Trust Agreement Form For Property

Description

How to fill out Special Needs Irrevocable Trust Agreement For Benefit Of Disabled Child Of Trustor?

- Log in to your US Legal Forms account if you are a returning user. Ensure that your subscription is current; if not, renew it according to your plan.

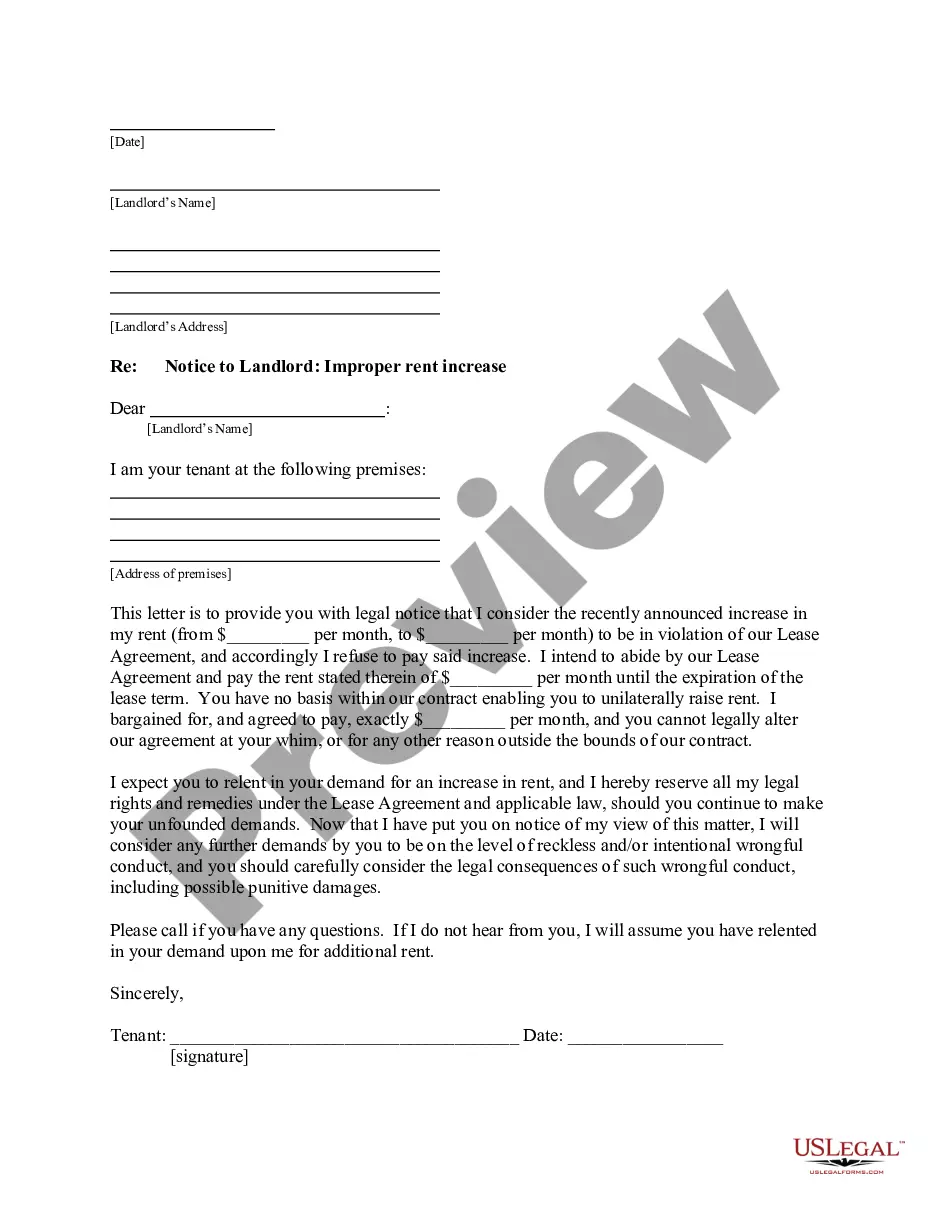

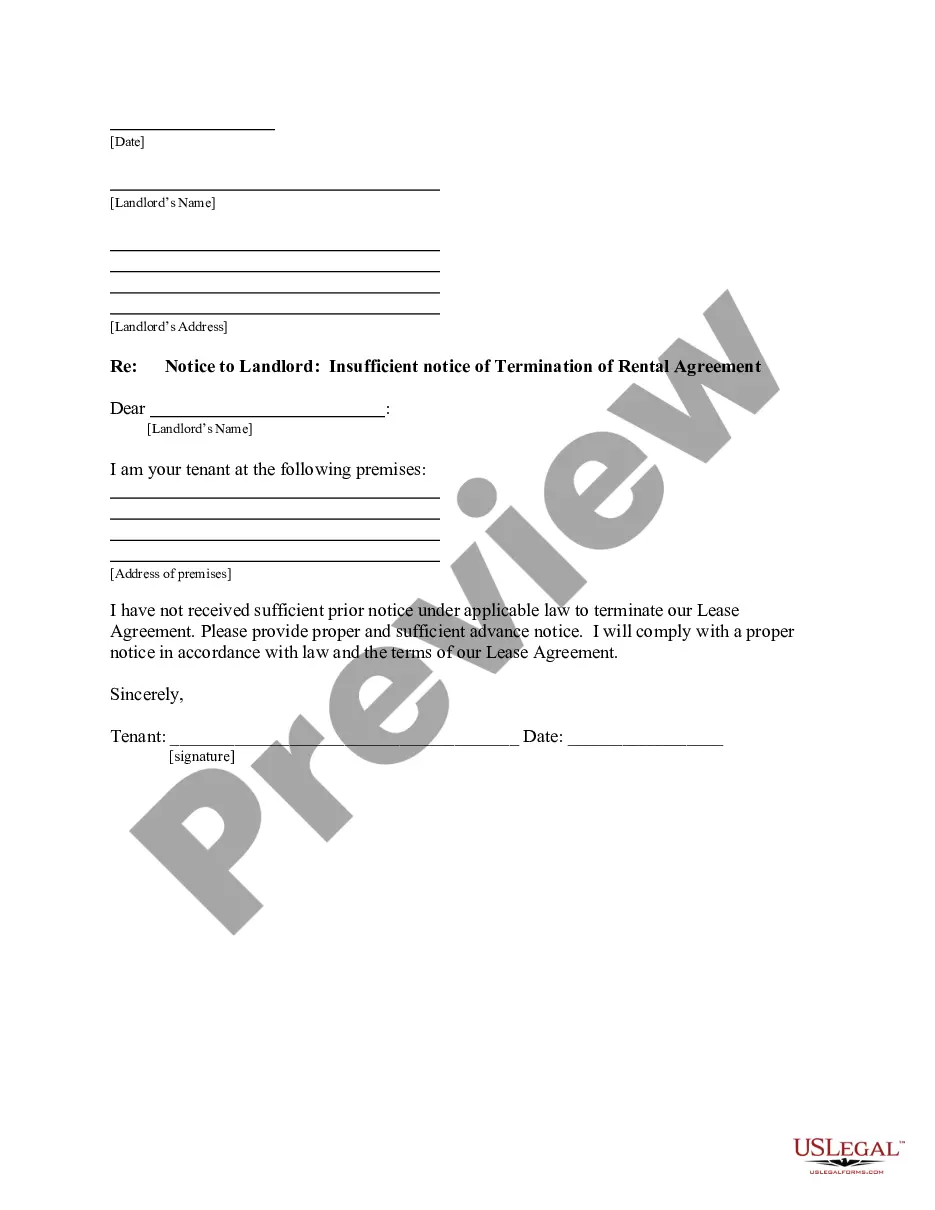

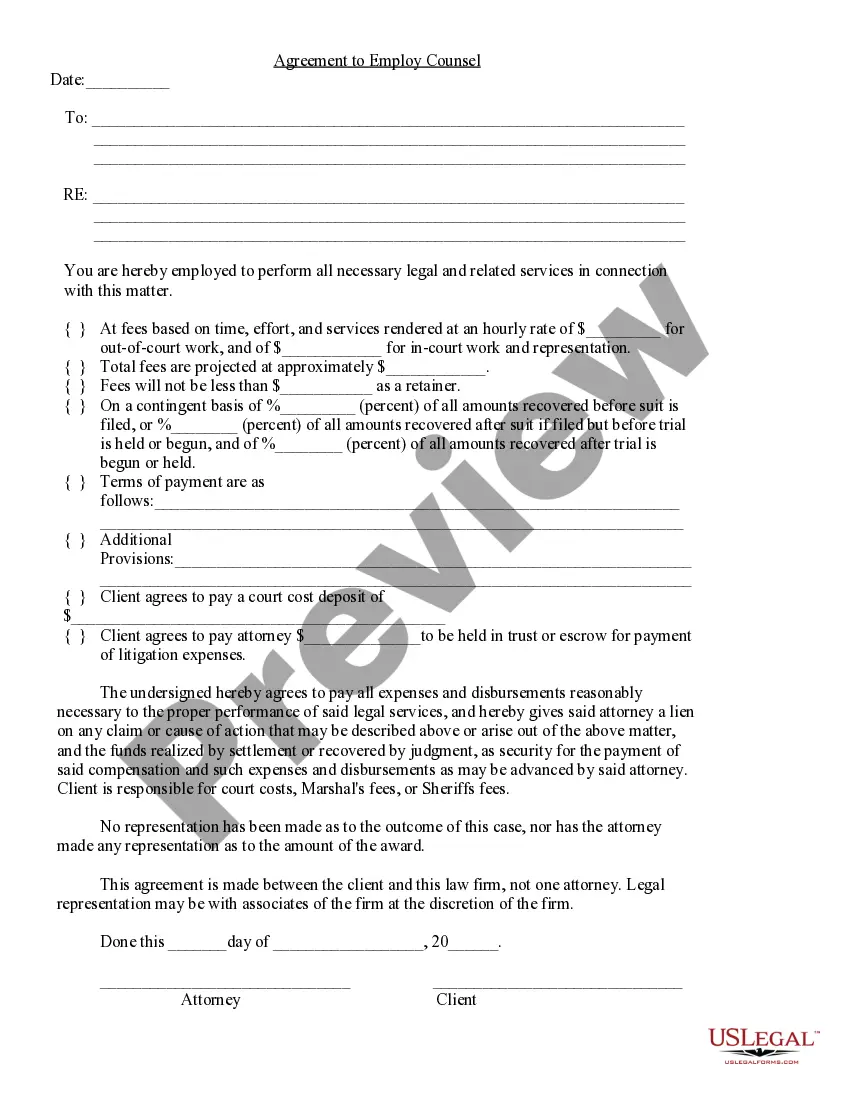

- For first-time users, start by visiting the website and reviewing the available forms. Use the Preview mode to check the form description and ensure it meets your jurisdiction's requirements.

- If you need a different template, use the Search tab to find the correct form without any inconsistencies.

- Once you have selected the right document, click on the Buy Now button and choose a suitable subscription plan. You will need to create an account if you are new.

- Provide payment details to finalize your purchase, either through credit card or PayPal.

- After your transaction is complete, download the trust agreement form directly to your device for completion. You can also access it anytime from the My Forms menu of your profile.

In conclusion, using US Legal Forms for your trust agreement form for property not only saves you time but also ensures that you have access to a wide range of expertly crafted documents. With premium assistance available, you can confidently complete your legal forms.

Start your journey today and experience the ease of legal form preparation with US Legal Forms!

Form popularity

FAQ

You can easily obtain a trust amendment form through various legal resources, including online platforms like US Legal Forms. This platform offers a comprehensive collection of legal documents, including a trust agreement form for property. It's important to ensure that the form you choose is tailored to your specific needs and state laws. By using US Legal Forms, you can navigate the process with confidence, knowing you have access to reliable and user-friendly legal documents.

