Waiver Of Conflict Of Interest Template For Nonprofit Organizations

Description

How to fill out Sample Attorney Conflict Of Interest Waiver Letter?

Whether for business purposes or for personal affairs, everyone has to deal with legal situations sooner or later in their life. Completing legal papers requires careful attention, beginning from picking the correct form sample. For example, when you pick a wrong version of a Waiver Of Conflict Of Interest Template For Nonprofit Organizations, it will be turned down when you submit it. It is therefore essential to get a trustworthy source of legal papers like US Legal Forms.

If you have to obtain a Waiver Of Conflict Of Interest Template For Nonprofit Organizations sample, follow these easy steps:

- Get the sample you need by using the search field or catalog navigation.

- Check out the form’s information to make sure it matches your situation, state, and region.

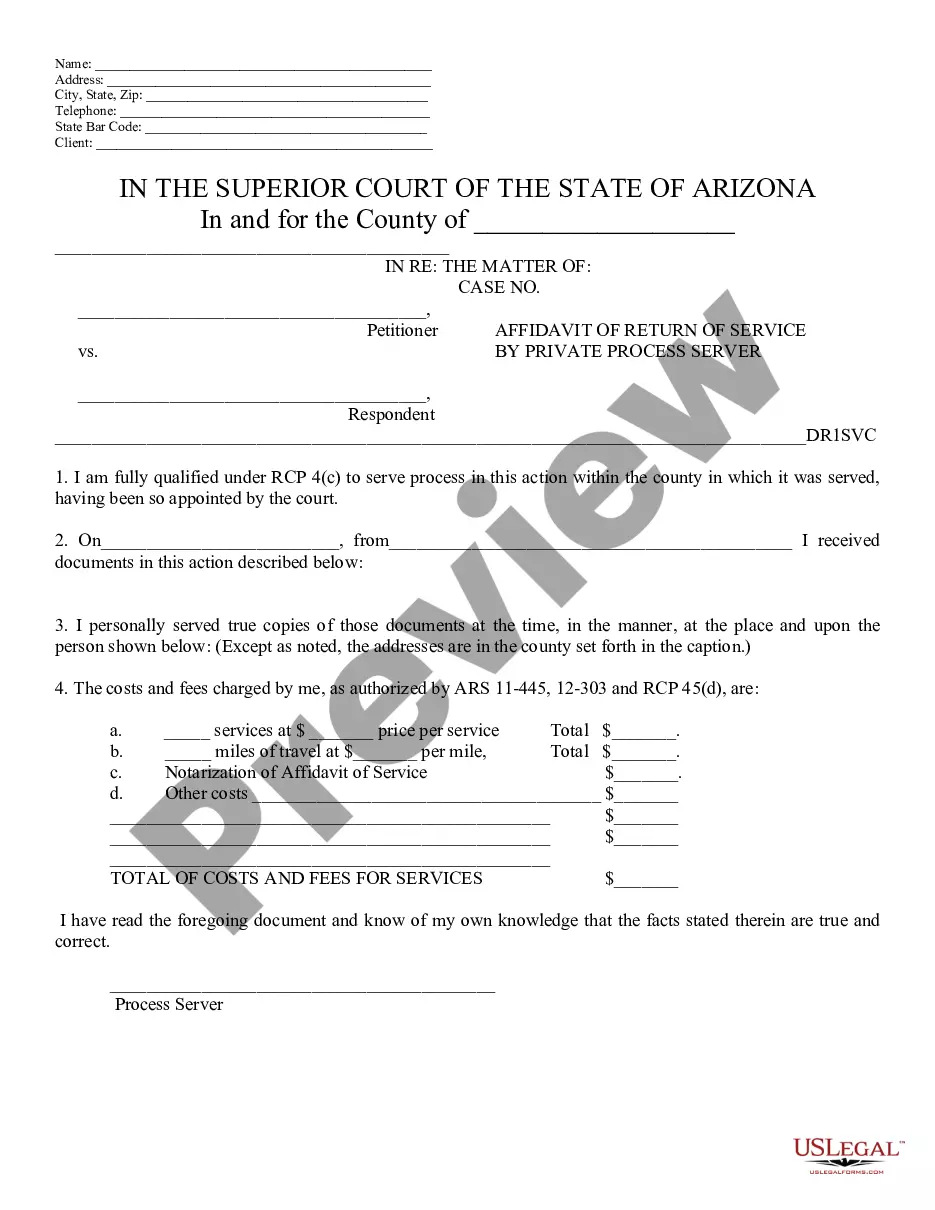

- Click on the form’s preview to see it.

- If it is the incorrect document, return to the search function to locate the Waiver Of Conflict Of Interest Template For Nonprofit Organizations sample you require.

- Get the file when it matches your requirements.

- If you already have a US Legal Forms account, click Log in to gain access to previously saved templates in My Forms.

- In the event you do not have an account yet, you can download the form by clicking Buy now.

- Pick the appropriate pricing option.

- Complete the account registration form.

- Choose your transaction method: use a credit card or PayPal account.

- Pick the document format you want and download the Waiver Of Conflict Of Interest Template For Nonprofit Organizations.

- When it is downloaded, you can complete the form with the help of editing applications or print it and finish it manually.

With a large US Legal Forms catalog at hand, you never have to spend time searching for the appropriate sample across the internet. Make use of the library’s straightforward navigation to get the correct template for any occasion.

Form popularity

FAQ

Some examples of a conflict of interest could be: Representing a family member in court. Starting a business that competes with your full-time employer. Advising a client to invest in a company owned by your spouse.

Sample Conflict-of-Interest Policy Statement All trustees, officers, agents, and employees of this organization shall disclose all real or perceived conflicts of interest that they discover or that have been brought to their attention in connection with this organization's activities.

A conflict of interest policy is intended to help ensure that when actual or potential conflicts of interest arise, the organization has a process in place under which the affected individual will advise the governing body about all the relevant facts concerning the situation.

What should a conflicts of interest policy include? A policy on conflicts of interest should (a) require those with a conflict (or who think they may have a conflict) to disclose the conflict/potential conflict, and (b) prohibit interested board members from voting on any matter in which there is a conflict.

For example, if the president or treasurer of a nonprofit organization also works full-time as a real estate agent and sells property that the nonprofit owns and makes a commission on it, that is considered a conflict of interest.