Subchapter S Trust With Employees

Description

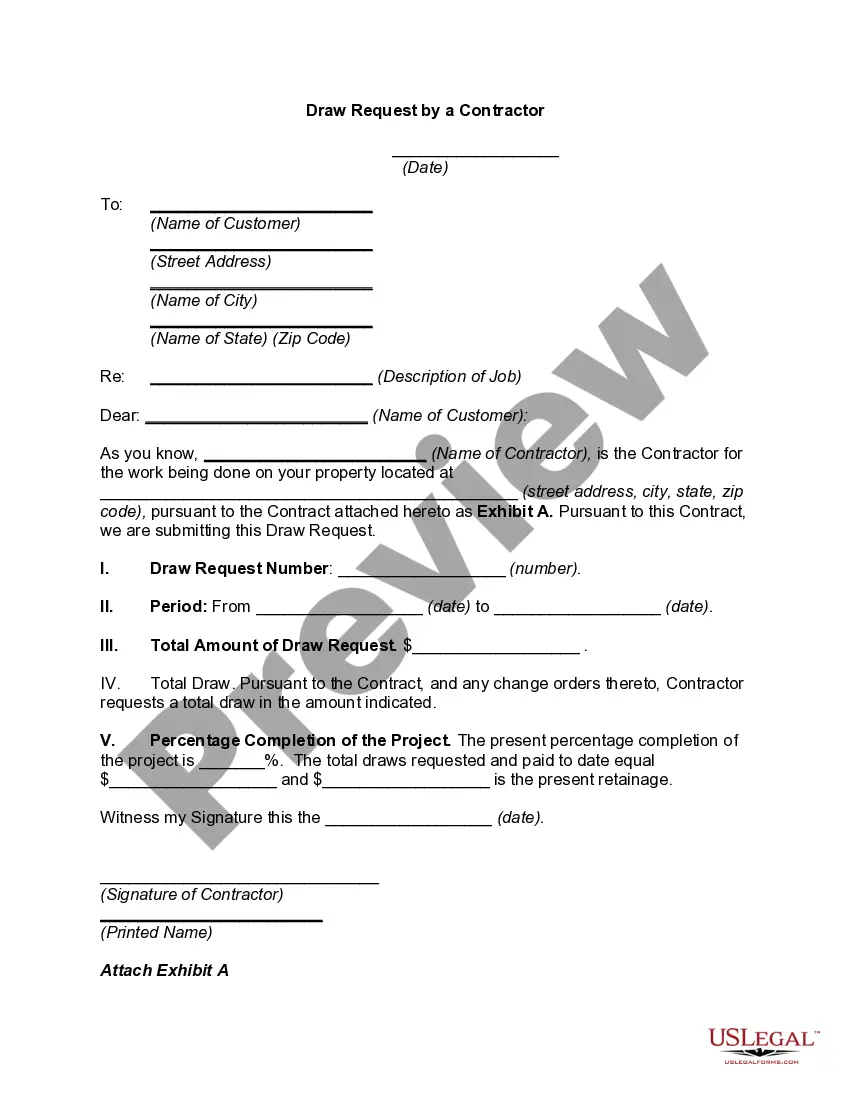

How to fill out Qualifying Subchapter-S Revocable Trust Agreement?

Finding a reliable source for the latest and suitable legal templates is a significant part of navigating bureaucracy.

Identifying the correct legal documents requires precision and careful attention, which is why it’s essential to obtain Subchapter S Trust With Employees samples solely from trusted providers, such as US Legal Forms. An incorrect format will squander your time and delay your current situation. With US Legal Forms, you have minimal concerns. You can access and verify all information regarding the document's applicability and importance for your circumstances in your state or county.

After obtaining the form on your device, you can modify it using the editor or print it out and complete it by hand. Remove the stress that comes with your legal paperwork. Explore the extensive US Legal Forms collection where you can discover legal samples, assess their applicability to your situation, and download them without delay.

- Utilize the library navigation or search bar to locate your template.

- Examine the details of the form to confirm it meets your state's and area's specifications.

- Preview the form, if an option is available, to ensure the template is indeed the one you seek.

- Return to the search to find the correct template if the Subchapter S Trust With Employees doesn’t meet your criteria.

- Once you're confident about the document's relevance, download it.

- If you are a registered user, click Log in to verify and access your selected templates in My documents.

- If you haven't created an account yet, click Buy now to acquire the form.

- Select the pricing option that aligns with your needs.

- Proceed to sign up to finalize your purchase.

- Complete your transaction by choosing a payment method (credit card or PayPal).

- Select the file format for downloading the Subchapter S Trust With Employees.

Form popularity

FAQ

5 Tips for Transferring S-Corp Shares to a Trust Transfer your ownership of the shares to yourself as Trustee of your trust. Carefully review the corporate documents to determine how shares of stock in the company are transferred to another person or entity.

State, local, and real property taxes. Expenses of the estate. Administrative expenses, such as trustee fees. Other miscellaneous itemized deductions subject to a 2% limitation of adjusted gross income.

Use trust funds to pay for personal expenses. Use trust funds to pay for monthly bills, such as phone bills or utilities. Use trust assets to purchase vehicles. Gift assets from the trust to beneficiaries.

While principal of the QSST may also be distributed to the beneficiary in the discretion of the Trustee, the QSST cannot provide for multiple beneficiaries. The income from a QSST is taxed at the individual beneficiary's income tax rate.

Generally, a trust cannot hold stock of an S corporation; however, grantor trusts, testamentary trusts, voting trusts, ESBTs, and qualified Subchapter S trusts (QSSTs) are permissible S corporation shareholders (Sec. 1361(c)(2)).