Lien Against Property Form Texas

Description

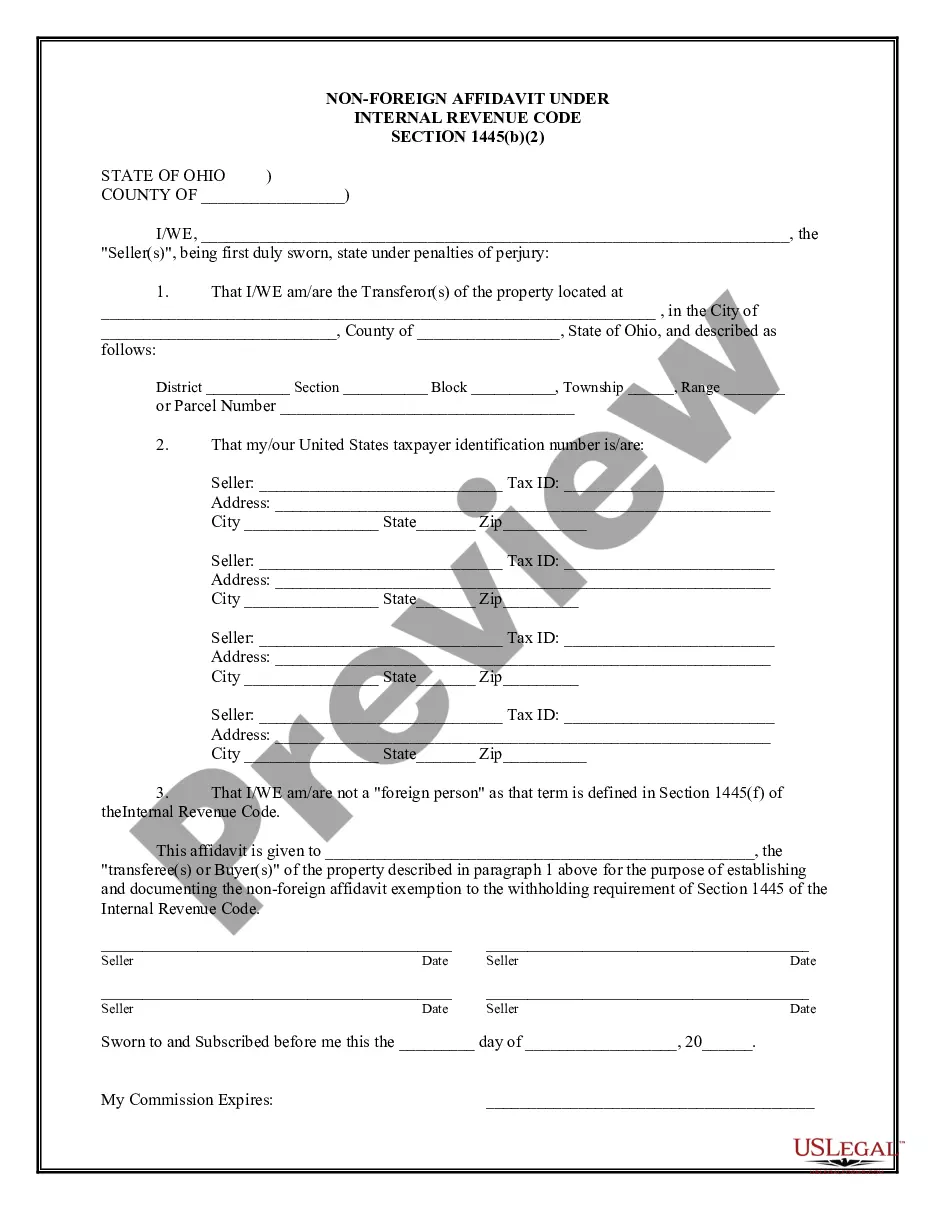

How to fill out Letter Agreement To Subordinate Liens Against Personal Property?

Drafting legal paperwork from scratch can sometimes be a little overwhelming. Some cases might involve hours of research and hundreds of dollars spent. If you’re searching for a more straightforward and more cost-effective way of creating Lien Against Property Form Texas or any other forms without jumping through hoops, US Legal Forms is always at your fingertips.

Our online collection of over 85,000 up-to-date legal documents addresses almost every element of your financial, legal, and personal matters. With just a few clicks, you can instantly access state- and county-specific forms carefully put together for you by our legal professionals.

Use our platform whenever you need a trusted and reliable services through which you can easily find and download the Lien Against Property Form Texas. If you’re not new to our website and have previously set up an account with us, simply log in to your account, select the form and download it away or re-download it anytime later in the My Forms tab.

Don’t have an account? No worries. It takes little to no time to register it and explore the catalog. But before jumping directly to downloading Lien Against Property Form Texas, follow these tips:

- Check the form preview and descriptions to make sure you are on the the form you are looking for.

- Check if form you select complies with the requirements of your state and county.

- Choose the right subscription option to buy the Lien Against Property Form Texas.

- Download the form. Then complete, certify, and print it out.

US Legal Forms boasts a spotless reputation and over 25 years of expertise. Join us now and turn form completion into something simple and streamlined!

Form popularity

FAQ

Steps to File a Construction Lien in Texas Step One: Know Your Deadline. Before filing a construction lien in Texas, it's essential to know your deadline. ... Step Two: Download and Fill Out the Lien Form. ... Step Three: Deliver the Lien Form to the Property Owner. ... Step Four: File the Lien with the County Clerk.

To check department records for tax liens, you may view homeownership records online or call our office at 1-800-500-7074, ext. 64471. Please be prepared to provide the complete serial number and HUD Label or Texas Seal number of the home.

In Texas, a lien is simply created when a property owner fails to pay their property taxes and the property taxes become delinquent. If these property taxes are still unpaid after a certain time frame, the home could end up in foreclosure.

Until payment requirements can be met, creditors may place liens on property to settle their debts. The homeowner is responsible for keeping track of and paying off all debts on time to avoid having liens placed on their home without their knowledge.

Filing Lien Affidavit It must be recorded (filed) in the real property records of the County Clerk's office in the county in which the owner's property is located by personally deliver- ing or mailing the lien affidavit to the County Clerk with the required recording fee. You need only file one lien affidavit.