Liens On Property In Texas

Description

How to fill out Letter Agreement To Subordinate Liens Against Personal Property?

Drafting legal paperwork from scratch can sometimes be a little overwhelming. Some cases might involve hours of research and hundreds of dollars invested. If you’re searching for an easier and more cost-effective way of preparing Liens On Property In Texas or any other paperwork without the need of jumping through hoops, US Legal Forms is always at your disposal.

Our online library of over 85,000 up-to-date legal forms addresses almost every element of your financial, legal, and personal matters. With just a few clicks, you can instantly access state- and county-compliant forms diligently prepared for you by our legal professionals.

Use our platform whenever you need a trustworthy and reliable services through which you can easily find and download the Liens On Property In Texas. If you’re not new to our website and have previously created an account with us, simply log in to your account, select the form and download it away or re-download it anytime later in the My Forms tab.

Not registered yet? No worries. It takes minutes to set it up and explore the library. But before jumping directly to downloading Liens On Property In Texas, follow these tips:

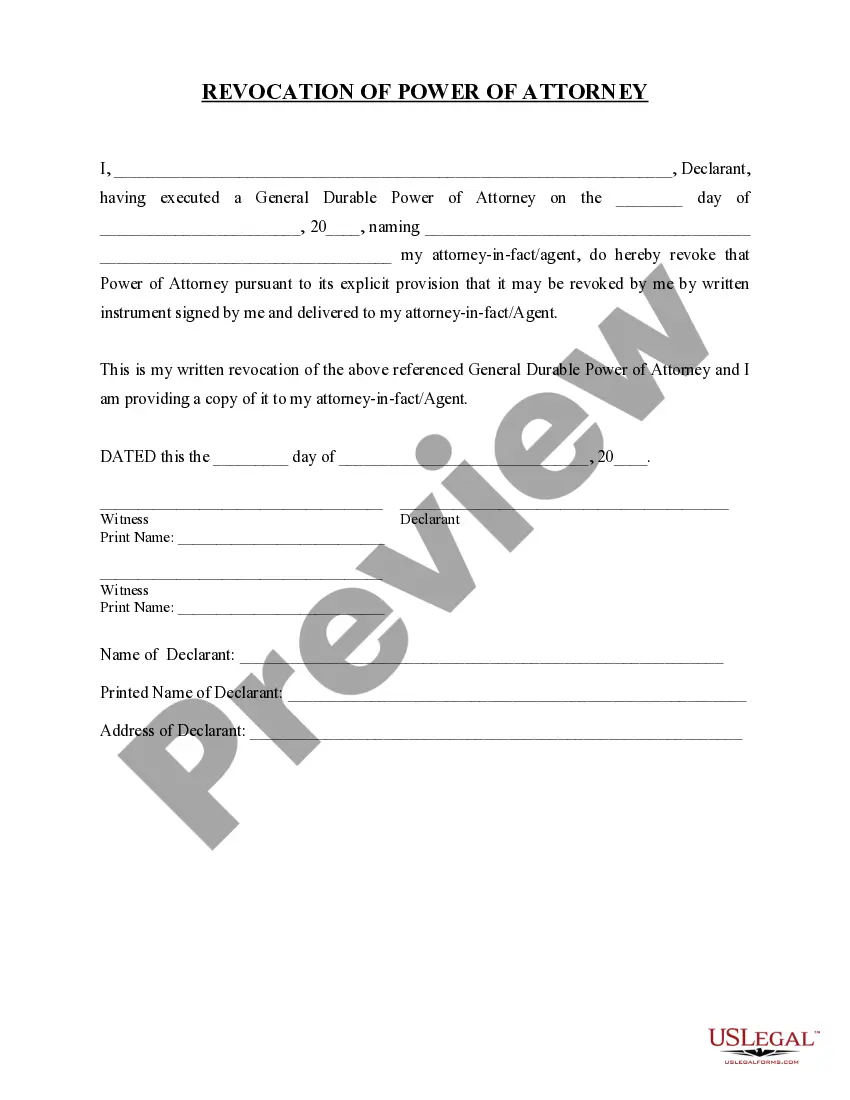

- Review the document preview and descriptions to make sure you have found the form you are looking for.

- Check if template you select conforms with the requirements of your state and county.

- Pick the best-suited subscription option to purchase the Liens On Property In Texas.

- Download the file. Then complete, sign, and print it out.

US Legal Forms has a spotless reputation and over 25 years of experience. Join us today and transform document completion into something easy and streamlined!

Form popularity

FAQ

Until payment requirements can be met, creditors may place liens on property to settle their debts. The homeowner is responsible for keeping track of and paying off all debts on time to avoid having liens placed on their home without their knowledge.

One of the ways in which a creditor could attempt to collect on their judgment is by placing a judgment lien on real property owned by the debtor. By filing a judgment lien, if the debtor sells any non-exempt property, you may be able to get all or some of the money you are owed from the proceeds of the sale.

General liens can be placed on all property owned by a debtor, not just real estate. For example, if you are going through a divorce, a general lien (attachment lien) can be placed on your property to prevent you from selling anything during the divorce proceedings.

Filing a property lien in Texas requires obtaining forms and documentation from the county, paying taxes and other fees, including the property owner and lien holder information in the document, filing the document with the county in person or online, sending a copy of the document to the property owner to give notice ...

Additionally, it can help to send notice to a construction lender, if any is involved on the project. On residential projects, the deadline to file a Texas mechanics lien is the 15th day of the 3rd month after the month the contract was completed, terminated, or abandoned.