To establish a trust, you need to complete a trust agreement form for property. This form outlines the terms and conditions of the trust, including the roles of the trustee and beneficiaries. You can easily find templates for this form through reliable platforms like USLegalForms, which provide state-specific resources to ensure compliance. By using a trust agreement form for property, you can clearly document your intentions and protect your assets appropriately.

While a trust agreement provides benefits like avoiding probate, there are disadvantages to consider as well. Creating a trust agreement form for property can involve upfront costs, including legal fees. Additionally, there may be ongoing management responsibilities, which can be time-consuming and require financial planning expertise.

A trust agreement in real estate is a legally binding document that outlines how property should be managed, used, and distributed upon the trustor's passing. This trust agreement form for property ensures clarity and protection for both the trustor and the beneficiaries. Essentially, it helps to avoid disputes among heirs by clearly stating each party’s rights.

Typically, a lawyer is responsible for setting up a trust, primarily because they understand the legal requirements of a trust agreement form for property. Lawyers know how to draft the necessary documents and ensure compliance with local laws. However, accountants may assist in tax-related aspects of the trust, providing valuable insights into financial implications.

A certificate of trust is generally created by the same individual who sets up the trust, usually the trustor or their attorney. This document serves as a summary of the trust agreement form for property, providing essential details without revealing the entire trust's contents. It helps facilitate transactions involving the trust without compromising confidentiality.

The individual who creates a trust is known as the trustor, grantor, or settlor. This person outlines the terms of the trust in the trust agreement form for property. By defining the guidelines, the trustor controls how the property is managed and distributed, ensuring their wishes are followed.

The preparation of a trust agreement form for property is typically handled by a qualified lawyer. This professional has the necessary expertise to ensure that the trust complies with your state’s laws and meets your specific needs. Additionally, using a legal form service, like US Legal Forms, can simplify the process, providing you with reliable templates that can save time and costs.

Family trusts can face limitations, such as the risk of family disagreements over asset distribution. Moreover, there may be tax implications that could affect the overall financial strategy of the family. It is crucial to address these concerns proactively, and a well-prepared trust agreement form for property can assist in creating clarity and reducing conflict among family members.

A notable downfall of having a trust is the complexity and potential confusion surrounding the management of the trust. In some cases, if the trust is not adequately documented or the terms are vague, it may result in disputes among beneficiaries. Additionally, the ongoing administrative duties can become burdensome. Thus, using a reliable trust agreement form for property can simplify these complexities.