Sample Cover Letter For Social Security Administration

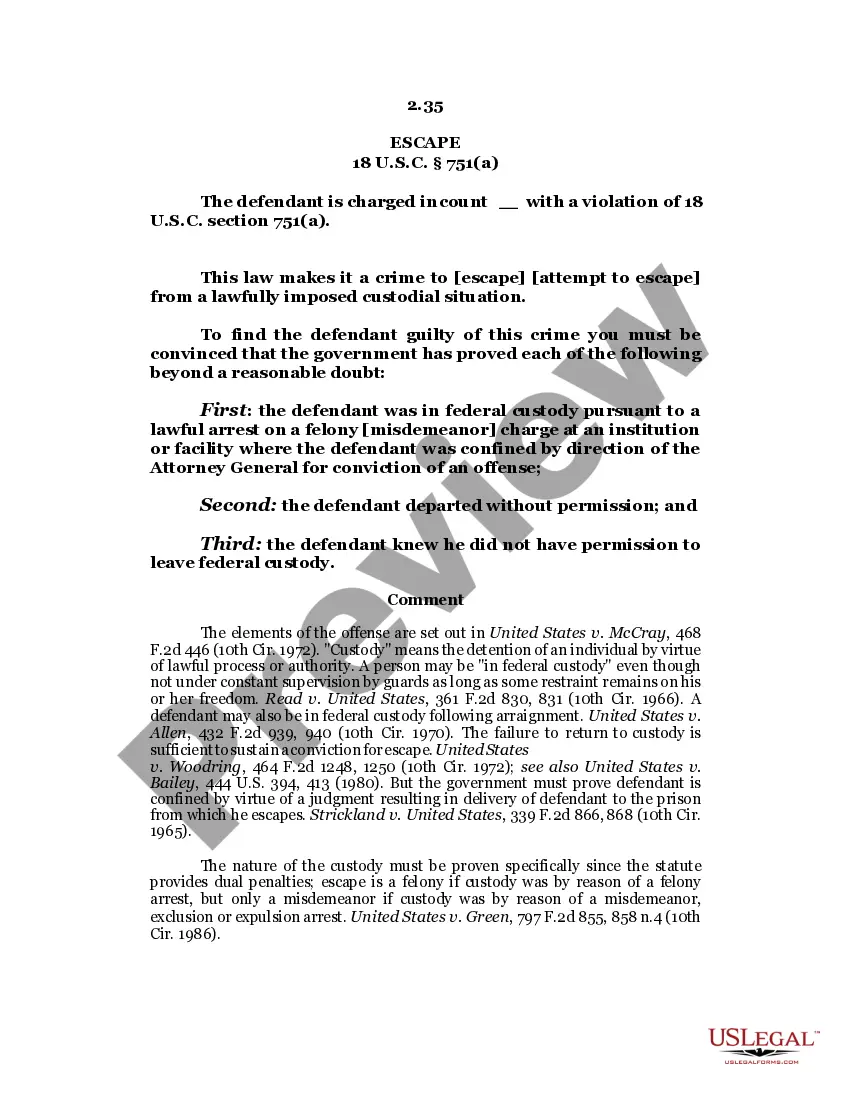

Description

How to fill out Sample Letter Disputing Denial Of Social Security Benefits?

Whether for business purposes or for individual affairs, everybody has to manage legal situations sooner or later in their life. Completing legal papers demands careful attention, starting with picking the correct form sample. For instance, if you select a wrong version of a Sample Cover Letter For Social Security Administration, it will be declined when you send it. It is therefore essential to have a trustworthy source of legal files like US Legal Forms.

If you need to get a Sample Cover Letter For Social Security Administration sample, stick to these easy steps:

- Find the sample you need by using the search field or catalog navigation.

- Check out the form’s description to ensure it suits your situation, state, and region.

- Click on the form’s preview to see it.

- If it is the incorrect form, go back to the search function to find the Sample Cover Letter For Social Security Administration sample you need.

- Get the template if it meets your needs.

- If you have a US Legal Forms account, simply click Log in to gain access to previously saved documents in My Forms.

- In the event you don’t have an account yet, you can obtain the form by clicking Buy now.

- Select the correct pricing option.

- Complete the account registration form.

- Select your payment method: use a bank card or PayPal account.

- Select the document format you want and download the Sample Cover Letter For Social Security Administration.

- Once it is saved, you can fill out the form with the help of editing applications or print it and complete it manually.

With a substantial US Legal Forms catalog at hand, you do not need to spend time seeking for the appropriate sample across the web. Use the library’s simple navigation to get the correct template for any situation.

Form popularity

FAQ

Ready to Start a Business in Pennsylvania? Pick an Entity Type. Name Your Business. File Formation Paperwork. Draft Internal Records. Get PA Business Licenses. Get Business Insurance. Build Your Business Website. File a Decennial Report.

If you're selling goods or services in Pennsylvania, you probably need a sales tax license. Pennsylvania also applies a sales and use tax on digital goods, so even if you're only selling online, you likely need a Pennsylvania sales and use tax license, sometimes also called a seller's permit.

Form PA-100 (Pennsylvania Enterprise Registration Form) is used by Pennsylvania businesses to register for certain tax accounts with the Pennsylvania Department of Revenue and the Pennsylvania Department of Labor and Industry. New businesses file PA-100 to set up state tax accounts.

Order forms online to be mailed to you. You may call 1-888-PATAXES (1-888-728-2937) to leave a message to have forms mailed to you.

The Pennsylvania Enterprise Registration Form (PA-100) must be completed by enterprises to register for certain taxes and services administered by the PA Department of Revenue and the PA Department of Labor & Industry.

Step-By-Step Startup StructureCostPennsylvania Nonprofit Click for step-by-step instructionsIncorporation: $125 Incorporation publishing: ~$200 EIN: $0 501(c): $275 or $600 IRS fee PA-100: $0 + fees for needed licenses Pennsylvania Charitable Registration: usually $0 due to exemption4 more rows

Form PA-100 (Pennsylvania Enterprise Registration Form) is used by Pennsylvania businesses to register for certain tax accounts with the Pennsylvania Department of Revenue and the Pennsylvania Department of Labor and Industry. New businesses file PA-100 to set up state tax accounts.

The Certificate of Organization PA is a document that contains important information about your company and filing this document is a requirement to form your LLC in Pennsylvania.