to your US Legal Forms account, search for the document, and download it.

- Check the My documents tab to view the documents you have previously retrieved and manage your folders as desired.

- If this is your first encounter with US Legal Forms, create a complimentary account and gain unlimited access to all platform advantages.

- A robust online form catalog can be a crucial advantage for anyone aiming to handle these situations effectively.

- US Legal Forms is a leader in online legal documents, offering over 85,000 specific legal forms for various states accessible at all times.

- With US Legal Forms, you gain access to state- or region-specific legal and business templates.

Form popularity

FAQ

You can request a payoff from Shellpoint mortgage by reaching out via their official website or calling their customer service number. Make sure to have your account information handy, as this will help expedite your request. They typically process payoff requests within a few business days. Using US Legal Forms can help you find the right documents to formalize your payoff request for Shellpoint mortgage.

The timeframe for receiving a payoff letter from Shellpoint typically ranges from one to three business days. However, this can vary based on your specific circumstances, such as the method of request and current processing times at the company. To avoid any delays, submit your payoff request for a Shellpoint mortgage through a reliable platform like US Legal Forms for quicker results. Being proactive helps ensure you receive your letter when you need it.

To request a payoff from Shellpoint mortgage, you can utilize their online services or contact customer support directly. Provide your account number and any relevant details to expedite the process. It's essential to request the payoff amount as this can change over time due to interest rates. US Legal Forms can guide you through this request efficiently.

Requesting a payoff statement is straightforward. You can typically do this through Shellpoint's online portal by logging into your account. Navigate to the payoff request section, provide the required details, and submit your request. For a more seamless experience, using US Legal Forms can help simplify the process.

To order a mortgage payoff from Shellpoint, you need to visit their official website. Find the appropriate section for payoff requests, and follow the instructions to submit your request. Ensure you have your account information and any necessary identification ready. If you prefer assistance, consider using the US Legal Forms platform for guidance.

A servicer typically has 5 to 7 business days to respond to a payoff request. This timeline allows them to process your request thoroughly and provide you with accurate information. If you do not receive a response within this period, consider following up to ensure your payoff request for Shellpoint mortgage is being addressed.

Recent lawsuits against Shellpoint mortgage revolve around claims of improper servicing and communication issues. If you are concerned about these legal matters, it might be wise to stay informed and seek legal advice. Understanding the implications can help you make more informed decisions regarding your payoff request for Shellpoint mortgage.

Typically, you can expect to receive your mortgage payoff letter within 7 to 10 business days after submitting your request. However, this may vary based on current workload and processing times at Shellpoint. For timely responses, make sure you clearly state it is a payoff request for Shellpoint mortgage.

To request a payoff for your Shellpoint mortgage, contact their customer service directly through their website or by phone. You will need to provide your account details for verification. Ensure you specify that you are seeking a payoff request for Shellpoint mortgage to avoid any confusion.